Uniswap’s legal challenge against the SEC is raising questions about the regulatory body’s jurisdiction, as a lawyer involved in the case expressed doubts about the strength of the SEC’s argument to crypto.news.

After Uniswap received a warning from the U.S. Securities and Exchange Commission regarding potential securities law violations (similar to a warning shot), the cryptocurrency community reacted strongly and critically.

For those unfamiliar with the terminology, this signifies that the Securities and Exchange Commission (SEC) plans to initiate enforcement proceedings against Uniswap, a decentralized exchange, based on their discovery of potential securities law breaches. However, since Wells notices are confidential, it is only Uniswap that is currently aware of the alleged violations.

Hayden Adams, the creator of Uniswap, shared his frustration with his 280,000 followers on X by stating, “I’m annoyed, disappointed, and prepared to fight.” He strongly believes in the legality of Uniswap’s services as a decentralized exchange (DEX). Adams also criticized SEC chair Gary Gensler for targeting “good actors” in the crypto industry while allegedly being lenient towards FTX until it faced significant consequences.

Today, Uniswap Labs received a warning letter from the Securities and Exchange Commission (SEC). I wasn’t taken aback by this development, but I am feeling frustrated, disappointed, and prepared to defend ourselves.

— hayden.eth 🦄 (@haydenzadams) April 10, 2024

SEC’s arguments ‘particularly weak’

Numerous other prominent figures in the industry have come out in support of Uniswap, criticizing the SEC for overstepping its boundaries, enforcing regulations without providing clear guidelines, and attempting to apply securities laws from the 1940s to cryptocurrencies. Industry associations have once again urged Washington to pass legislation that creates a regulatory framework for digital assets, but this seems uncertain given the upcoming presidential election.

Laura Sanders, policy counsel at the Blockchain Association, told crypto.news:

“The SEC continues to push the limits of its congressional mandate. Its authority is explicitly confined to securities, which do not include tokens exchanged on secondary platforms such as Uniswap. The recent ruling in SEC v. Coinbase, Inc. dismissing the SEC’s claim that crypto wallets qualify as brokers, underscores the weakness of the SEC’s position here. We anticipate that its arguments in any future legal dispute with Uniswap will face similar skepticism in court.”

Laura Sanders, Blockchain Association policy counsel

Coinbase’s tangle with the SEC after it too was handed a Wells notice in March 2023 helpfully illustrates the exasperation that crypto businesses face. At the time, the exchange criticized the commission for failing to offer a clear path to registration — as well as for declining to state which digital assets listed on its platform were suspected securities. “The U.S. crypto regulatory environment needs more guidance, not more enforcement,” it said in a blog post.

Marvin Ammori, Uniswap Labs’ top legal officer, is voicing a familiar concern once more. He contends that the protocol, application, and digital wallet of Uniswap do not align with the legal definitions of securities exchanges or brokers. Furthermore, he finds the SEC’s arguments to be rather flimsy. (X: Marvin Ammori expressed his disagreement with the SEC’s stance on Uniswap, arguing that its protocol, application, and wallet do not fit the legal definitions of securities exchanges or brokers, and that the SEC’s arguments lack substance.)

“Uniswap Labs supports reasonable crypto regulations and the rule of law in the United States. We object to arbitrary enforcement and misuse of power. If necessary, we are ready to challenge such abuses and are optimistic about a favorable outcome.”

Marvin Ammori, Uniswap Labs chief legal officer

Jake Chervinsky, as the legal head at Variant, made a stronger statement: he alleged that the SEC was deliberately scaring and intimidating crypto founders with the intention of forcing them out of the US.

The SEC’s method of regulating cryptocurrencies through enforcement actions gives the impression that they prioritize discouraging the industry over strictly adhering to the law. This may cause crypto innovators to consider relocating their businesses outside of the US due to fear and intimidation.

