Well, shucks, folks! It seems like the big cheeses, I mean, institutional investors, are finally getting in on the Bitcoin and Ether ETF action! 🤠 A whopping $1.39 billion poured into Bitcoin ETFs, while Ether ETFs raked in a respectable $528.12 million. That’s a whole lotta moolah! 💸

Now, I know what you’re thinkin’, “What’s behind this sudden surge?” Well, partner, it seems like investors are gettin’ a hankerin’ for some crypto exposure via ETFs. And who can blame ’em? The digital asset market is lookin’ like the Wild West, full of possibilities and promise! 🌟

The biggest daily haul came on Tuesday, June 10, when Bitcoin ETFs lassoed $431.12 million. And the champion of champions was Blackrock’s IBIT, which corralled a whoppin’ $1.21 billion for the week! 🏆

But wait, there’s more! Bitwise’s BITB rustled up $82.83 million, Fidelity’s FBTC brought in $79.79 million, and Vaneck’s HODL snagged $29.02 million. And let’s not forget Grayscale’s GBTC ($15 million), Grayscale’s Bitcoin Mini Trust ($12.75 million), Invesco’s BTCO ($7.65 million), and Franklin’s EZBC ($6.30 million). That’s a whole passel of ETFs gettin’ in on the action! 🤠

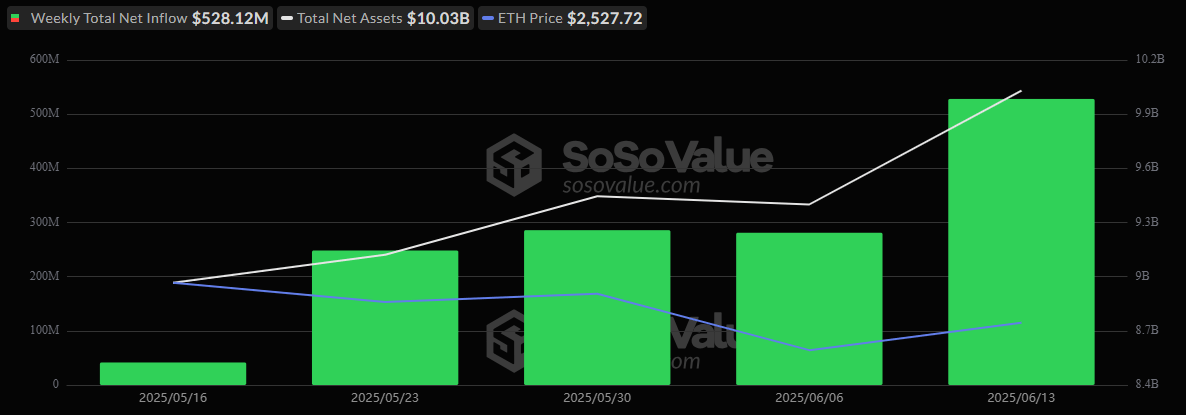

And don’t even get me started on Ether ETFs! They’re on a hot streak, with five consecutive weeks of inflows and a tidy $528.12 million net addition. That’s the third-highest since launch, folks! 🚀

Blackrock’s ETHA led the pack with $380.95 million, followed closely by Fidelity’s FETH ($78.49 million), Grayscale’s Ether Mini Trust ($40.57 million), Bitwise’s ETHW ($14.81 million), and Grayscale’s ETHE ($13.30 million). That’s a regular Ether ETF hoedown! 🎉

So, what’s the takeaway from all this hubbub? It seems like institutional investors are gettin’ optimistic about Bitcoin and Ether ETFs, and the broader market sentiment is lookin’ rosy. Regulatory clarity and strong macroeconomic signals are helpin’ to fuel the fire. 🔥

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Black Myth: Wukong minimum & recommended system requirements for PC

2025-06-16 23:57