XRP swaggered up a modest 2% last week, which in crypto terms is like bringing a fork to a laser sword fight—basically, not impressive. Our beloved technical divining rods—the RSI, Ichimoku Cloud, and EMA lines—are all humming a symphony of bearish doom. Let’s crack open these charts like a wizard’s spellbook and see what arcane mischief XRP might get up to next.

XRP RSI: The Buyers Are Dropping The Mic (And Maybe Their Coins)

The Relative Strength Index (or RSI if you want to sound fancy at parties) has plummeted from a sprightly 57.30 to a moderately glum 46.34 in a day. Imagine a caffeinated trader suddenly realizing the coffee machine is broken—that’s the energy shift here.

When RSI dives faster than a startled frog, it usually means traders are cashing out or just tired of holding bags that look like they might explode. XRP hasn’t hit ‘sell everything!’ territory yet, but dropping below 50 is like waving a red cape at a bull—it’s more of a “Hmm, maybe back off” sign.

The RSI dances between 0 and 100. Above 70 means everyone’s hoarding like dragons on gold; below 30 means panic ensues. At 46.34, XRP is somewhere in the middle—maybe more like a confused dragon debating whether to nap or roar.

This suggests upward mojo is fading faster than a wizard’s patience during audit season. Unless some mysterious buyer with deep pockets crashes the party, things might get shakier still.

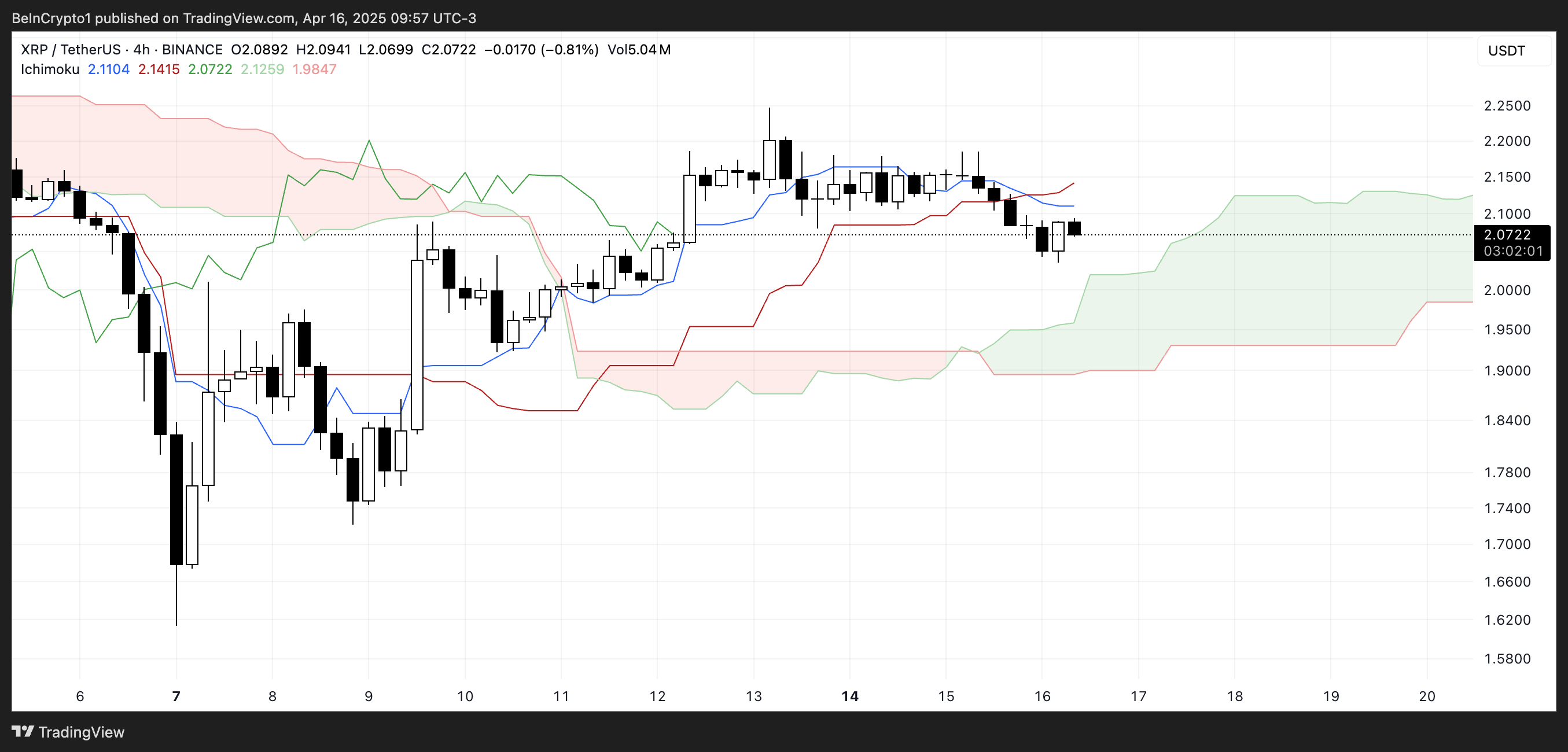

Ichimoku Cloud: XRP’s Emotional Weather Report

The Ichimoku Cloud, which sounds like a place where techno-shamans hang out, currently signals the market mood as ‘slightly damp and gloomy.’

XRP’s price has bailed below the Tenkan-sen and Kijun-sen lines, basically skipping out on the VIP balcony. This is usually bad news, hinting the party’s winding down unless someone can crank the tunes back up pronto.

It’s now tiptoeing into the green cloud, which feels a bit like walking into a foggy pub: things could turn lively, or it could just be everyone quietly staring at their drinks. The cloud ahead is wide and flat, sort of like a lumpy mattress—comfortable but not exactly springy.

The broader trend still leans bullish-ish—like a cat cautiously considering a nap on your keyboard—but if XRP doesn’t scamper back above those critical lines, we could see a mood swing faster than a troll at a poetry slam.

EMA Lines: XRP’s Price Tag is Playing Hard to Get Near $2

The EMA (Exponential Moving Average, or “Mystical Lines of Doom” to insiders) are flashing red flags. XRP keeps trying to bust past the stubborn $2.17 barrier but keeps hitting an invisible force field. Even gossip about a ‘Swift’ partnership isn’t shifting these stubborn sellers.

We might be witnessing a “death cross” in the making—no, not a grim Viking farewell, but when the short-term EMA dives below the long-term EMA. This often means traders should buckle up for a bumpy ride that could see XRP dipping to $2.02 or even $1.96, which is like a clearance sale no one wanted.

Should XRP fall through those floors, it might tumble further to $1.61, possibly resulting in much gnashing of teeth and hair pulling. On the flip side, if the bulls muster some courage and reclaim $2.17, then eyes on $2.24 as the next hurdle—clearing that might even spark a rally up to $2.50, which would be like the market suddenly finding a forgotten bag of wizard gold.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Gold Rate Forecast

- Gods & Demons codes (January 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Former SNL Star Reveals Surprising Comeback After 24 Years

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

2025-04-17 02:42