— Jake Chervinsky (@jchervinsky) April 11, 2024

In a hopeful tone, he reminded everyone that Gary Gensler’s term with the SEC will end in 2026, leaving it up to Congress to decide the regulatory framework for cryptocurrencies. This means the SEC can be challenged and potentially overturned in court if they make incorrect decisions. The commission has faced several losses recently, such as when a judge ruled against them for denying Grayscale’s application to create a Bitcoin-based exchange-traded fund.

“The SEC has had to twist the law beyond recognition in order to justify expanding its reach beyond financial instruments that are actually meant to be securities. Thankfully, federal judges aren’t easily fooled.”

Jake Chervinsky, Variant chief legal officer

Chervinsky commended the crypto community’s ingenuity and legal battles against regulatory challenges, such as the Defi Education Fund and Beba suing the SEC to curb their perceived overreach in enforcement actions. Nevertheless, he cautioned that the situation might worsen before improving.

It’s regrettable that it may take a lengthy process before the applicability of securities laws to digital assets becomes clear. I fervently hope that Congress will eventually pass reasonable legislation for cryptocurrencies. Until then, we must resort to legal battles in the courts.

Jake Chervinsky, Variant chief legal officer

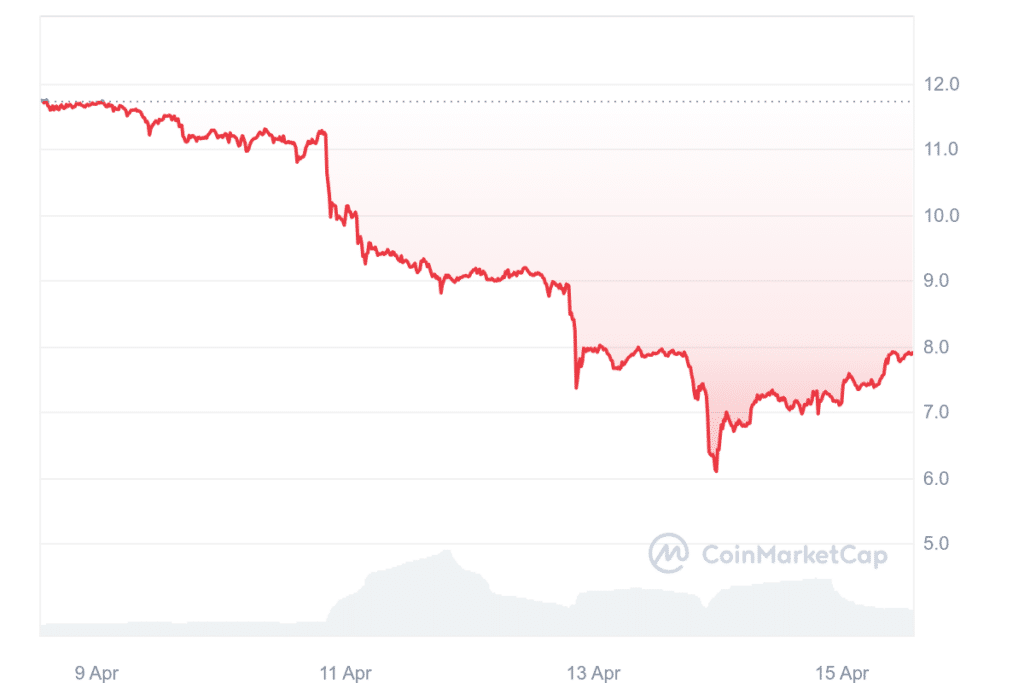

This past week has been challenging for the crypto market as a whole, but Uniswap’s UNI token has taken a hard hit following reports of a Wells notice. As a result, UNI’s value dropped by 32% between April 8 and April 15.

Observing regulatory infringements by a company may result in hefty fines or even the halting of their operations, with confiscation of their assets. However, due to Uniswap’s decentralized infrastructure, where no individual or entity holds ultimate control, it poses a challenge for regulatory bodies like the SEC to impose such actions.

Gary Gensler appears to be betting that the DEX isn’t as decentralized as it seems.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-15 14:38