As a seasoned crypto investor with a decade-long journey under my belt, witnessing these astronomical figures and staggering inflows into Bitcoin and other digital assets is nothing short of exhilarating. The $37 billion year-to-date total inflows surpass even the early adoption of U.S. gold ETFs, painting a compelling picture of the burgeoning interest in this new frontier.

With Bitcoin approaching the $100,000 mark, cryptocurrency investment products have seen their highest weekly influx ever, pushing the year-to-date total to an unprecedented $37 billion record.

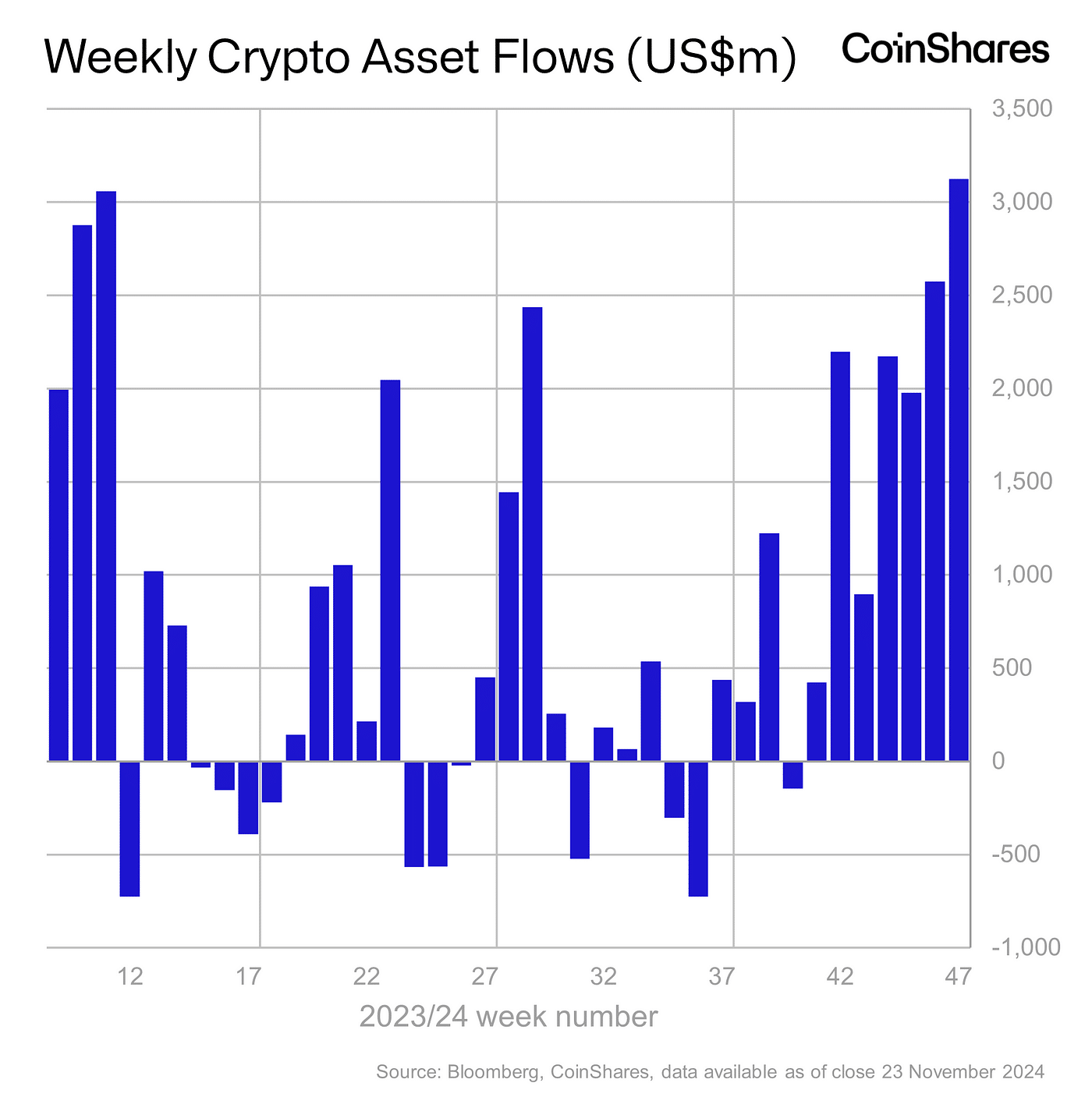

Crypto investment funds achieved another record weekly inflow of $3.13 billion, making the total inflows since September reach a staggering $15.2 billion. This surge in investments is attributed to adjustments in interest rate policies and data from CoinShares. As per a recent report published on November 25, year-to-date inflows have reached an unprecedented $37 billion, significantly outperforming the initial adoption of U.S. gold exchange-traded funds which attracted only $309 million during their first year.

From my perspective as an analyst, I can share that last week, Bitcoin (BTC) was the primary magnet for investments, pulling in approximately $3 billion. As the price of Bitcoin approached $100,000, there was a significant surge in interest in short-Bitcoin products, with inflows totaling around $10 million. This weekly inflow has elevated the monthly total to an impressive $58 million – a level not seen since August 2022.

Mixed regional crypto sentiment

The regional investment patterns displayed a blend of optimism and caution. American funds attracted an inflow of $3.2 billion, whereas European markets experienced outflows totaling $141 million. German, Swiss, and other European investors seemed to seize the opportunity presented by recent price peaks to realize their profits, as noted by Butterfill. Conversely, investments in Australia, Canada, and Hong Kong showed growth, contributing $9 million, $31 million, and $30 million respectively.

In terms of altcoins, Solana (SOL) surpassed Ethereum (ETH) last week, attracting approximately $16 million compared to Ethereum’s $2.8 million. Additionally, XRP (XRP), Litecoin (LTC), and Chainlink (LINK) experienced significant interest, with inflows of around $15 million, $4.1 million, and $1.3 million respectively. However, a variety of investment products that include multiple assets faced their second consecutive week of outflows, totaling approximately $10.5 million based on the data.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-25 16:02