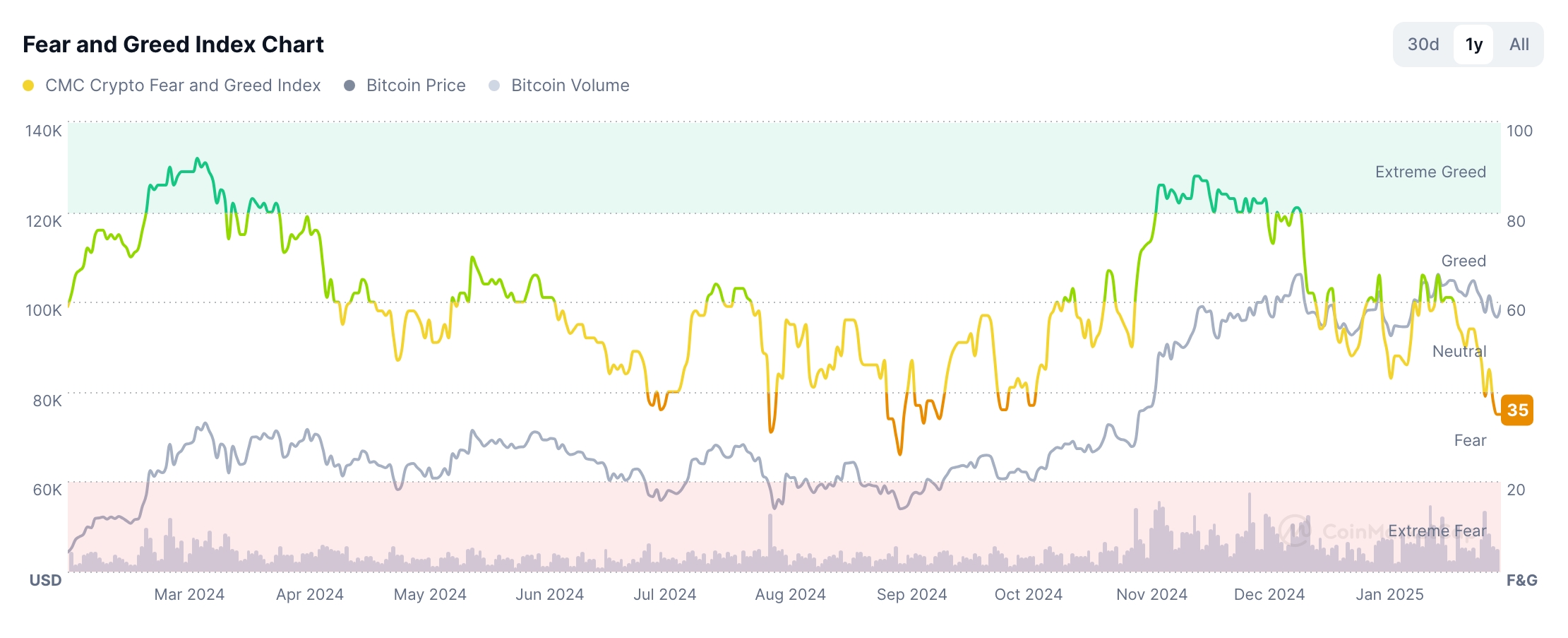

Ah, the capricious dance of the digital dollar! This week, Bitcoin and its motley crew of altcoins—those gauche imitations of the granddaddy of crypto—underwent a rather unseemly retreat. The crypto fear and greed index, that barometer of our collective financial anxieties, plummeted into the abyss of “fear” 😨, a state of being not unfamiliar to those who ventured into this volatile realm.

Ethereum, that supposed champion of smart contracts, dropped to a paltry $2,100, a precipitous decline from its lofty perch earlier this year. Even Dogecoin, that meme-spawned darling of the internet, tumbled to $0.2060, its lowest point since the autumn of 2023. As for XRP, that perpetually misunderstood child of Ripple, it fell to $1.8010, a descent mirroring the trajectory of a disgraced socialite. 😔

Solana, Polkadot, and Chainlink, those lesser-known players in the crypto game, also suffered double-digit losses. However, like fallen angels, they managed to claw their way back towards their starting positions, albeit with a few bruised feathers. 🤕

The total cryptocurrency market cap, a measure of the combined value of all cryptocurrencies, initially dipped to a paltry $3 trillion on Monday before rebounding to a more respectable $3.3 trillion by Friday. A testament to the volatility of this digital playground, one might say.

The broader crypto market retreated this week amid growing concerns over a potential trade war between the United States and its trading partners, a scenario that could be described as “unfortunate” at best. Former U.S. President Donald Trump, that enigmatic figure of the past, announced a 25% tariff on goods imported from Mexico and Canada, and a 10% tariff on Chinese imports. A move, one might say, that could be viewed as a catalyst for a global trade war. 🌎💣

He then, in a display of unexpected benevolence, paused tariffs on Canadian and Mexican goods for 30 days, pending negotiations. However, tariffs on Chinese imports remain in place, a lingering threat to global economic stability. One could say this is reminiscent of a chess game, with each country vying for a strategic advantage, leaving the crypto market, like a pawn, susceptible to the whims of international politics.

Bitcoin and Ethereum ETFs: A Tale of Weak Demand

Bitcoin and its altcoin entourage also suffered losses due to the lackluster demand from institutional investors. Spot Bitcoin and Ethereum witnessed net outflows, while MicroStrategy, a company known for its Bitcoin acquisition spree, paused its purchases. The company, having acquired Bitcoins for twelve consecutive weeks, now holds a staggering 471,000 coins. It seems even the most fervent Bitcoin believers are starting to question the future of the digital asset.

Altcoins, including Ethereum, DOGE, XRP, and SOL, also tumbled as investor sentiment waned. The closely watched fear and greed index, a gauge of market sentiment, plunged to 35, its lowest level since October of the previous year. A stark reminder that when fear reigns supreme, cryptocurrencies tend to follow suit.

These losses coincided with a decline in the altcoin season index, a measure of the relative strength of altcoins compared to Bitcoin. The index dropped to 33, down from its year-to-date high of 47, indicating a preference for Bitcoin over its lesser-known counterparts. A potential bullish catalyst for altcoins is the formation of a hammer candlestick pattern on the weekly chart. This pattern, characterized by a long lower shadow and a small body, is a well-known bullish reversal signal. A glimmer of hope for the beleaguered altcoins, one might say.

Additionally, Bitcoin has formed a bullish flag pattern on the weekly chart, which could indicate a potential rebound. A beacon of optimism for the beleaguered Bitcoin faithful. One can only hope that this rebound will be swift and decisive, restoring order to this volatile market.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-02-07 20:51