In the vast and often tumultuous world of cryptocurrency, where fortunes can rise and fall with the swiftness of a summer storm, the shares of the U.S. crypto exchange Coinbase soared by over 8% on Thursday. This surge came as a pleasant surprise to many, following the company’s report of stronger-than-expected Q4 earnings.

Coinbase, the once-humble exchange that has grown to be a titan in the crypto realm, saw its shares leap 8.44% to $298.11 on Thursday, Feb. 13. This remarkable jump was fueled by the company’s most robust quarterly revenue in three years, a testament to its resilience and strategic acumen.

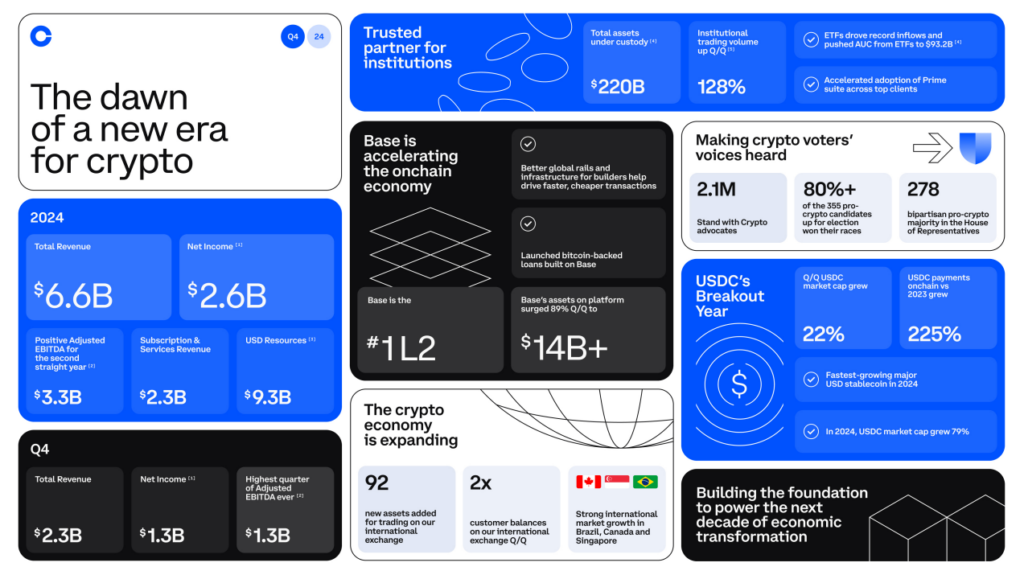

According to its Q4 2024 earnings report, Coinbase generated a staggering $2.3 billion in revenue, a 138% increase from the previous year, far surpassing the $1.88 billion estimate from LSEG analysts. The company’s net income reached $1.3 billion, with earnings per share at $4.68, both figures handily outpacing the $2.11 forecast by FactSet and the $1.81 expected by LSEG. 📈✨

The exchange attributes its impressive growth to a confluence of factors, chief among them the rise in trading activity and a significant shift in the regulatory landscape. As Coinbase put it:

“Zooming out, the last few months have demonstrated a sea change in the regulatory environment, unlocking new opportunities for Coinbase and the crypto industry.”

Coinbase

Transaction revenue surged to $1.6 billion, a 172% increase from the previous quarter, while subscription and services revenue climbed to $641 million. These figures are a clear indication of the company’s growing influence and the trust it has garnered among crypto enthusiasts and investors alike.

Coinbase is not one to rest on its laurels. The company is bullish about its future, heralding the latest regulatory shifts under the Trump administration as the “dawn of a new era for crypto.” With renewed vigor, Coinbase plans to focus on building, with ambitious goals to boost stablecoin adoption, expand its layer-2 network Base, and broaden the horizons of crypto payments.

“At the same time you will see us working hard to bring more people onchain through products like our leading layer 2 platform Base, SmartWallet, and Coinbase Developer Platform.”

Coinbase

Yet, even as Coinbase basks in its current success, it remains acutely aware of the challenges that lie ahead. Stablecoin transaction fees, while still robust, dipped 9% quarter-over-quarter to $226 million. However, the company is confident that through strategic partnerships and the introduction of new products, it will navigate these waters with grace and determination. With a strong Q4 under its belt, Coinbase sees an “unprecedented opportunity” on the horizon, provided that market conditions and regulations remain favorable. 🌟🚀

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-02-14 09:54