As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen my fair share of projects promising the moon and delivering a crater instead. With IOTA, it seems to be a case of potential versus reality thus far. The recent surge in price, while welcomed by many investors, is a familiar dance for those who have been around the block a few times – a pump followed by a dump.

On November 19th, the value of IOTA surged to $0.2153, following the announcement of the next update in its distributed ledger network by its developers.

On Tuesday, IOTA (IOTA) experienced a pullback, dropping to approximately $0.1760, which is close to entering a technical bear market. This downturn reduced its market capitalization to about $627 million, a substantial drop from its all-time high of over $14 billion.

Developers have revealed their intentions to unveil Rebased, a fresh update designed to enhance the appeal of the network for coders. If this plan is endorsed, IOTA’s infrastructure will incorporate aspects such as complete decentralization, support for Ethereum Virtual Machine (EVM), and the capability to process over 50,000 transactions per second.

Compared to Ethereum (ETH), which can only process around 50 transactions per second, Solana performs approximately 2,500 transactions per second. With the upcoming upgrade, Solana will also incorporate a staking feature, allowing users to generate earnings by assigning their coins to others.

In essence, the concept of Rebased signifies a significant transformation for IOTA. It moves away from a largely centralized structure that offered limited programming capabilities and towards a more advanced version boasting increased functionalities.

Although it offers potential enhancements, IOTA finds itself up against fierce rivalry in the first layer market, which is primarily controlled by Ethereum, Solana, and BNB Smart Chain. Additionally, it competes with second-layer networks such as Avalanche, Arbitrum, Optimism, and Polygon.

Moreover, it’s crucial for IOTA to conquer its challenge in luring developers towards its platform. Unfortunately, its IOTA Ethereum Virtual Machine has managed to attract only a limited number of developers, with a total value locked at $32.3 million and merely seven decentralized finance applications within its ecosystem.

IOTA price path to $1 is challenging

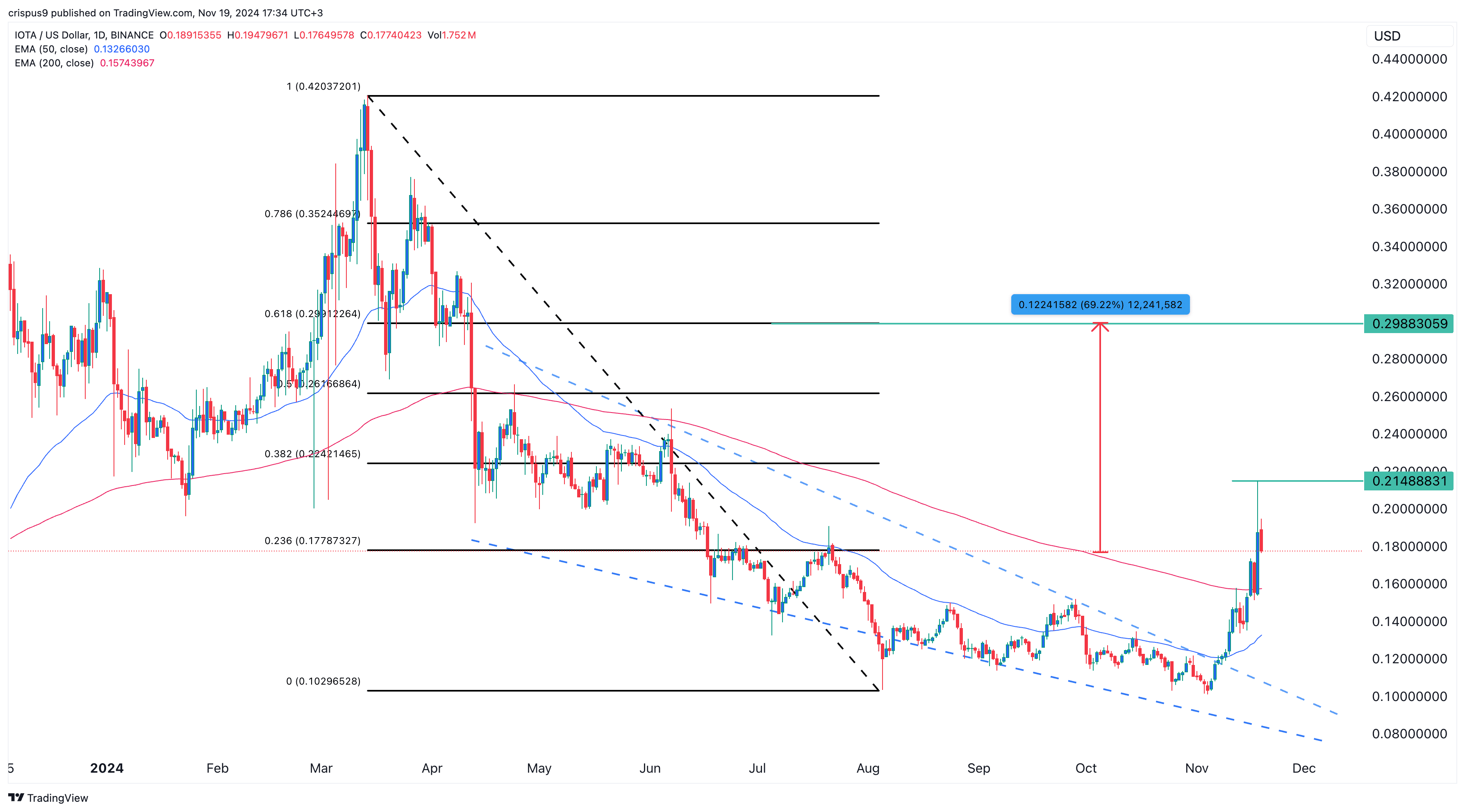

Each day’s graph demonstrates that the IOTA token previously displayed a falling wedge formation, followed by an upturn. This upward trend occurred concurrently with a general rise in cryptocurrencies and optimistic feelings indicated by the fear and greed index.

The price of IOTA surpassed a wedge formation and exceeded both its 50-day and 200-day Exponential Moving Averages. Additionally, it briefly touched the 23.6% Fibonacci resistance level.

If the token surpasses its highest point of $0.2150 on Nov. 18, which acts as a significant resistance, it could potentially lead to further growth. This upward trend might take the price close to the 61.8% Fibonacci retracement level around $0.2988, roughly 70% higher than its current value.

Nonetheless, the likelihood of IOTA hitting $1 is considered quite low, given that such a price surge would equate to a significant jump of around 466% from its current market value.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2024-11-19 18:53