Like a sudden blizzard gripping April 7 with icy resolve, whispers of a “black Monday” echo through trading halls. Industry voices tremble at weekend carnage, and so, our drama unfolds 😏.

For two days, wild winds of fortune tore through over $1 billion in long and short positions, leaving the battlefield scattered with digital debris. Who said weekends were for rest? 🤷♂️

A Storm of Crypto: Weekend Carnage

Wise watchers at Coinglass report that on Saturday, April 5, a tidy $116.59 million vanished into the market’s vortex—an unbalanced cocktail of $33.02 million short and $83.57 million long. And if Saturday’s chaos wasn’t enough, Sunday delivered a furious encore, sweeping up over $850 million in positions, with $743.115 million in bullish hope dashed and $107.881 million of short-lived smugness also undone.

“In the past 24 hours, 320,444 traders were liquidated, the total liquidations come in at $985.82 million,” Coinglass pronounced, presumably clutching their pearls.

This collective gasp rattled the market’s bones. CoinGecko notes a total market slump of over 10%, plunging global crypto worth to $2.5 trillion. Among top-tier coins, XRP had the dubious honor of leading the free-fall, down 15.4% at $1.7, while Ethereum donned a somber look at $1,480, shedding 14.3%—the perfect recipe for a crypto pity party 😢.

Armchair prophets on X (Twitter) conjure up comparisons to “Black Monday,” that historic meltdown from 1987, fostering an atmosphere of poetic gloom accompanied by a side dish of “Surely it can’t get worse?!” 🥴

“Tomorrow [April 7] is shaping up to be Black Monday 2.0,” declared analyst Maine, presumably while clutching the crypto equivalent of a teddy bear.

Back in 1987, the world witnessed a jaw-dropping avalanche of stock values—a 22.6% dive for the Dow Jones. Without a circuit breaker in sight, the plunge continued unabated, scarring financial history forever. One can almost imagine the ticker tape weeping. 😭

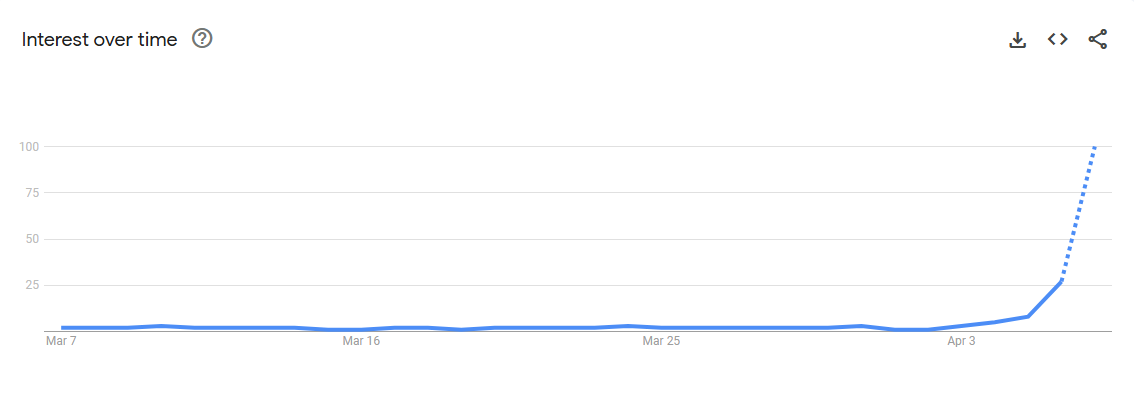

Today, the search term “black Monday” frolics at its highest rank on Google Trends, which is probably the only kind of peak anybody wants to see right now.

