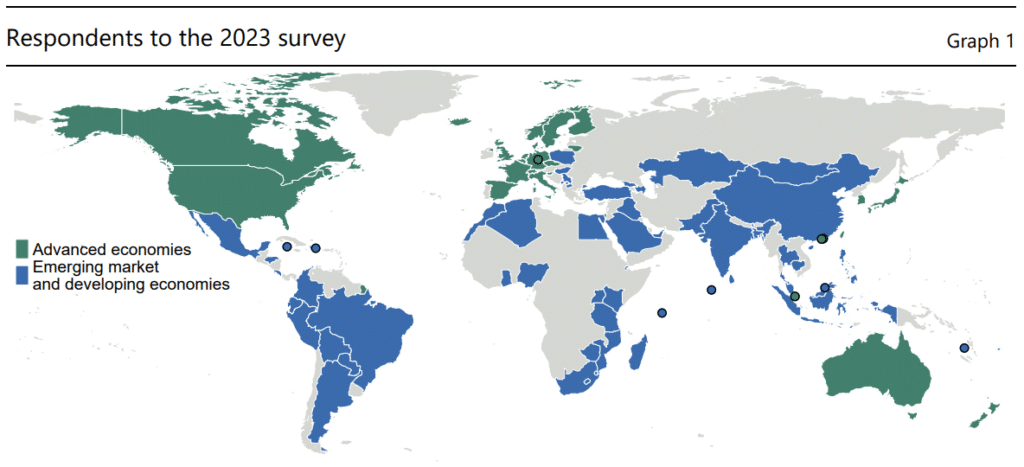

As an experienced financial analyst, I find the results of the 2023 BIS survey on central bank digital currencies (CBDCs) and crypto quite intriguing. Based on the data presented, it appears that while a significant number of central banks are considering issuing wholesale CBDCs, retail CBDCs are not a priority for most in the medium term.

As a researcher examining the findings of the 2023 BIS (Bank for International Settlements) survey on central bank digital currencies and cryptocurrencies, I discovered that just 12% of central banks are intending to release retail CBDCs (Central Bank Digital Currencies) in the intermediate term.

According to a recent survey conducted by the Bank for International Settlements (BIS), the vast majority of central banks globally are unlikely to introduce retail versions of central bank digital currencies (CBDCs) in the near future. In fact, around 88% of the respondents indicated that they have no plans to issue such currencies during this period.

Based on survey findings, the probability of a wholesale Central Bank Digital Currency (CBDC) being introduced within the next six years is higher than that for retail, the Bank for International Settlements (BIS) stated. Furthermore, there could be as many as nine wholesale CBDCs in circulation by the end of this decade.

As a crypto investor, I’ve noticed that central banks continue to express interest in wholesale Central Bank Digital Currencies (CBDCs). The reason behind this is to improve cross-border transactions for both developed and emerging economies. By implementing CBDCs, we can streamline international payments and enhance the overall efficiency of global financial systems.

Certainly, some individuals have pointed out that a comprehensive central bank digital currency (CBDC) could potentially overcome the obstacles in today’s cross-border payment system. These challenges include expensive transaction fees, slow processing times, restricted access for certain populations, and a lack of transparency.

The Bank for International Settlements

As a CBDC analyst, I’ve discovered from the survey that central banks primarily aim to grant financial institutions the ability to utilize advanced features offered by tokenization in wholesale Central Bank Digital Currencies (CBDCs). These features include composability and programmability.

As a CBDC analyst, I’ve noticed that retail Central Bank Digital Currencies (CBDCs) are a topic of ongoing exploration for over half of the surveyed central banks. Regarding these emerging currencies, financial regulators have expressed particular concern with several key issues. They seek clarity on “holding limits,” which refers to the maximum amount individuals can hold in CBDCs. Additionally, they are focusing on ensuring “interoperability,” meaning that different CBDC systems can communicate and function effectively together. Furthermore, there is a need for “offline options” to allow CBDC usage even without an internet connection. Lastly, regulators are advocating for “zero remuneration,” which suggests that no interest or fees will be charged on CBDC holdings.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-14 15:42