Last week, the saga of Bitcoin exchange-traded funds—those mysterious vessels carrying hopes and funds across the turbulent seas of finance—revealed a modest triumph: a net inflow of a mere $15 million, a humble reversal from the tempest of losses exceeding $713 million the prior week.

Yet, this glimmer of hope is but a faint flicker, for in the grand chronicle of 2025, it stands as the lowest weekly inflow witnessed since the year’s dawn.

The Quiet Ebb of Bitcoin ETF Inflows in 2025

Between the four days spanning April 14 to April 17, the grand institutions, like cautious generals surveying a battlefield, infused their capital into the BTC spot ETFs, swelling the coffers by $15.85 million.

However, this small tide, though forward-moving, is but the faintest ripple in an ocean that once surged mightily. The bullish fervor has dimmed, as if the great beast of enthusiasm is momentarily asleep.

What weighs upon these sluggish currents? The great dance of nations wrapped in escalating trade tensions, weaving webs of uncertainty so thick that even the most stalwart investors pause, their hearts heavy and their swords sheathed, waiting for clearer omens before throwing their fortunes into the fray.

Bitcoin Ascends, Yet Shadows Lurk as Traders Quietly Depart

At the moment this tale is told, Bitcoin glimmers at $87,64—a notable 3% rise over the day. Yet an eerie silence pervades futures markets, for open interest—the measure of lingering bets—has slipped by 2%.

Open interest is the count of promises yet unpaid, contracts unresolved; when these dwindle amidst rising prices, it whispers that many warriors withdraw from the field, unwilling to wager further. The optimism, if present, is cautious and measured.

This somber caution stretches its shadow even to options markets, where the appetite for protective puts has risen like a melancholic tide.

When puts outnumber calls, it is akin to preparing for an incoming storm—traders batten down their hatches, hoping to shield their fortunes from decline.

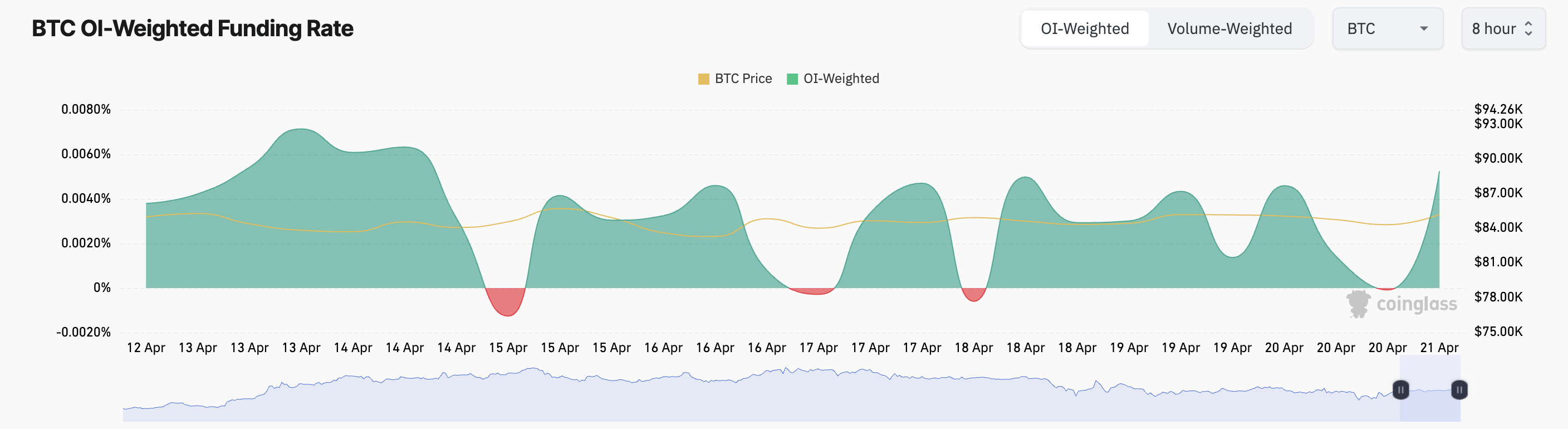

Yet amongst these signs of restraint, a slender ray of light—the funding rate glimmers positively at 0.0052%, according to the oracle Coinglass.

This means long traders, those who believe in the dawn, are paying shorts, those who bet on nightfall. Subtle battles rage beneath the surface, revealing a market still divided—some hopeful, others watchful, all cautious.

Thus, despite the weary gait in ETF flows and the prudence in derivative markets, a faction of traders clutch their optimism, eyes fixed on the horizon, daring to dream of further ascent amid the uncertainty.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2025-04-21 10:49