As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed numerous market trends and cycles. The recent inflows into crypto investment products are reminiscent of the dot-com bubble, where excitement and speculation drove unprecedented growth. However, unlike the internet stocks then, Bitcoin seems to be capturing the majority of these inflows.

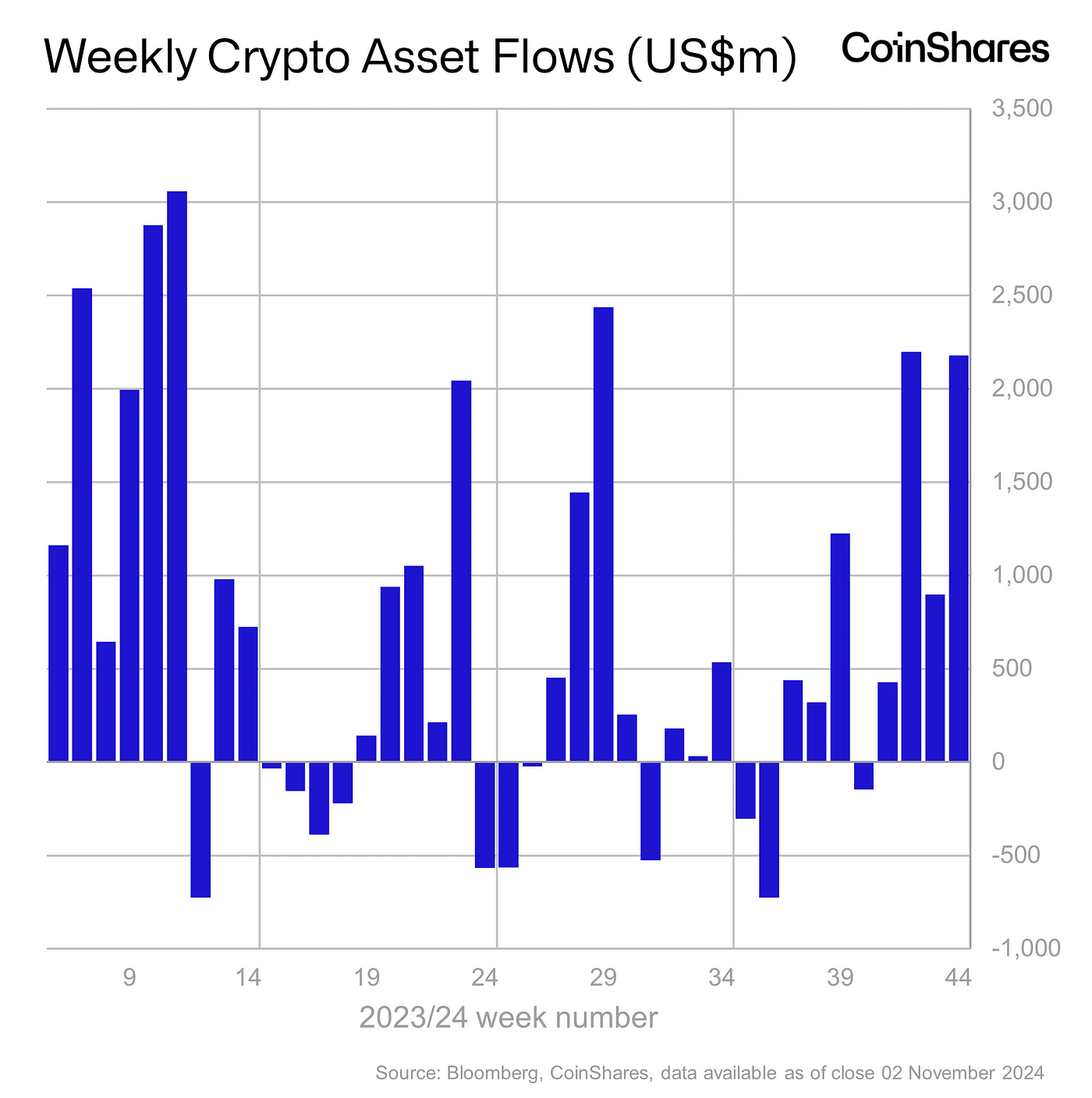

Investment in cryptocurrencies saw an increase of approximately $2.2 billion, bringing the year-to-date total to a new high of $29.2 billion.

Last week, investments in crypto products attracted approximately $2.2 billion, bringing the year-to-date inflows to nearly $30 billion. This surge has pushed the total assets under management over $100 billion for just the second time this year, mirroring the $102 billion figure reached in early June, as reported by CoinShares’ data.

James Butterfill, head of research at CoinShares, believes that the recent influx of investments can be linked to investor optimism about the upcoming U.S. elections. He suggests that “the anticipation of a Republican win might have fueled these inflows, as it seems to have done so during the first few days of last week.

Over the course of the week, the atmosphere changed somewhat, as hinted by small withdrawals on November 1, suggesting Bitcoin‘s responsiveness to political events. The U.S. market was responsible for all the inflows last week, amounting to $2.2 billion, while Germany added a relatively small sum of $5.1 million, according to the data.

Last week’s investment inflows totaled $2.2 billion, primarily directed towards Bitcoin (BTC), while Ethereum (ETH) received just $9.5 million. This is markedly different from the optimism surrounding Bitcoin and Solana, as stated by Butterfill. Essentially, Bitcoin was the main attraction, overshadowing Ethereum in terms of investment inflows.

Last week’s trading activity in the wider market saw a significant jump of approximately 67%, reaching a total volume of around $19.2 billion. This accounts for about 35% of all Bitcoin transactions carried out on cryptocurrency exchanges.

In the lead-up to the upcoming U.S. election, I’ve noticed a surge in popularity for political meme coins. Specifically, PolitiFi tokens tied to Donald Trump have seen impressive growth, with gains exceeding 120%. Meanwhile, tokens representing Kamala Harris have also risen by approximately 30%. As the Nov. 5 election draws nearer, activity surrounding these tokens has intensified, as many predict that this event could significantly impact the direction of the crypto market not just in the U.S., but globally.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-04 14:52