Ah, my dear friends, gather around as we delve into the exhilarating world of Chainlink! A rare harmonic pattern is strutting its stuff on the monthly chart, promising a breakout that could send us into high double-digit territory—well, if we can overcome the inevitable hesitation of our dear traders. Hold on to your hats! 🎩

Intraday Rebound: Liquidity Woes or Just a Daydream?

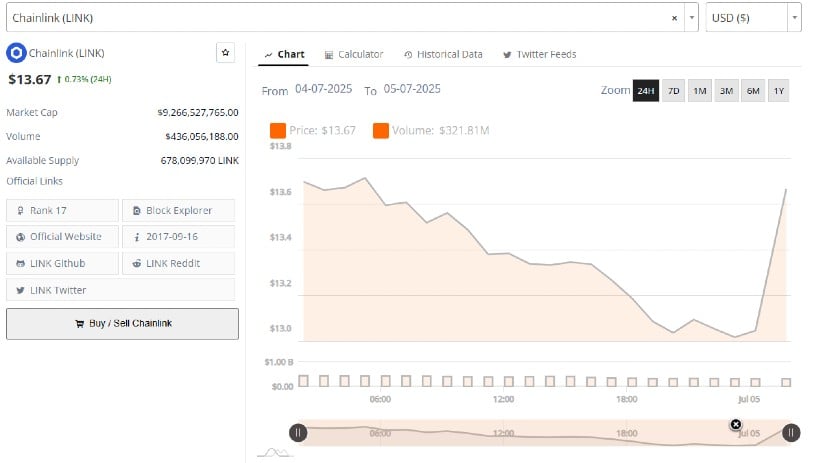

The 24-hour chart, covering the period from July 4 to 5, 2025, showcases a V-shaped pattern. Steep decline followed by a brisk recovery—oh, the drama! The price opened at $13.67, then plummeted to an intraday low of $13.05. Surely a sign of traders sneaking off for a quick nap amid low-volume trading.

But wait—there’s a twist! The decline, though steady, was met with a rebound in the early hours of July 5, with Chainlink making a swift recovery to $13.67. It was almost like the market realized, “Well, that was dramatic, but let’s just go back to where we started, shall we?” 😅

However, dear reader, the volume on this little escapade was a modest $321.81 million, a far cry from the previous session’s $436 million. So, what’s the verdict? A short-lived rally unless we see some robust volume to back this up. Until then, we wait… and hope for a decisive close above $13.70. 🍀

The Harmonic Pattern: A Glimmer of Long-Term Hope?

Now, let us turn our attention to the grand, sweeping gesture of the harmonic pattern. A recent post by a market analyst has spotlighted a bullish setup on the monthly LINK/USD chart. Yes, darling, it looks like a possible long-term breakout is on the horizon—if only we can find the courage to believe it. It’s a harmonic masterpiece, spanning multiple years, with distinct XA, AB, BC, and perhaps even a CD leg (oh my, how far it might go!).

The projected target reversal zone (PRZ) lies between $42.8 and $47.6, nestled perfectly within key Fibonacci levels—oh, the magic of numbers! Specifically, it’s at the 0.786 retracement of the XA leg and the 1.618 extension of BC. Mathematics, darling, it’s poetry in motion. 📉✨

The harmonic setup begins with point X near $53, drops to A around $0.80 (yes, you read that right—$0.80!), retraces to point B at $36.5, and then forms a pullback to point C at $10.2. The drama of it all! If this pattern completes, we’ll see a reversal from multi-year lows. Truly, a tale of redemption if there ever was one. 🌟

This setup also happens to resemble a cup-and-handle pattern—how very chic—from 2022 to 2024. But will it be enough to fuel the bullish rally we’ve all been waiting for? Analyst Zip B reminds us that such patterns take time to unfold and require sustained momentum, volume inflows, and a little bit of market alignment. No big deal, right? 😉

Daily Indicators: Mixed Feelings, Darling

As of July 5, 2025, the daily timeframe reveals a 3.29% drop to $13.22. The chart looks like a little drama of its own, showing tight consolidation with a series of failed attempts to breach the $14 resistance zone. The latest candle features a long upper wick, suggesting selling pressure near $13.78. Oh, the resistance! It’s almost like the market refuses to let go of its cautious demeanor. 😬

As for the technical indicators, they’re feeling quite neutral—neither bullish nor bearish. The Chaikin Money Flow (CMF 20) sits at 0.00, showing a perfect balance of capital inflows and outflows (how diplomatic). Meanwhile, the Bull and Bear Power (BBP 13) is a touch positive at +0.16, indicating the mildest presence of buyers. But don’t get too excited; it’s nothing to write home about. 📉

Without increased participation or a breakthrough above the near-term resistance, Chainlink may remain range-bound for a while. But who knows? Maybe the harmonic pattern will save the day in the long run. 🍸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2025-07-06 01:30