In the grand theater of the cryptocurrency bazaar, Bitcoin, that stalwart titan, stood firm amidst the tempest of market sell-offs, while the altcoins, poor wretches, were left to flounder in the abyss of estimated liquidations ranging from a staggering $8 billion to $10 billion. Oh, the irony! Funding rates, those fickle harbingers of doom, plunged into the depths of negativity, as if mocking the very essence of hope.

As volatility erupted like a poorly timed joke, the crypto market trembled, erasing billions in open interest. Bybit and Block Scholes, those watchful sentinels, reported that while Bitcoin (BTC) clung to its dignity, the altcoins were dealt a savage blow, akin to a slapstick comedy gone awry.

In a research report shared with crypto.news, Bybit proclaimed with a flourish that Bitcoin “outperformed relative to the wider crypto market.” How noble! Meanwhile, the Ethereum (ETH) options market, in a fit of dramatic flair, experienced a spike in short-term volatility, soaring above 140%—the highest level in over three months. One can only imagine the gasps of disbelief! 😲

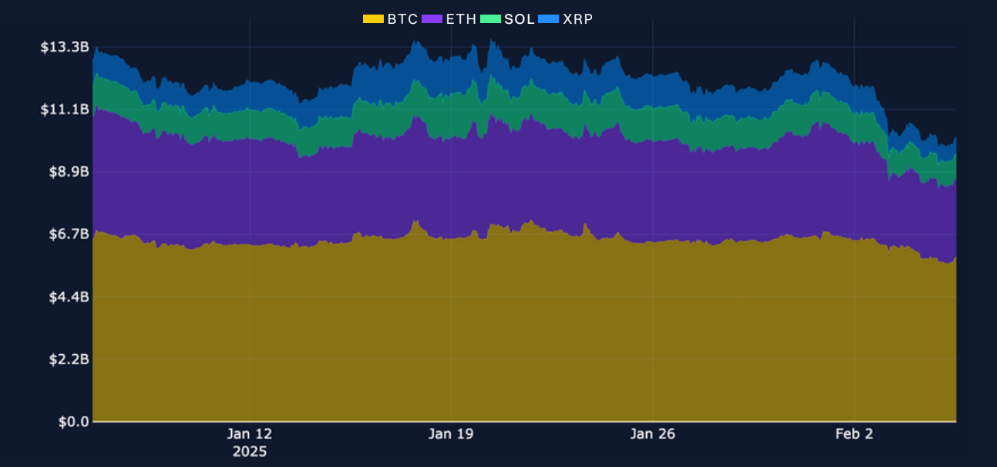

Ah, the liquidations! A veritable bloodbath! As crypto.news previously reported, Bybit CEO Ben Zhou, with a glint of grim humor, estimated that the true notional value of liquidated positions could have been “at least $8 billion to $10 billion.” Across the realms of BTC, ETH, XRP (XRP), and Solana (SOL), more than $3.1 billion in open interest vanished like a magician’s rabbit after a late-Friday high. Abracadabra! 🪄

Funding rates drop for altcoins

Funding rates, those cruel jesters, reflected the bearish shift with a mocking grin. Altcoins, in their despair, saw funding rates plunge deeper into the abyss in the days following the crash, while BTC, that steadfast guardian, remained relatively stable, as the report so dryly states. Open interest levels plummeted across major tokens, save for one—Bitcoin’s options market, which, unlike its perpetual counterparts, did not suffer a major liquidation event. A miracle, perhaps? Bybit noted that its term structure inversion resolved with the swiftness of a well-timed punchline.

Despite the market’s chaotic ballet, trading volume surged, with over $31.1 billion in perpetual swaps traded on Feb. 2, marking the highest daily volume in over a month. For Bitcoin, short-term options volatility eased after an early-week spike, suggesting a return to stability, at least for now. But in the world of crypto, who can ever be truly certain? 🤔

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-02-08 01:45