As a seasoned analyst with over two decades of experience in the financial markets, I find it fascinating to observe the dynamic nature of the crypto market, particularly in North America. Despite the regulatory uncertainties, the region continues to dominate the global landscape, driven primarily by institutional investors and massive transactions exceeding $1 million.

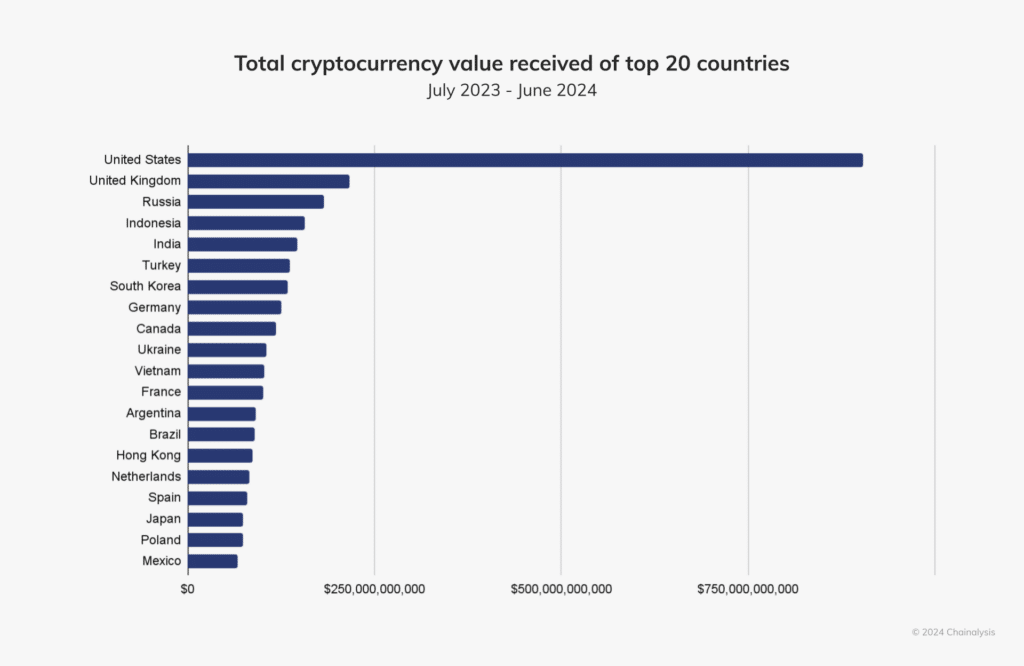

Globally, the crypto market continues to be dominated by North America, with approximately $1.3 trillion in activity, equating to around 22.5% of all on-chain transactions, as per Chainalysis’s data.

Despite an ambiguous regulatory environment, cryptocurrencies are predominantly accumulating in North America as per data from Chainalysis. The continent has attracted approximately $1.3 trillion in on-chain value, which equates to about 22.5% of global activity between July 2023 and this June.

Specialists from a New York-based company focusing on blockchain analysis claim that the sector is primarily influenced by institutional investors. They further note that around 70% of the crypto activity within the region involves transactions worth more than $1 million. Despite U.S. markets being the most significant globally, they are also characterized by a higher level of volatility compared to international markets in terms of growth, according to these analysts.

Over the past few periods, the U.S. financial market has shown a greater responsiveness to fluctuations in both rising (bull) and falling (bear) cryptocurrency markets. In other words, if the prices of cryptocurrencies go up, the U.S. market tends to experience more significant growth compared to the global market. Conversely, when cryptocurrency markets drop, the U.S. market usually experiences a more substantial decline relative to the rest of the world.

Chainalysis

Yet, the American financial markets have faced hurdles during the last year, notably due to a decrease in stablecoin activity moving off of U.S.-compliant platforms, according to the report.

As a researcher, I’ve been following the trends in stablecoin transactions and as per Chainalysis, there was a consistent increase in their share on U.S.-regulated exchanges until 2023. However, surprisingly, this trend began to reverse in 2024. This shift has led to an uptick in stablecoin transaction volumes on crypto exchanges located outside the U.S., suggesting that global adoption of stablecoins is surpassing the rate of growth within the U.S. as reported by Chainalysis.

Despite being smaller compared to their American counterparts, the Canadian market holds significance within North America, as it garnered around $119 billion in value during the given timeframe, according to the data.

By the start of October, Chainalysis reported that Latin America had the second-highest annual growth rate for cryptocurrency adoption, surpassing 42%. According to their statistics, Brazil received approximately $90.3 billion in cryptocurrencies from July 2023 to this June, making it the second-largest recipient behind Argentina.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-10-17 11:28