As a seasoned researcher who has closely followed China’s economic trajectory for years, I find myself intrigued by the recent monetary stimulus package announced by the Chinese government. Having witnessed the ebb and flow of their economy, it seems that the current measures are indeed a calculated move to boost liquidity and stabilize the market.

As a crypto investor, I’ve noticed China, a massive economic powerhouse, has been struggling with an economy that’s not firing on all cylinders for some time. The issue stems from industrial output exceeding domestic consumption, creating an imbalance. For years, China has relied heavily on investment to drive growth, but now, they’re facing a property market slump and mounting local government debts, which are dampening investor morale.

Today, China introduced a monetary stimulus package to help the slowing economy.

The strategy aims to boost the economy by increasing the circulation of money, ultimately making the nation financially robust. As reported in recent news, the People’s Bank of China has lowered the maximum amount of funds that banks can hold. This action hasn’t been taken since 2018.

To meet the nation’s goal, a stimulus package was introduced, including plans to lower average mortgage rates for individual homebuyers by about 0.5%, equivalent to approximately $5.3 trillion. This move aims to lessen restrictions on purchasing second homes. Furthermore, Governor Pan Gongsheng of the People’s Bank of China stated that the central bank will provide 8000 billion yuan ($133 billion) in liquidity support to boost market activity and maintain stability.

Implications of the stimulus package

China’s decision to secure a strong economic rebound may bring about various effects, both favorable and unfavorable, within their borders and across the globe. Some possible consequences, without being exhaustive, might encompass:

Inflation Concerns

Although China’s actions are praiseworthy, implementing such a large-scale stimulus may raise inflation worries, particularly when there’s an excess of money supply and increased consumer spending. This could lead to higher prices for market goods and intensify existing inflationary pressures.

Economic Growth

Based on what Pan said, these actions are designed to stimulate economic expansion, thereby boosting business performance, fostering increased consumer spending, reigniting investor trust in China’s economy, and influencing interest rates positively.

Global Impact

As a researcher examining global economic trends, I can’t help but notice the significant role China plays in our world market, being second only to a few other nations. Thus, should China implement a monetary stimulus package that bolsters its economy, it’s reasonable to expect a ripple effect on their trade and export activities. This positive change would undoubtedly contribute to the overall health and growth of the global economy.

Impact on Crypto Industry

Following China’s economic stimulus proposal, there’s a strong prediction that Bitcoin, currently the world’s leading cryptocurrency, may witness a substantial increase in value, potentially reaching around $78,000. Interestingly, Bitcoin’s price surged to $64,000 following the Federal Reserve’s rate cut in September. Looking at the technical chart, Bitcoin appears to be growing stronger and could soon establish a new record high.

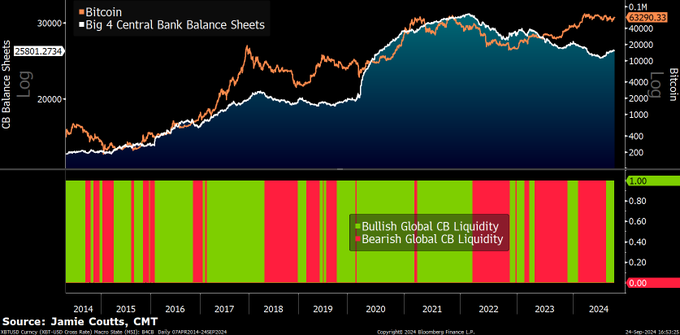

Regarding China’s latest stimulus package, as per Jamie Coutts, the chief cryptocurrency expert at Real Vision, this move could be advantageous for Bitcoin. His reasoning is that this action might prompt other central banks to follow suit, which could potentially have a positive impact on Bitcoin.

It’s less clear how Chinese liquidity affects Bitcoin since China outlawed cryptocurrency mining in 2021.

From my perspective as an analyst, I concur with Coutts’ assertion that Bitcoin’s performance remains closely tied to global liquidity conditions. Given China’s recent policy easing, these shifts could potentially trigger more substantial adjustments in risk appetite, which might have a significant impact on the digital currency market.

Moreover, the financial markets have shown positive reactions towards the actions, as Asian markets touched their peak levels in about 2.5 years, while Chinese stocks and bonds have soared. Notably, the Yuan has also reached a new high against the US dollar, marking its strongest point in the past sixteen months.

The purpose behind the PBoC’s stimulus initiatives is to increase financial fluidity within the economy, potentially sparking increased speculation across various investment sectors, such as cryptocurrencies. In times when traditional markets are performing well, investors might decide to withdraw funds from digital currencies, leading to temporary price decreases. Conversely, if the yuan weakens, there could be a shift towards cryptocurrencies as an alternative form of currency.

Conclusion

The current economic boost initiated by China is comprehensive and long-lasting, aiming to thaw the cold Chinese economy. This involves easing monetary policies, taking on additional debt, implementing beneficial measures for the real estate sector, and encouraging consumer spending. These actions are intended to bolster economic activity and restore the economy to a stable state.

Effective implementation of each policy is crucial for their success, regardless of how the global economy fluctuates. Meanwhile, the world watches with amusement as China tries to strengthen its economy using stimulus tactics. These actions, in turn, will influence not only China’s but also the global economy.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-25 11:00