As a seasoned crypto investor with over a decade of experience navigating the ever-changing digital asset market, I find myself intrigued by Sui’s recent surge. The news about Grayscale’s new investment trusts and the broader market recovery have certainly caught my attention. However, I remain cautious as the question of sustainability looms large.

Since last Friday, Sui has experienced a significant increase of 38.57%, primarily driven by favorable market conditions and significant news announcements. Notably, Grayscale Investments unveiled two new crypto investment trusts, one of which includes Sui. This move has sparked heightened interest among investors.

Beyond these elements, the market’s bounce-back following a Yen rate increase and Jump Trading’s mass selling played a role in Sui’s surge (SUI). This has sparked a robust rally, leaving us wondering if Sui can maintain this growth trajectory or if a reversal could be imminent.

Table of Contents

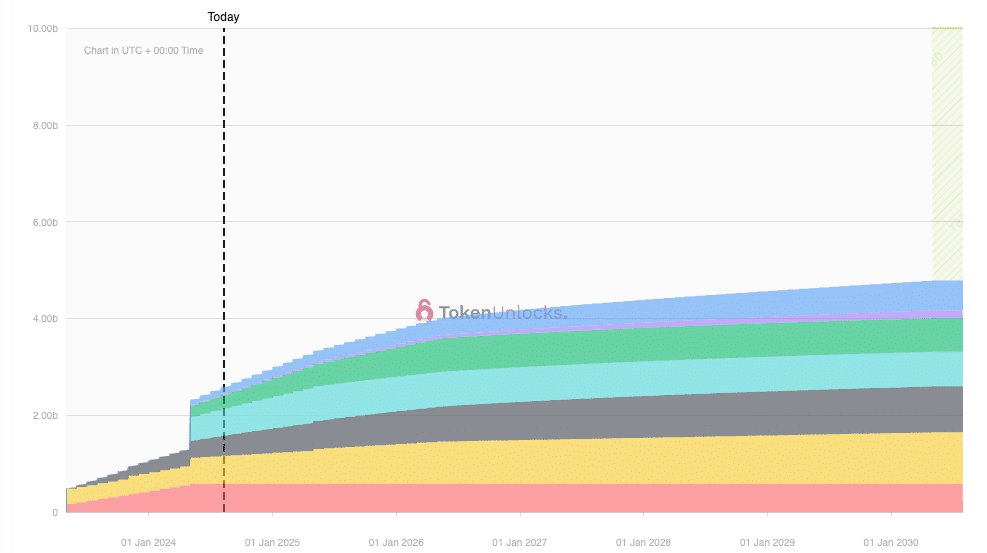

Supply dynamics

Sui’s inflation rate is quite high due to a fast-rising supply, which is significant because token releases can potentially lower the price. However, luckily, the next major token release that makes up 2% of the total supply is still 22 days off in the future. Thus, traders who are considering exiting before this event might not need to worry about its immediate effect.

