“Crypto Chaos: When ETFs Get the Last Laugh 🤑”

On days like these, one cannot help but ponder the whimsical nature of the market. A curious case of schizophrenia, where two disparate tales unfold simultaneously, leaving the observer bewildered.

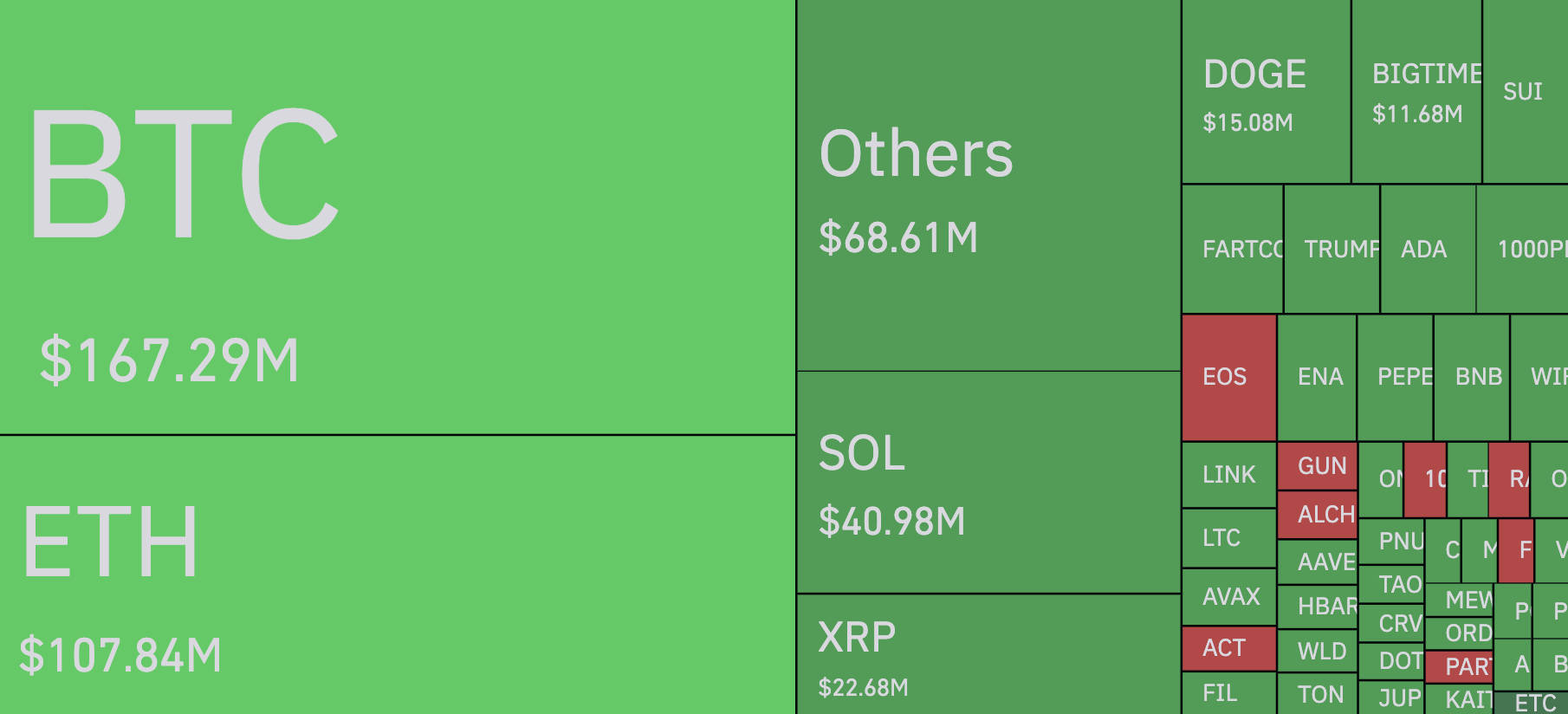

As the crypto market succumbed to a bloodbath, with nearly 200,000 traders sent reeling, a staggering $567.99 million vanished into thin air. And yet, amidst the carnage, Bitcoin ETFs – those enigmatic creatures – continued to accumulate BTC with the stealth of a ninja.

Long traders, it seems, were left holding the bag, with a $370.27 million loss to show for their troubles. Short sellers, on the other hand, suffered a $197.84 million blow. Meanwhile, Bitcoin itself took a nosedive, plummeting from $88,500 to below $81,000 in the wake of the U.S. government’s tariff announcement. 🤯

But, like a phoenix from the ashes, Bitcoin ETFs arose, their net inflow totaling 1,941 BTC, a value of approximately $159.76 million. The ARK 21Shares Bitcoin ETF led the charge, adding 1,500 BTC to its stash, now a veritable treasure trove worth $3.95 billion. 🏹

Fidelity Wise Origin Bitcoin Fund and Bitwise Bitcoin ETF followed suit, with inflows of 1,375 BTC and 386 BTC, respectively. BlackRock’s iShares Bitcoin Trust, however, suffered a net outflow of 1,341 BTC, a testament to the enduring skepticism of some investors. 🤔

But here’s the rub: ETF inflows and outflows are often a reflection of past events, rather than real-time chaos. So, what does it all mean? Are Bitcoin ETF investors playing a long game, while the rest of the market panics? Or are we witnessing the first signs of a seismic shift in how institutions and retail investors react to volatility? 🤷♂️

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-03 18:43