In the grand theater of the cryptocurrency market, a dramatic scene unfolds as a staggering sum of $2.58 billion in Bitcoin and Ethereum options prepares to meet its maker today. This financial melodrama is poised to inject a gallon of volatility into the veins of the market, promising a rollercoaster ride for the intrepid traders who dare to partake in its thrills.

The lion’s share of this loot, a cool $2.18 billion, is courtesy of Bitcoin (BTC), while Ethereum (ETH) modestly contributes $396.16 million to the day’s potential pandemonium.

Holders of Bitcoin and Ethereum Clench Their Portfolios

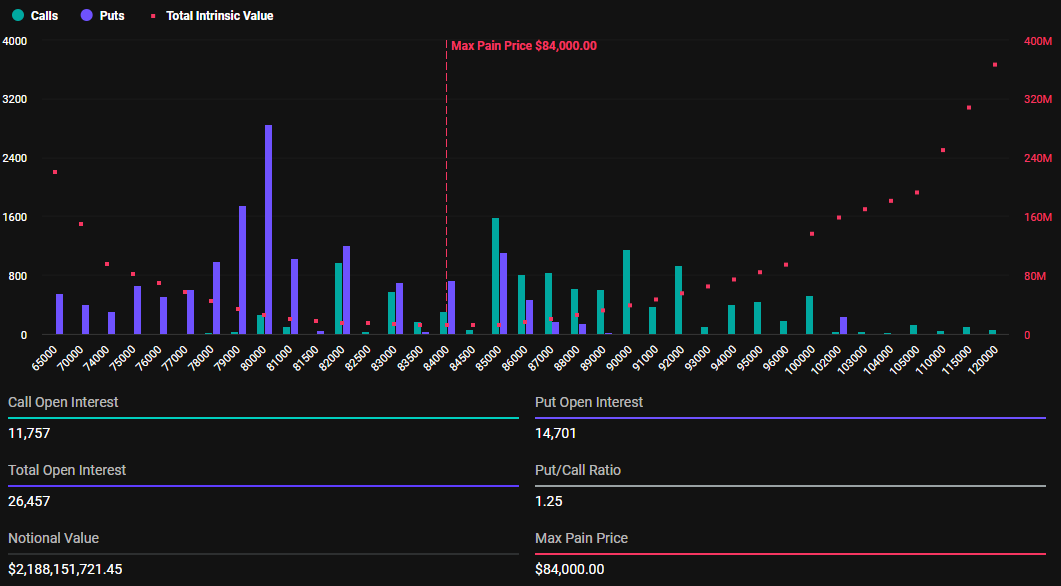

Data from Deribit, the esteemed cryptocurrency exchange that sounds like a Scandinavian furniture assembly manual, reveals that 26,457 Bitcoin options will expire today. This pales in comparison to the Q1 finale, where a whopping 139,260 BTC contracts took their final bow. The contracts set to expire today boast a put-to-call ratio of 1.25 and a maximum pain point of $84,000, a figure that may well cause some to wince.

The put-to-call ratio, akin to a theatrical critic’s review, suggests a bearish sentiment, with more bets placed on the market’s potential plunge than on its ascent to the stars. It seems the traders are donning their bear costumes for Halloween in April.

