As a seasoned researcher with a keen interest in the evolving world of cryptocurrencies and decentralized finance (DeFi), I find myself once again navigating the complexities of regulatory action against a key player in this space – Uniswap. The latest settlement with the Commodity Futures Trading Commission (CFTC) is indeed a significant event, especially considering that it’s the second such enforcement action against Uniswap this year.

The decentralized platform Uniswap has reached an agreement with the U.S. Commodity Futures Trading Commission (CFTC) regarding unlawful activities related to derivative trading of digital assets

As an analyst, I’ve recently come across a notification from the Commodity Futures Trading Commission (CFTC), dated September 4th. This notice alleges that Uniswap Labs, the organization managing Ethereum‘s (ETH) largest Decentralized Exchange (DEX), has been offering leveraged and margin trading of retail commodities in an unlawful manner

In response to Uniswap’s significant assistance in the CFTC’s probe, the commission decided to lessen the civil fine. Consequently, Uniswap Labs consented to pay a penalty of $175,000

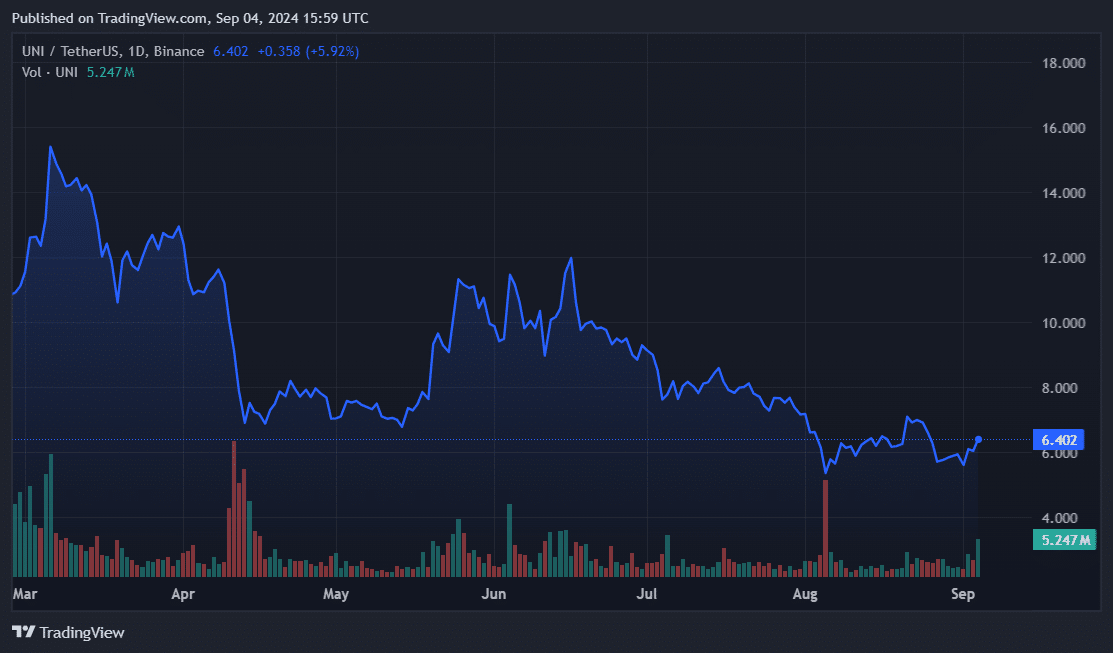

In simpler terms, the business has been ordered to stop violating the Commodity Exchange Act, which means they can no longer offer commodity future contracts. However, despite this news, Uniswap’s native token (UN) saw a rise of more than 5% at the time of reporting

Uniswap hit with second enforcement action

This year, Uniswap’s legal team has faced two significant regulatory actions, with the recent settlement by the Commodity Futures Trading Commission being the second one. Earlier in April, Uniswap received a Wells Notice from the U.S. Securities and Exchange Commission, accusing them of violating federal regulations

It’s possible that the recent crackdowns are connected to an extensive investigation being conducted by U.S. regulators regarding decentralized finance and cryptocurrencies. This area, as per the SEC chairman, Gary Gensler, has been accused of failing to comply with regulations and experiencing a high level of fraudulent activities

Indeed, the CFTC confirmed in its complaint that its action against Uniswap continued a regulatory focus on DeFi activity.

Critics within the industry have also highlighted the potential impact of Operation Choke Point 2.0, a strategy aimed at disconnecting cryptocurrencies from the American financial market and economic landscape

As an analyst, I’m sharing some recent developments in the digital asset sector. In line with this, the Securities and Exchange Commission (SEC) has issued a Wells Notice to OpenSea, an Ethereum-based NFT marketplace. This notice usually precedes a lawsuit but does not necessarily mean the SEC will follow through with legal action. Additionally, SEC attorneys have levied charges against Galois, a crypto firm, for alleged lapses in custody and misleading investor information

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-04 19:09