As a seasoned researcher with years of experience in the crypto market, I must admit that watching Chainlink’s (LINK) impressive comeback over the past few days has been quite exhilarating. The coin reaching its highest point in over four weeks, up by more than 53% from its lowest level this year, is a testament to the growing ecosystem and use cases that Chainlink offers.

Linkchain has persisted in its robust recovery, climbing steadily for two successive days, marking a new peak not seen in over four weeks.

Chainlink (LINK )jumped to $12.3, up over 53% from its lowest level this year, as its ecosystem and use cases continue to grow.

According to DeFi Llama’s data, Chainlink holds the largest portion in the oracle sector with a total value locked (TVL) of approximately $23.3 billion. It outperforms competitors such as WINKlink, Chronicle, and Pyth Network, collectively boasting a TVL of around $20.5 billion.

The upward trend in Chainlink’s value is being fueled by investor expectations that the Decentralized Finance (DeFi) sector will experience a revival. Notably, Aave (AAVE), a significant component of Chainlink’s ecosystem, has reached its highest point since April 2022.

It appears that there are indications of growth within the Chainlink ecosystem. This week, Stader Labs incorporated their Cross Chain Interoperability Protocol, allowing token transfers across Arbitrum, Ethereum, and Optimism. Notably, other recent integrations with Chainlink include Arcadia Finance, Backed, and Nexera (formerly known as AllianceBlock).

In the past week, Chainlink saw 19 adoptions of its six services on eight distinct platforms: Arbitrum, Avalanche, Basis Cash, Binance Smart Chain, Ethereum, Optimism, Polygon, and zkSync.

— Chainlink (@chainlink) September 22, 2024

The value of Chainlink increased alongside a growing appetite for the cryptocurrency and its future contracts. As per data from CoinGlass, the futures open interest peaked at $187 million, marking its highest level since July 24.

Concurrently, data gathered by CryptoQuant up until August 20th indicates a continuous decrease in exchange balances. A reduction in coins held on exchanges suggests that numerous investors are retaining their tokens instead of selling them.

However, data compiled by Nansen shows that LINK had a CEX inflow of almost $5 million in the last 24 hours. CEX inflows mean that some investors have started to exit.

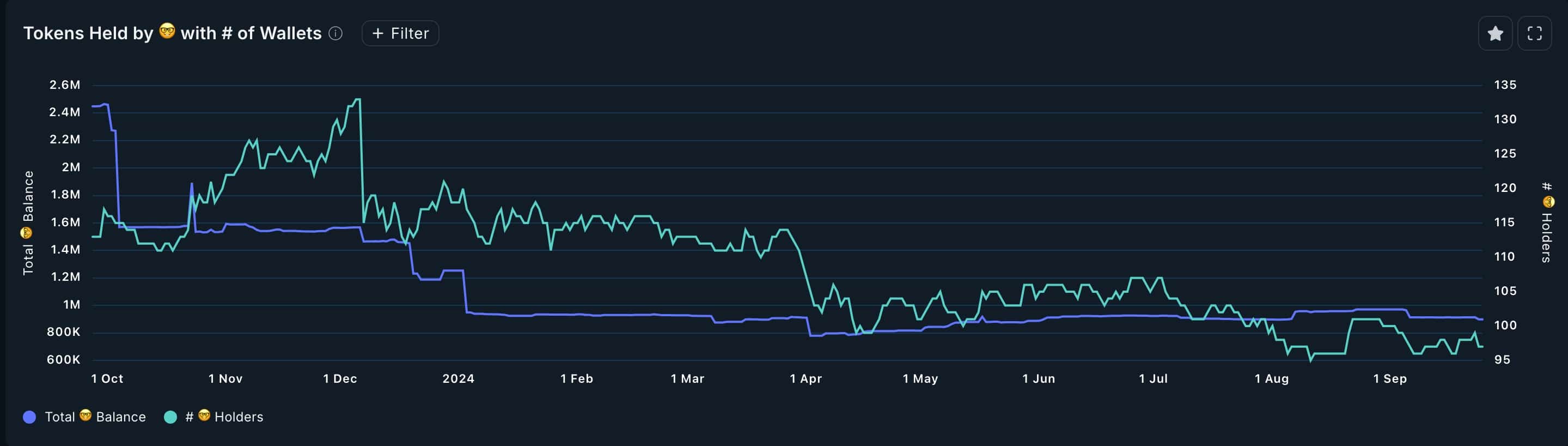

As an analyst, I’ve observed a significant shift in the smart money investment landscape for LINK. The number of these savvy investors has decreased from 133 in December to 97 now. Moreover, the amounts they hold have significantly reduced, falling from approximately 2.4 million last October down to 900,000 at present.