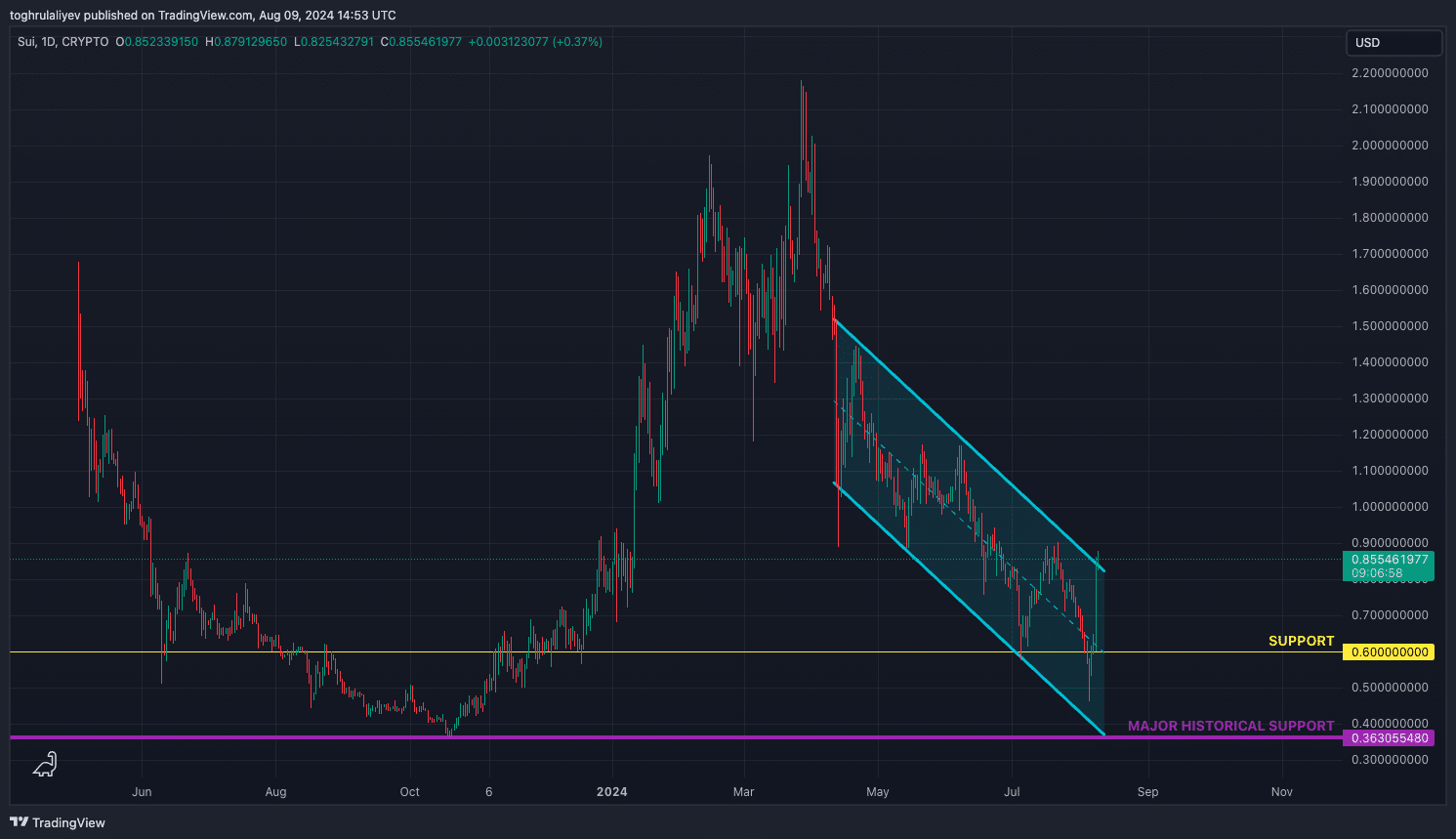

Downtrend and parallel channel

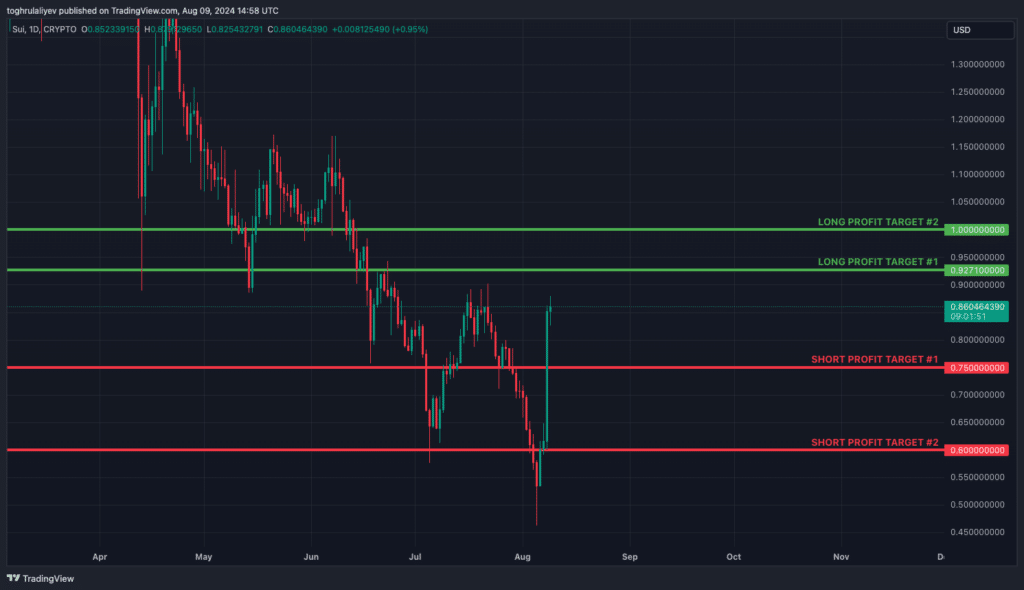

Starting from late March, Sui has been in a significant decline, losing more than 61% of its worth. Since mid-April, its price fluctuations have followed a parallel trend line, serving both as a floor and ceiling, confining the price changes within this range. Currently, Sui is close to the upper limit of this channel, facing resistance. It’s important to keep an eye on $0.60 as a crucial support level, since this is where the middle of the channel overlaps with past supportive prices.

