More people worldwide are interested in the Bitcoin halving this year compared to 2020.

Based on a study by CoinWire, reported at crypto.news, interest in Bitcoin‘s (BTC) halving event has nearly doubled compared to the last time its reward was cut in half.

This year’s Google search trends for Bitcoin halving were examined globally by the company, revealing a surge in public interest 51 to 100 days prior to the actual event.

In November 2012, the first bitcoin halving resulted in a score of zero on the trends chart since blockchain technology and cryptocurrencies were still novel concepts to most financial observers. However, by July 2016, the score had climbed to four. Then, during the third halving in May 2020, the trend score experienced a significant increase of almost thirteen times.

Europe dominates

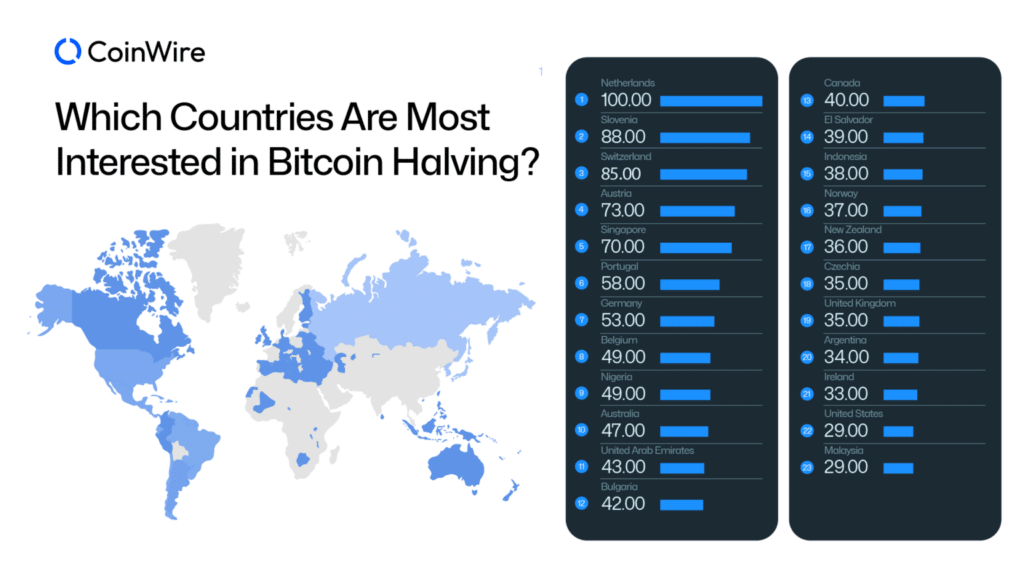

European countries led Google searches relating to the Bitcoin halving, even with the US’s approval of a spot Bitcoin ETF and massive trading volumes of $200 billion. The top five nations were the Netherlands, Slovenia, Switzerland, Austria, and Singapore.

Among the top 10 cities outside of Singapore with high demand for Bitcoin’s halving, European cities took the lead, with Zurich, Switzerland being the frontrunner, scoring a perfect 100, according to CoinWire’s findings.

Amsterdam and Rotterdam in the Netherlands had strong interest in Bitcoin halving with scores of 98 and 93 respectively, following closely behind the Swiss leader. The top 10 cities with the most curiosity towards Bitcoin halving were completed by Vienna, Austria, and five German cities: Dusseldorf, Stuttgart, Munich, Frankfurt, and Cologne.

In the global search for Bitcoin halving information, the U.S. ranked 22nd. However, individual American states demonstrated significant interest: North Dakota and South Dakota both topped the charts, sharing this position with Zurich.

BTC halving could stir defi boom

Experts believe that this year’s Bitcoin halving may have a different effect on prices and emerging trends because of the introduction of spot Bitcoin ETFs and the increasing popularity of decentralized finance (DeFi) applications on the Bitcoin network.

According to Ryan Lee, the Chief Analyst at Bitget, who spoke with crypto.news, there could be an increased interest in Bitcoin (BTC) applications and decentralized apps (dapps) as the halving event brings more focus on Bitcoin’s role as the leading decentralized network.

“Bitcoin’s long-held positive attitude among buyers has ignited a surge of interest in Decentralized Finance (DeFi). Pioneers are eagerly investigating how DeFi can be implemented on the Bitcoin platform. Although this development is still new, we believe it could become a significant trend that brings added value to Bitcoin supporters beyond ETFs.”

Ryan Lee, Bitget Chief Analyst

Anonymously, Domo the innovator advanced the concept further and developed the BRC-20 norm, akin to Ethereum’s (ETH) acclaimed ERC-20 standard used for creating digital assets on the crypto world’s second most prominent blockchain.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-12 20:50