One potential risk for Chainlink investors is that over 373 million tokens, valued at $4.2 billion, are still locked. Recently, developers unlocked tokens worth $208 million, with most moved to Binance. Future token unlocks could lead to significant dilution for existing investors.

Chainlink price nears key resistance

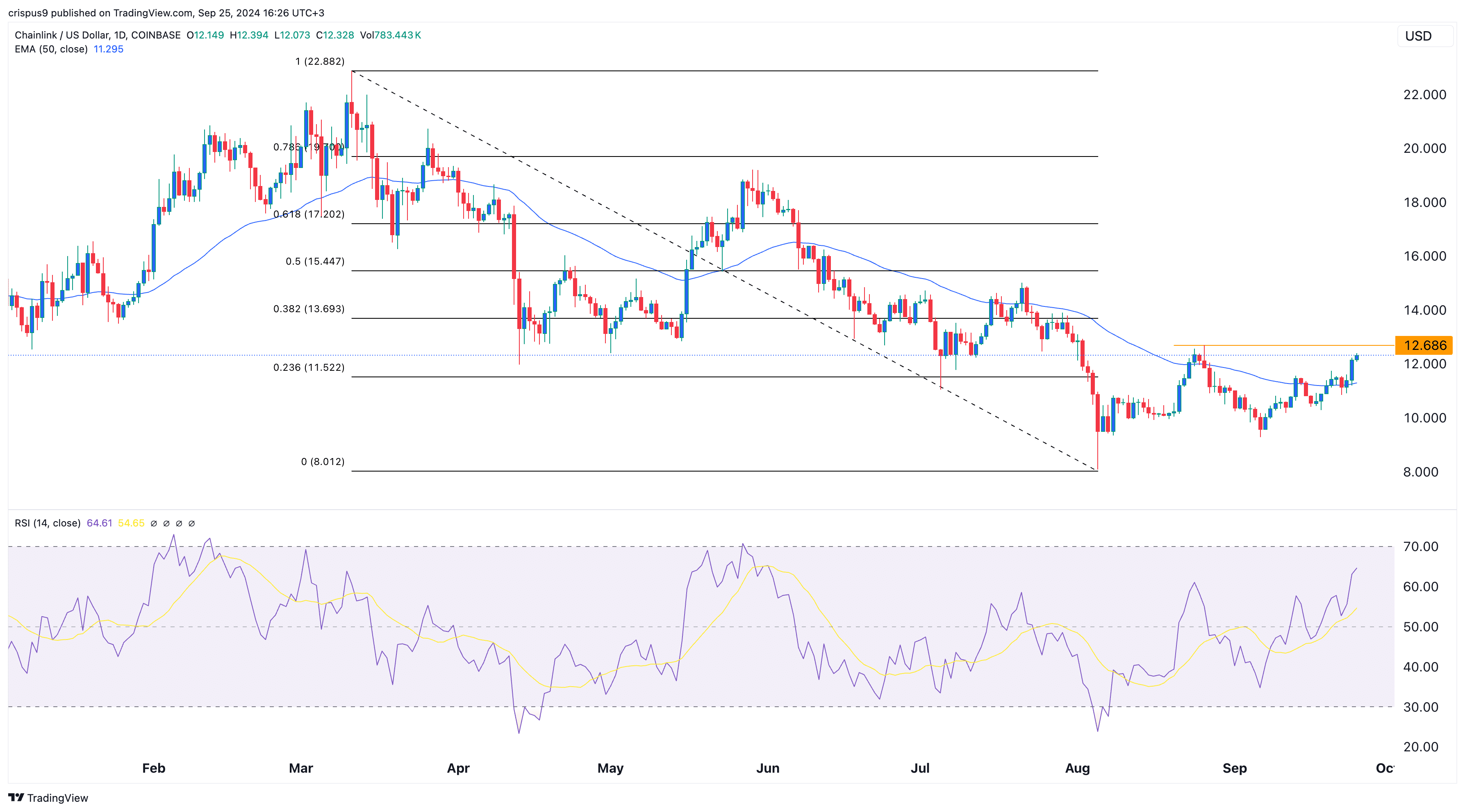

On the daily chart, Chainlink’s price has bounced back from its yearly low of $8.01 to reach $12.3. The $11.52 level, which is a 23.6% Fibonacci Retracement point, has now been transformed into a support zone for the coin. Furthermore, Chainlink’s price has surpassed its 50-day moving average, and the Relative Strength Index (RSI) stands at 64.

The RSI is an oscillator that measures the rate of change of an asset. It increases when an asset gains momentum. More upside could be confirmed if LINK rises above the key resistance level at $12.68, its highest swing on Aug. 26.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-25 17:02