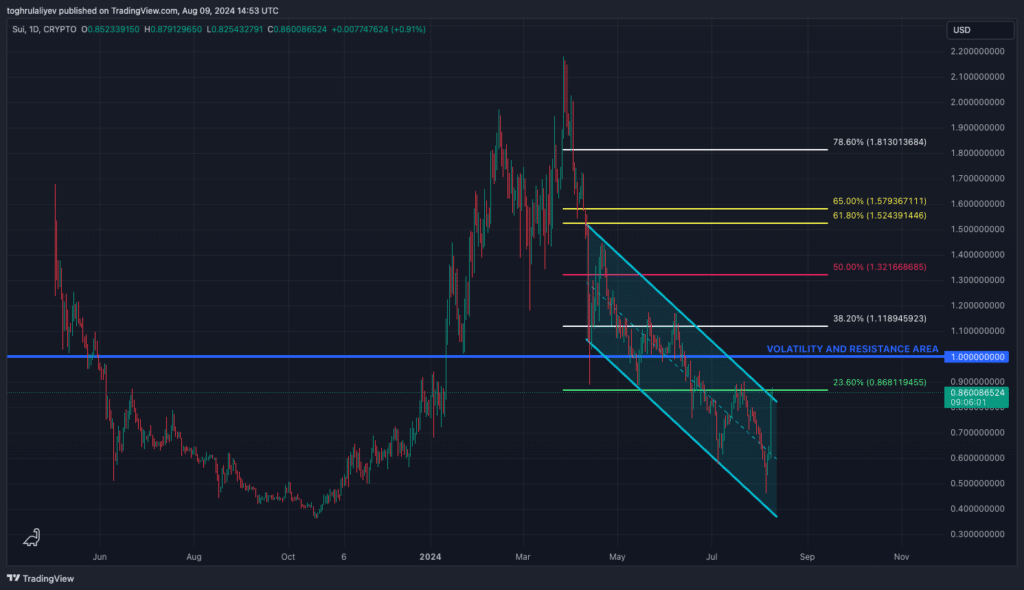

Fibonacci retracements

By drawing Fibonacci levels from the peak in March to the trough in August, we identify a significant potential resistance point at approximately $0.8681. This level aligns with the upper band of a parallel trend line and has shown past tendencies of serving as both a support and resistance line.

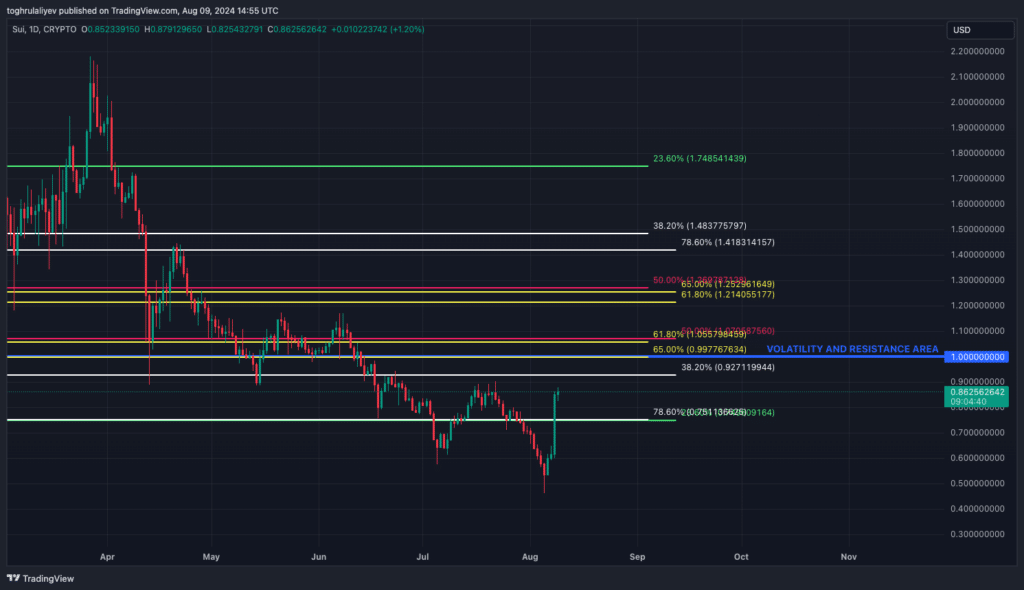

In simpler terms, two significant Fibonacci levels are meeting at the price point of $0.75. The first one is the 78.6% Fibonacci retracement level between Sui’s lowest price in October 2023 and its highest price in March 2024. The second one is the 23.6% Fibonacci retracement level between Sui’s initial trading price in May 2023 and its lowest price in August 2024. Interestingly, the $1 level, which has historically shown resistance and high volatility, lines up with a “golden pocket” from the latter Fibonacci retracement.

Strategic considerations

If SUI manages to surpass the $0.8681 barrier and maintains its position above it during a retest, this situation could lead to a favorable buy opportunity. Subsequently, potential profit-taking points would be at $0.9271 and $1.00, where another significant resistance is anticipated.

Pessimistic Outlook: Although there’s been a recovery in the market lately, it seems that this surge might have gone too far, hinting at a possible correction. The ongoing uncertainty with the yen carry trade and the traditionally bearish trend during August increase the likelihood of a decline. If SUI can’t break through the resistance at $0.8681 but instead encounters rejection there, it could be an indication to sell. Potential price drops could take SUI down to $0.75 and even as low as $0.60.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-09 18:31