As a seasoned analyst with extensive experience in the global financial market and a particular focus on emerging economies, I find it fascinating to observe the rapid adoption of stablecoins in Sub-Saharan Africa. Having spent considerable time in this region, I’ve witnessed firsthand the challenges faced by businesses and individuals due to volatile local currencies and limited access to U.S. dollars.

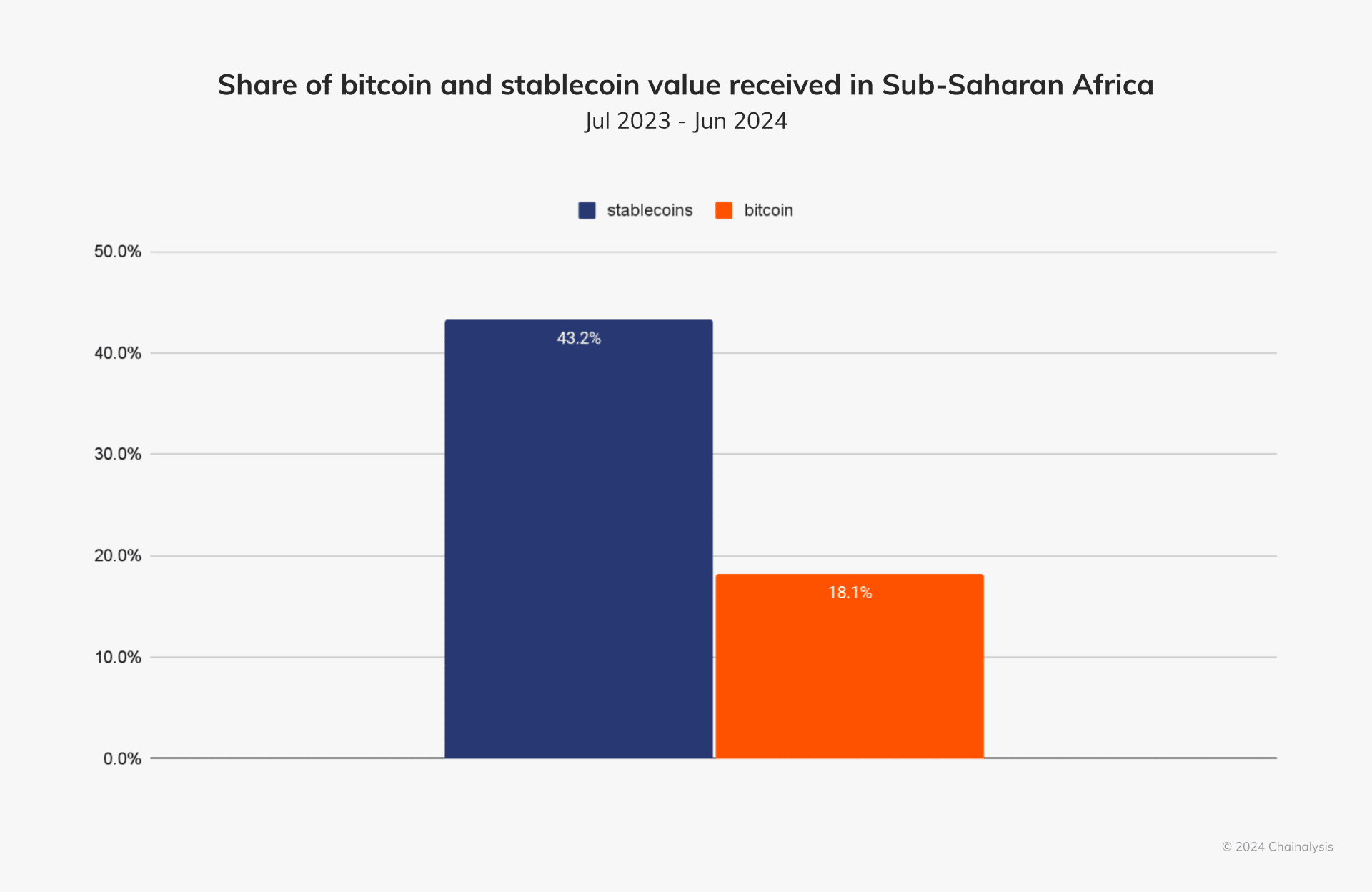

In Sub-Saharan Africa, stablecoins make up more than 40% of the region’s cryptocurrency market as an increasing number of businesses opt for dollar-backed alternatives.

In a recently published report by Chainalysis, it’s been found that Stablecoins are playing a crucial role in the cryptocurrency market of Sub-Saharan Africa, making up about 43% of all transactions in the region.

In countries facing unstable local currencies and limited availability of U.S. dollars, digital coins that are tied to the dollar like Tether (USDT) and Circle (USDC) have become more popular. These coins allow businesses and individuals to secure their wealth, conduct international transactions, and boost cross-border trade by offering a stable store of value.

In a commentary to Chainalysis, Yellow Card chief executive Chris Maurice said that “about 70% of African countries are facing an FX shortage, and businesses are struggling to get access to the dollars they need to operate.”

Stablecoins to become primary use case for crypto in South Africa

Due to economic hardships, Ethiopia, one of Africa’s most populous countries, has experienced a significant surge in retail-sized stablecoin transfers. This growth, amounting to 180% year-on-year, can be attributed to a recent 30% drop in the value of its national currency, the birr.

In contrast to conventional banks finding it challenging to fulfill the high demand for U.S. dollars, stablecoins like USDT and USDC are being seen more frequently as a stand-in for the dollar. Maurice stated that “having access to USDT or USDC can make it quite straightforward to exchange those into actual U.S. dollars elsewhere.

In the future, Rob Downes, who leads digital assets at ABSA Bank – a significant bank with operations across 12 African countries, predicts that stablecoins will assume a crucial position in Africa’s economic panorama. He believes that dollar-linked tokens will be the predominant application of cryptocurrency in South Africa during the subsequent three to five years.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-03 04:00