For the second consecutive week, crypto investors removed approximately hundreds of millions of dollars from digital asset investments, spurred by apprehensions over rising interest rates and global political unrest.

Last week, there was a total withdrawal of $206 million from digital asset investment products as reported by CoinShares. The majority of these withdrawals came from U.S.-based Exchange-Traded Funds (ETFs) and financial instruments linked to Bitcoin (BTC).

Last week saw a drop in global ETP (Exchange-Traded Product) Bitcoin trading volumes from $21 billion to $18 billion. However, the overall Bitcoin trading market remained active. A month ago, ETPs accounted for approximately 55% of all Bitcoin trades; however, this proportion has now decreased to roughly 28% due to economic factors beyond the cryptocurrency market.

Based on the data, it seems that investor interest in ETPs/ETFs related to ETPs (Exchange-Traded Products) and ETFs (Exchange-Traded Funds) is decreasing. This may be due to the belief that the Federal Reserve will maintain current interest rates for a longer period than initially anticipated.

CoinShares report

During this period, U.S. ETFs experienced a loss of approximately $244 million, while Bitcoin saw over $192 million in withdrawals. Some of these losses can be attributed to Grayscale GBTC liquidations. However, pessimistic investors seemed unprepared for falling market prices as they failed to significantly invest in short positions or related products. Short-Bitcoin investment vehicles reported only minor outflows worth around $300,000.

Crypto proponents show little demand for Ether, blockchain stock

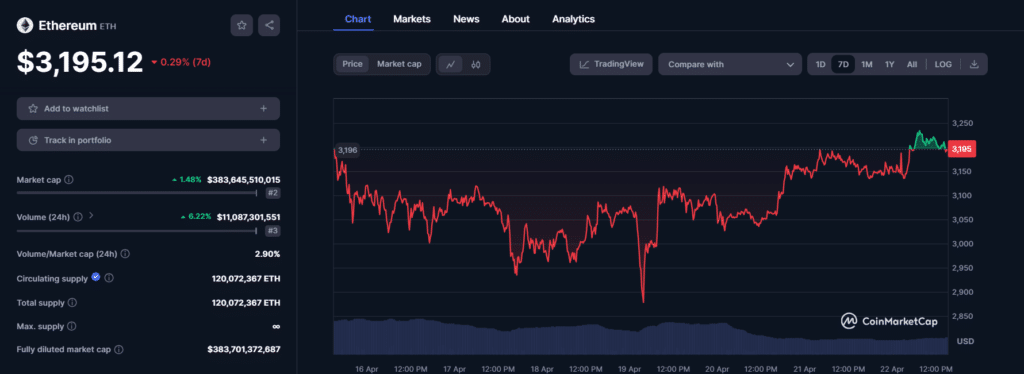

Over the past six weeks, Ethereum has seen a consistent withdrawal of funds to the tune of $34 million each time. The value of Ether (ETH) has remained relatively stable during this period, with only a minimal 0.30% increase or decrease according to CoinMarketCap’s records.

The total value of investments in blockchain stocks decreased by $9 million, marking the 11th consecutive week with reduced confidence among crypto investors. Analysts at CoinShares explained that investors are particularly anxious about how Bitcoin’s halving could influence Bitcoin mining operations.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-22 18:21