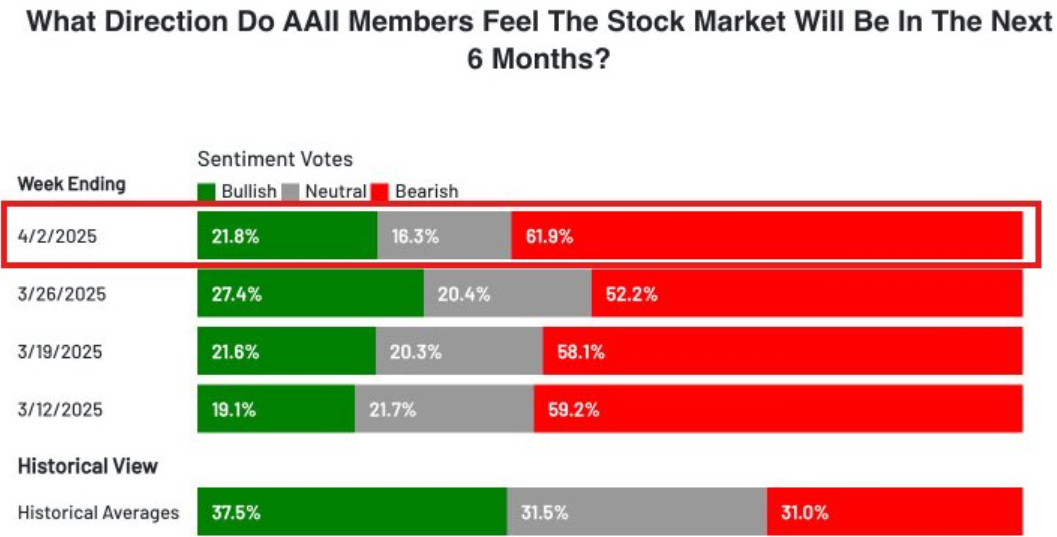

“Bearish sentiment is arguably near its highest levels in history,” deadpanned The Kobeissi Letter, winking at the despair.

Week of Dread: The Roots of Monday’s Gloom

Into this solemn waltz prances talk of new tariffs and an uneasy consensus that we might have found a fresh doomsday. The Kobeissi Letter fans these flames, whispering of “short-term capitulation,” presumably concluding that a break in the clouds might follow today’s hailstorm ⛈️.

“Down then up,” teased these analysts, hinting that life is just one big rollercoaster ride we all forgot to sign up for.

The AAII Sentiment Survey chimes in, with 61.9% soured on the market—a gloomy figure about double the usual. One wonders if a sense of humor is included in that missing half 😂.

“Black Monday 2.0,” warns TheMaineWonk, so at least we have a sequel nobody asked for.

Analyst Duo Nine leaps into the fray, fretting over tariffs that might choke global supply chains and very politely escort us into a long, gloomy crypto winter. Perhaps it’ll last 1-2 years, he muses, if a recession decides to crash the party. Time to stock up on marshmallows? 🤔

“If the US does not make a U-turn soon, then the only conclusion is that this is intentional and the damage will only increase with time. Unfortunately, for crypto, this means the start of a prolonged bear market. It can last 1-2 years or more if a global recession starts,” Duo None solemnly declares, presumably packing a travel bag for the apocalypse.

On the bright side (if there is one), contrarian sorts might see this as their golden moment—when everything’s darkest, you might find hidden treasure under the rubble, or at least a slightly hopeful tweet.

But not everyone’s sipping the doomer Kool-Aid. Ryan Wollner, from Pearpop, waves off the grim comparisons, cautioning that the overshadowed picture might look silly in hindsight.

“I think we might only be looking at a 2-3 week transition, and then we will see people buying back in once the tariffs are more understood,” Wollner said, wearing a confident grin (we assume).

He suggests the cunning among us could sell now, swoop back in later at bargain-bin prices, and skip all the drama. It’s just a short interval, after all, not the epic meltdown from eons past (fingers crossed).

In the meantime, Bitcoin languishes at $77,030, shedding 8% of its sparkle—some might say it’s merely catching its breath. Yet the market stands poised between the siren calls of ruin and the faint melody of rebirth 🌱.

Will this fiasco culminate in epic downfall or a cunning, cryptic renaissance? Grab your popcorn, dear dreamers, for the stage is set, and the next act awaits. 🎭

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-07 09:52