Ah, Coinbase, the grandmaster of crypto exchanges, has finally earned the coveted approval from the Commodity Futures Trading Commission (CFTC). What for, you ask? To launch XRP futures contracts, of course. Because, darling, who doesn’t want more drama in their portfolios?

In a move that could only be described as ‘daring’, this marks a rather thrilling moment for institutional investors to finally get their paws on XRP, in the midst of a delightful little shakeup in the broader derivatives market. How positively exhilarating!

XRP Futures: Now Live and Kicking

Earlier this month, Coinbase, with its usual flair, hinted at this glorious moment by announcing that it was preparing to offer regulated XRP futures. Naturally, they filed with the CFTC—self-certifying, naturally, because who needs permission when you’re this confident?

“We’re thrilled to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures—ushering in a regulated, capital-efficient way to dip your toes into one of the most liquid digital assets,” the announcement triumphantly declared.

And lo and behold, the momentous day arrived on April 21, when Coinbase officially confirmed that the product was live—just in time for a glorious Monday night drama fest. The world sighed with relief.

“Coinbase Derivatives, LLC now offers CFTC-regulated futures for XRP,” said the exchange in a statement, as if we hadn’t already guessed.

The fast-track endorsement by the CFTC suggests that, yes, the US is slowly loosening its iron grip on crypto derivatives. A bold move, given that the CFTC recently decided to clear a few regulatory hurdles. Truly, a momentous occasion. The real twist? This could very well open the floodgates for crypto derivatives across the US. How exciting!

In fact, the agency has been quite the softie lately, lifting barriers for firms who’d previously been told to keep out. As BeInCrypto reported, the CFTC has practically invited crypto derivatives firms with open arms. A more welcoming attitude is always a crowd-pleaser, isn’t it?

“As stated in today’s withdrawal letter, DCR [Division of Clearing and Risk] decided to withdraw its advisory, just to ensure there’s no confusion about how it handles digital assets. We like to keep things simple,” the CFTC announced. How charming.

In short, the process has become much easier for firms to launch crypto derivatives products. Well, isn’t that just the cherry on top?

Shockingly, XRP Network Activity Surges by 67.5%

XRP, as one of the world’s most liquid assets, is no stranger to the limelight. And now, in the wake of Coinbase’s great move, it has yet another chance to bask in the glory. Who needs a mid-cap token when you’ve got XRP, with its combination of legal clarity (thanks to that Ripple lawsuit) and a substantial market cap? Quite the catch for institutional traders, darling.

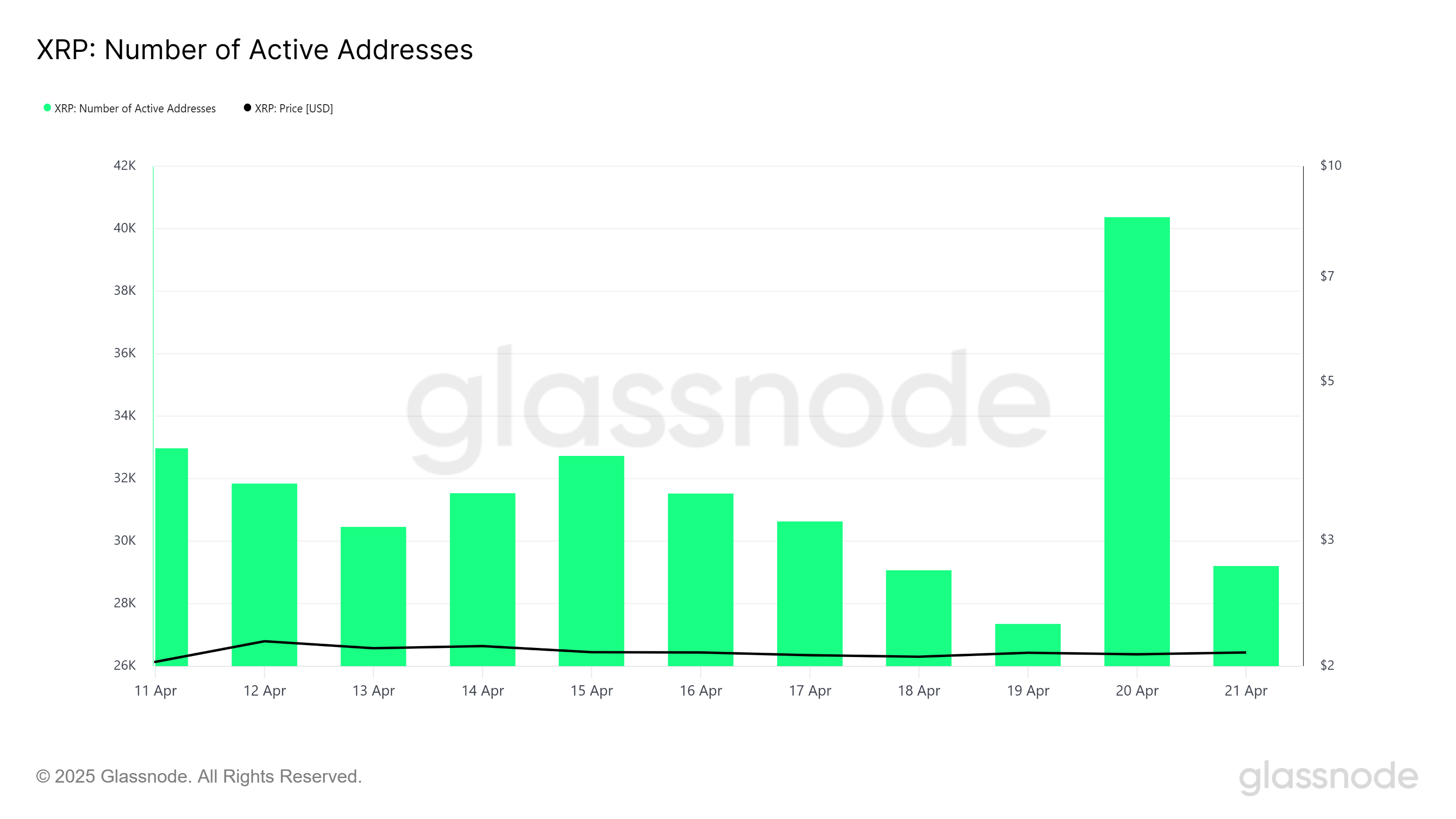

And here’s the plot twist you’ve been waiting for: On-chain data has shown a rather impressive 67.5% spike in network activity, between April 19 and 20. Because nothing screams excitement like a surge in addresses—up from 27,352 to 40,366, no less.

The surge suggests that, perhaps, retail and institutional players are preparing for more action. Could it be they’re anticipating the juicy benefits of crypto derivatives? The suspense is unbearable.

Yet, let’s not get carried away with optimism. Despite all the excitement, XRP’s spot price has dipped by a modest 1.26% in the last 24 hours. Perhaps a small dose of reality to balance out all the hype? Certainly a lesson in managing expectations—if we were to get serious for a moment.

Of course, we must remember that futures listings can enhance liquidity and price discovery over time. But in the short term? Oh, darling, prices don’t always behave as we’d like them to.

Coinbase’s master plan is clear: position itself as the ultimate regulated gateway to crypto derivatives in the US. With Ethereum and Bitcoin futures already a reality, it’s no surprise that XRP now joins the roster. A bold move, yes, but then again, Coinbase has never been one to shy away from a little risk. It seems they’re convinced XRP will be the belle of the crypto ball, despite the whispers of doubt from the regulatory crowd.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-22 08:42