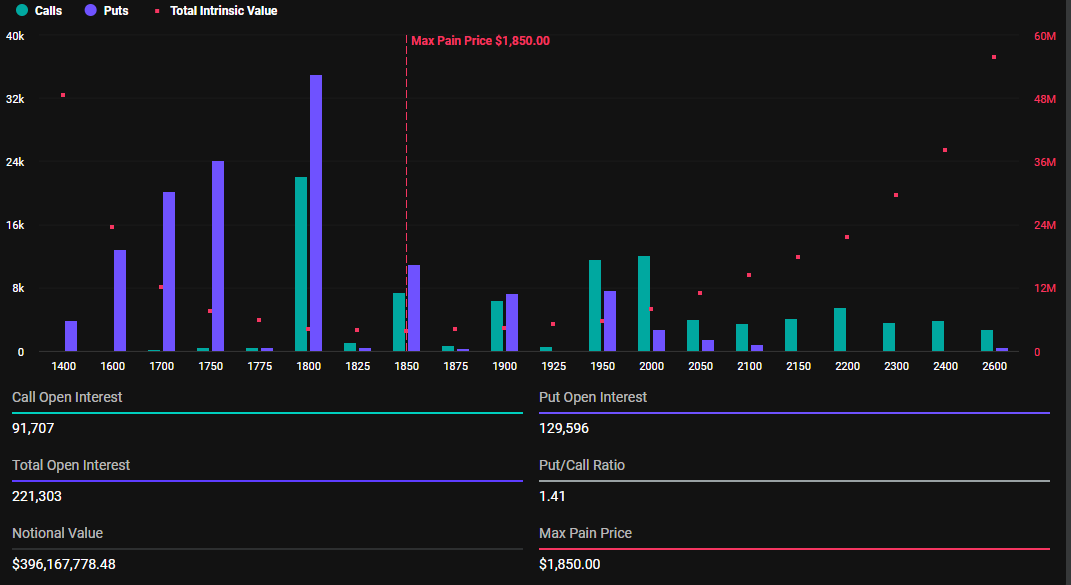

Meanwhile, Ethereum options are not to be outdone, with 221,303 contracts preparing to take their final bow. The put-to-call ratio stands at a lofty 1.41, with a max pain point of $1,850, suggesting that ETH might perform its own dramatic price movements before the curtains close.

As the tick-tock of the options clock approaches the witching hour of 8:00 UTC, the prices of Bitcoin and Ethereum are expected to dance a tango toward their respective maximum pain points. At the time of writing, BTC and ETH were spotted flirting with the levels of $82,895 and $1,790, respectively. Could this be the market’s attempt at a tragicomic romance, aiming to reunite with the “max pain” level just in time for the grand finale?

According to the Max Pain theory, a masquerade ball where options prices waltz toward the strike prices where the most contracts expire worthless, the market may yet surprise us with its twisted sense of humor.

However, once Deribit settles the contracts, the price pressure on BTC and ETH will likely take a bow, though the echoes of this grand expiration could still stir up some mischievous volatility.

“Where do you see the market going next? Deribit inquires with the nonchalance of a spectator at a tennis match.

Over at Greeks.live, the analysts, who one might suspect are actually soothsayers in disguise, have been heard discussing the market’s mood. They speak of a bearish bent, lending credence to the flurry of bets placed on the market’s potential stumble.

The Market’s Mood: As Gloomy as a British Seaside Resort

In a tweet that could rival the brevity of a haiku, Greeks.live reported a predominantly bearish sentiment in the options market. This comes on the heels of the former President Trump’s tariff announcement, which, while not the 100% blanket rate that some had feared, was still greeted with the enthusiasm of a cat at a dog show.

BeInCrypto, the herald of all things crypto, noted that the new tariffs, a 10% blanket rate with an additional 25% on autos, were seen as a negative turn, sparking a symphony of concern among the trading masses.

The options flow, often more telling than a blushing bride on her wedding day, reflects this pessimism. Heavy put buying has dominated the trades, with analysts observing significant put buying, including “700 79k puts for end of April.” This is the financial equivalent of stockpiling canned goods ahead of an impending storm.

“Trump’s tariffs are viewed as severe trade disruption… The market’s initial positive reaction with a price spike to $88 was seen as gambling/short covering, followed by a sharp reversal as reality set in about economic impacts. Options flow remains heavily bearish, with traders noting significant put buying, including “700 79k puts for end of April,” wrote Greeks.live analysts, with the gravitas of a Shakespearian actor delivering a soliloquy.

The purchase of 700 $79,000 puts for the end of April is akin to a vote of no confidence in the market’s immediate future. The consensus among traders, as sharp as a tailor’s measuring tape, points to continued volatility, with a potential “bad close” below $83,000 today, Friday, April 4. Such a move would not only erase the earlier pump but also leave traders feeling as deflated as a soufflé that failed to rise.

In this bearish landscape, traders are reportedly favoring bearish strategies, such as short calls or put calendars. Shorting calls, in particular, is regarded as the strategy du jour, much like a well-tailored suit at a society wedding.

Thus, the market’s initial reaction to Trump’s tariffs, a mix of hope and hard truths, has given way to a reversal that reflects the broader economic ramifications of his policies. As traders steel themselves for a bout of market turbulence, the bearish outlook in options trading crafts a portrait of caution and preparedness for the tumultuous days ahead.

With global supply chain disruptions and economic uncertainty looming over the market like a dark cloud at a picnic, it’s clear that the only certainty in the crypto world is its unrelenting unpredictability. 🎭🐻💰

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-04-04 10:02