As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of ups and downs in the cryptocurrency market. The latest news about Celcius Network and its founder Alex Mashinsky pleading guilty to fraud charges is certainly not surprising, considering the red flags that have been apparent for quite some time.

For over a year, the international cryptocurrency and Bitcoin mining firm, Celcius, has been embroiled in a fraudulent scandal. More recently, its founder has admitted to the charges and consented to serve a 30-year prison sentence.

According to a report by Reuters on December 3rd, Alex Mashinsky, the former CEO and founder of Celsius Network, is expected to admit guilt for fraud charges. The U.S. Attorney’s Office alleges that Mashinsky deceived customers into investing in his company and artificially boosted its value using cryptocurrency tokens.

To work effectively with prosecutors, Mashinsky consented to serve a prison term of 30 years or fewer. Consequently, the court has scheduled the announcement of his sentence for April 8th of the following year.

“I know what I did was wrong, and I want to try to do whatever I can to make it right,” he said.

Earlier this year, he faced accusations for seven offenses such as fraud, conspiracy, and market manipulation. In court, he admitted guilt to two out of those seven charges: commodity fraud and artificially influencing the value of the Celsius token (CEL) in 2021.

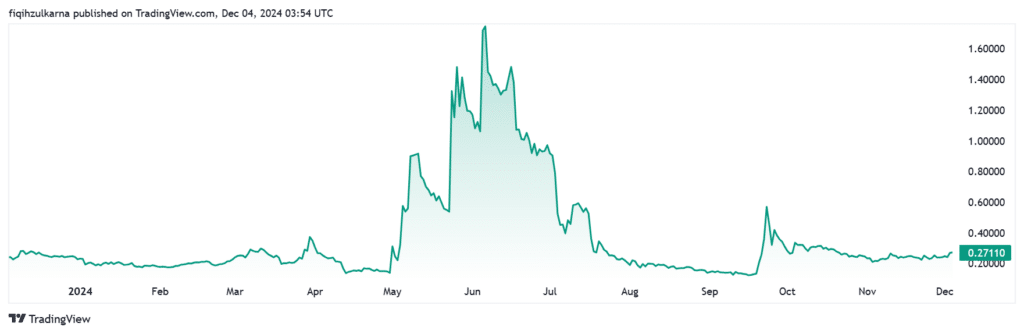

Celcius price movement

After its launch, the price of CEL skyrocketed by an astonishing 14,700% from a starting point of $0.05 to reach $7.4 in 2021. This dramatic rise occurred exclusively that year, but following allegations, CEL experienced a significant sell-off causing the price to drop back below $1 until Mashinsky’s arrest on July 13; at this point, the token was trading at just $0.1.

As an analyst, I’ve recently uncovered some intriguing insights regarding the latest developments in the case of Celsius and FTX. Notably, Ben Armstrong, popularly known as BitBoy Crypto, posits that Canadian businessman Kevin O’Leary may have played a significant role in both these bankruptcies.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-12-04 07:01