As an experienced analyst, I believe that Lido’s recent surge of 20.57% in seven days is intriguing but not enough to ignore the historical resistance levels at $2.30 and $2.40. Based on the given technical indicators, the current resistance level appears to be a significant barrier for further upward movement.

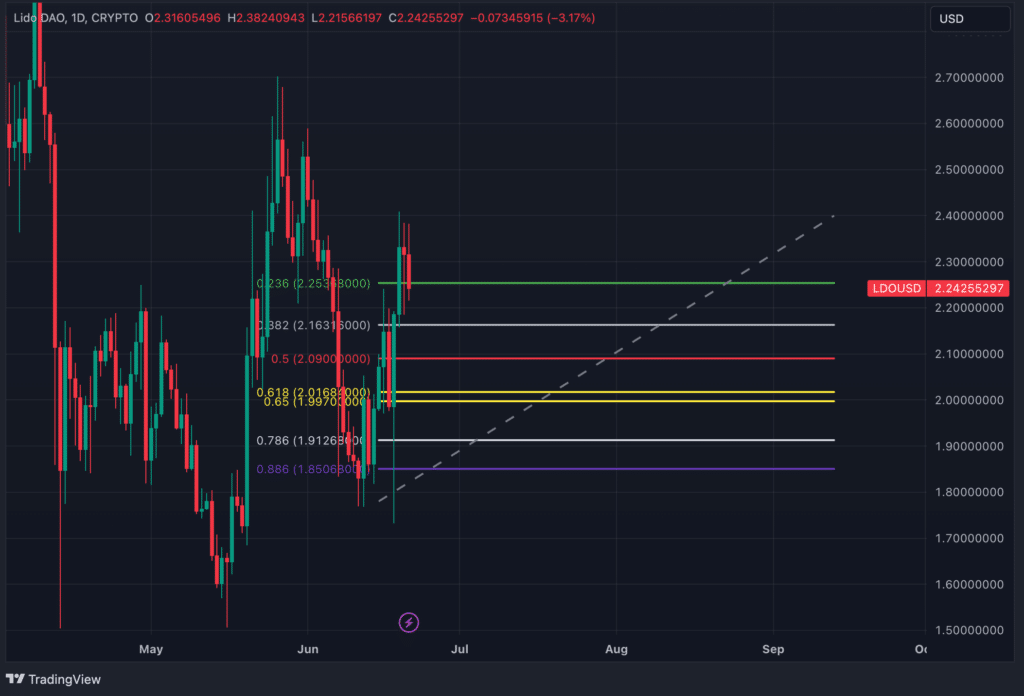

Beginning on June 21, 2024, Lido underwent a notable increase of 20.57% over the previous seven-day period. Nevertheless, there are indications that this growth may not persist. The primary reason for this uncertainty is its proximity to a historically significant resistance level at $2.30 on the daily chart. Previously, this resistance level has acted as a formidable barrier, making it unlikely for Lido to advance further without first surpassing this threshold and subsequently reaching $2.40. Without such a breakout, the likelihood of prolonged upward momentum appears limited.

Table of Contents

Technical Indicators

Resistance and Support Levels

- Current resistance: $2.30

- Additional resistance: $2.40

- Support level: $2.00

Relative Strength Index

With the present RSI nearing the historically significant threshold of 60, it indicates that the market may be moving towards being overbought. Consequently, potential advancements might be curtailed due to this resistance.

Fibonacci Retracement

If Lido doesn’t manage to surpass the resistance levels at $2.30 and $2.40, it’s probable that the price will fall towards the Fibonacci retracement levels, which are located between $1.997 and $2.016 (golden pocket).

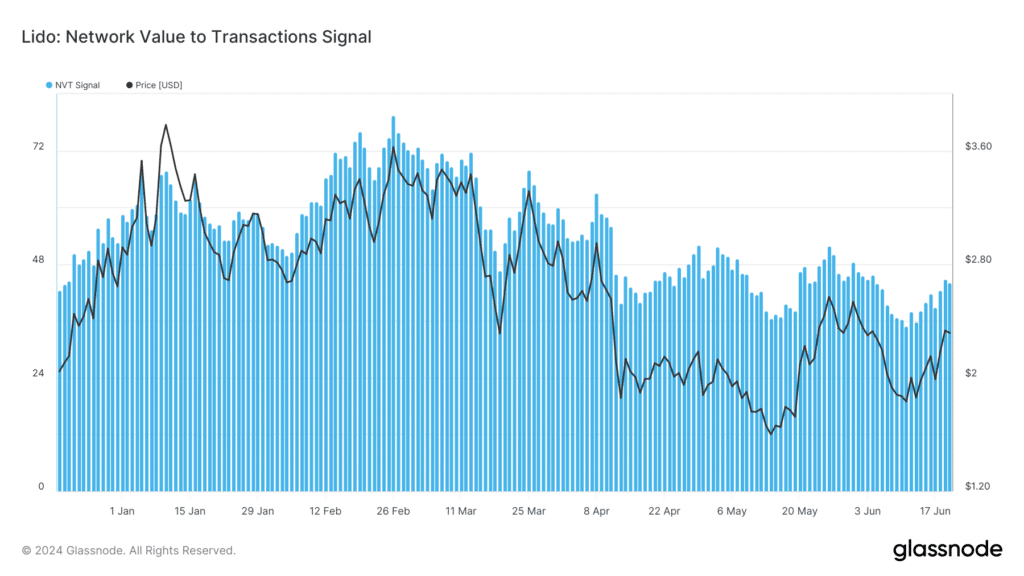

Network Value to Transactions Signal

As an analyst, I would interpret the NVT signal of Lido as a significant indicator for determining its valuation. A NVT signal above the benchmark of 55 indicates that the asset is overvalued, whereas a signal below 25 implies undervaluation. As of June 21, 2024, Lido’s NVT ratio stands at 44, which represents fair value based on this metric. However, it’s important to note that this assessment should be considered in conjunction with other relevant data points. The NVT ratio peaked at an elevated level of 79.5 back in March, suggesting potential for upside price movement. Nevertheless, the current market conditions and historical performance trends suggest caution, making a definitive conclusion about Lido’s valuation more complex than just relying on this single metric.

Historically, the summer months from June to September have traditionally seen slower growth for the cryptocurrency market, averaging a return of 1.45%. Due to Lido’s strong correlation with Bitcoin and Ethereum, significant price shifts in these leading cryptocurrencies could influence Lido’s price trend.

- Bitcoin and Ethereum Trends: If Bitcoin and Ethereum experience downturns, Lido is likely to follow suit.

- Ethereum Staking: As a staking platform for Ethereum, Lido’s performance is closely tied to Ethereum’s market movements.

Strategy

Considering the current market analysis, it is advisable to adopt a cautious approach:

-

Short Position: Given the strong resistance at $2.30, consider going short on Lido at the current levels.

Reentry Point: Look to reenter around the $2.00 support level, provided it holds this line.

Monitoring BTC and ETH: Keep a close watch on the broader market trends, particularly Bitcoin and Ethereum, as their movements will likely influence Lido’s price.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-21 12:12