As a seasoned analyst with over two decades of experience in the financial industry, I find the Stabila Foundation’s initiative to boost stablecoin adoption within the Celo ecosystem quite intriguing and potentially groundbreaking. Having witnessed the transformative power of digital currencies in various emerging markets, particularly Africa, Latin America, and Southeast Asia, I am optimistic about the potential impact this move could have on financial inclusion and stability in these regions.

The Stabila Foundation is starting a fresh venture aimed at increasing the usage of stablecoins within the Celo system, with the goal of fostering practical applications for the network.

A fresh foundation dedicated to boosting the integration and usage of stablecoins within the Celo (CELO) blockchain system has been officially introduced.

According to a press release shared on August 28th with CryptoNews, The Stabila Foundation – supported by the Celo community – is working to bolster the stability of the financial system by advocating for the practical application of stablecoins, especially in developing regions like Africa, Latin America, and Southeast Asia.

As a collaborative analyst, I strive to attain our objectives by forging strong partnerships with reliable stablecoin creators, ecosystem application developers, infrastructure providers, businesses, and everyday users.

The Stabila Foundation

Besides the Celo community, the foundation has also earned support from Allbridge Core, Angle Labs, and Wormhole Foundation.

Celo seeks more stablecoin activity

The organization will direct its assets towards establishing rewards for stablecoin liquidity pools, promoting educational initiatives, and endorsing projects that align with its objectives. By partnering with stablecoin issuers, the organization aims to boost transaction activity and user expansion on Celo, thereby positioning it as a front-runner in the realm of stablecoins, according to a press release.

Celo already supports major stablecoins such as (USDT) and (USDC), which collectively account for over 85% of the stablecoin market. However, the foundation seeks to expand the ecosystem even further by encouraging the use of a diverse range of local currency stablecoins, including those from Mento Labs, Angle Labs, and BRLA Digital.

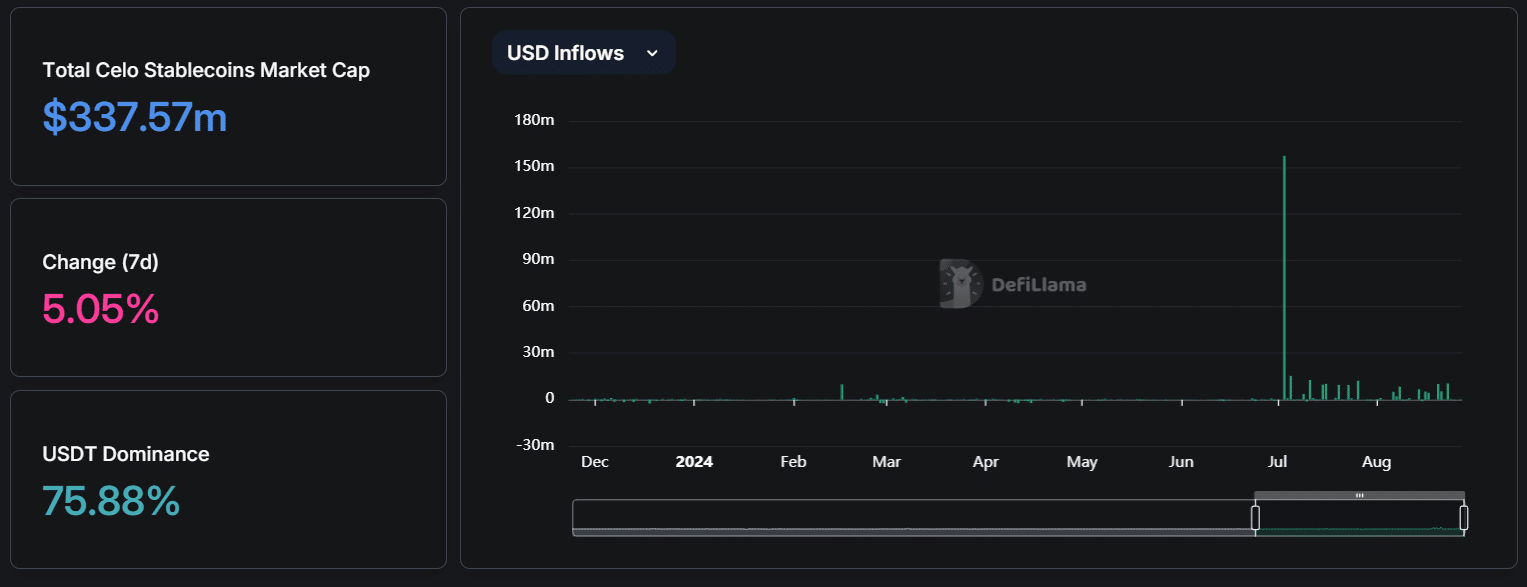

As per DefiLlama’s statistics, the combined value of all stablecoins circulating on the Celo network amounts to approximately $337.57 million. It is worth noting that more than three-quarters (over 75%) of this total market cap is attributed to Tether’s USDT.

Regarding the launch of the foundation, Paul Kremsky, Cumberland’s global head of business development, remarked that stablecoins represent a “revolutionary application” of blockchain technology. He emphasized that extending stablecoins beyond the US dollar is a significant endeavor that will make this infrastructure accessible to everyone globally, particularly regions that are underserved by conventional banking systems.

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-08-28 17:03