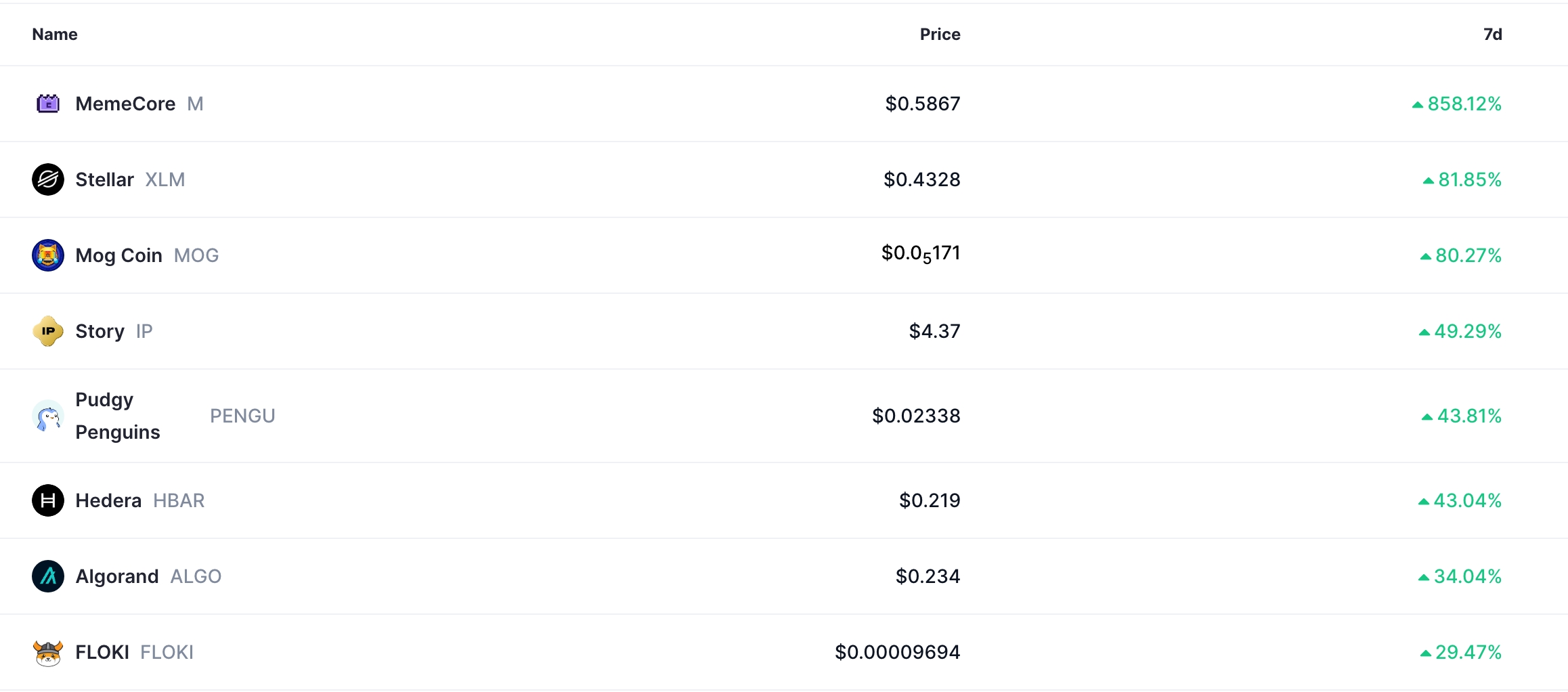

Bitcoin (BTC) has decided to play a game of “let’s see how high I can go” and smashed through a whopping $118,800 last week! 🎉 This little leap pulled the entire crypto circus up to a dizzying $3.68 trillion valuation—no big deal, right? It’s like the crypto market threw a party, and even the altcoins like Stellar (XLM), Mog Coin (MOG), Story (IP), and Hedera (HBAR) jumped on the dance floor, shaking their digital booties.

But wait! Before you start popping confetti, there’s a cloud of uncertainty in the sky, courtesy of looming inflation data, the kickoff of earnings season, and Congress putting on their legislative superhero capes for something dubbed “Crypto Week.” 🎭 This rally might just find fresh fuel—or take a nosedive into turbulence.

One word: inflation (ugh)

So, what’s the latest buzz? It’s all about the US consumer inflation data hitting our inboxes on Wednesday. Economists are broadcasting the exciting news that inflation apparently rose in June, thanks to President Trump’s tariffs crashing the party 🥳. The median prediction is that core inflation ticked up to a thrilling 0.3%—the highest drama we’ve seen in months, leading to an annual rise of 2.9%. Talk about a party crasher!

A puffed-up inflation report, combined with the recently sizzling U.S. nonfarm payrolls data, is making the Federal Reserve look all hawkish. No rate cuts in July, folks! 😱 And think about it: when the Fed’s slashing rates or hinting at more cuts, risky assets like cryptocurrencies usually get a high-five.

2 reasons why earnings matter this week (are you paying attention?)

Buckle your seatbelts—the grand U.S. earnings season kicks off on Tuesday! We’ll see numbers from the biggest names in finance: Goldman Sachs, BlackRock, JPMorgan, and Citigroup. Place your bets—are they still in the game?

These results are crucial for the crypto market for two reasons:

- If the earnings are sparkling, and the stock market throws itself a party, cryptocurrencies are likely to join in the fun and bounce up!

- And who knows? Some of these bigwigs might dish out exciting news about stablecoin or crypto treasury strategies. I mean, who doesn’t love a surprise?

3 pieces of legislation (yawn, but important)

Get ready for the headlines, because three bills are about to crash the “Crypto Week” shindig: CLARITY, GENIUS, and an anti-CBDC measure.

- The House Rules Committee is expected to dazzle us with the GENIUS Act—a stablecoin policy bill—possibly dropping as early as this afternoon. It’s geared up for a floor vote later this week. No amendments allowed. They said, “Let’s make this smooth and easy-peasy!” 🤔

- The CLARITY Act is also on the table, tackling the separation of crypto powers between the Securities and Exchange Commission and the Commodity Futures Trading Commission. Sounds exciting, right? 🙄

- And how about the Anti-CBDC Surveillance State Act, brought to you by Rep. Tom Emmer? This beauty aims to keep central bank digital currencies (CBDCs) on a short leash. The Blockchain Association and other banking groups are throwing their support behind it. Just what we needed—more laws! 🎉

Getting some clarity on regulations could either send crypto prices skyrocketing or tank them altogether. Buckle up!

Four Horsemen of the crypto ETF boom (you don’t want to miss this)

One of the juiciest catalysts for the crypto market last week was ETF inflows for Bitcoin, Ethereum, XRP, and Solana exchange-traded funds. 💰💥 It’s like a financial feast, and everyone wants a slice! According to crypto.news, the demand from American investors has been robust—spot Bitcoin ETFs raked in over $2.7 billion in net inflows, while Ethereum funds enjoyed a cozy $907 million.

The same party vibes hit Teucrium’s XXRP and Rex-Osprey Staked SOL ETFs, which continued their momentum. Historical data suggests that more inflows typically lead to higher Bitcoin and altcoin prices. So, hold onto your hats—this could get bumpy!

Read More

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-13 17:39