As an experienced financial analyst, I’ve closely monitored the crypto market trends and have observed how the latest CPI data has influenced its performance. The U.S. Consumer Price Index (CPI) remaining flat in May and the year-over-year rate dropping to 3.3% from 3.4% was a welcome surprise for the market, leading to a significant surge in crypto prices.

As a researcher studying crypto markets, I observed a significant surge in prices on June 12, following the release of the U.S. Consumer Price Index (CPI) figures for May. The absence of notable inflation in those numbers sparked optimistic anticipation among market participants regarding potential beneficial inflation data in the future.

Last month, the Consumer Price Index (CPI) in the United States remained unchanged, marking a decrease from the 0.3% increase observed in April. Contrarily, the yearly change in CPI (YoY) saw a slight drop, decreasing from 3.4% in April to 3.3% in May. This figure surpassed expectations as many analysts had predicted no change in the YoY CPI rate.

Last month, the year-over-year Core Consumer Price Index (CPI) decreased from 3.6% to 3.4%, marking the lowest rate since April 2021. Analysts had anticipated a 3.5% increase for this index instead.

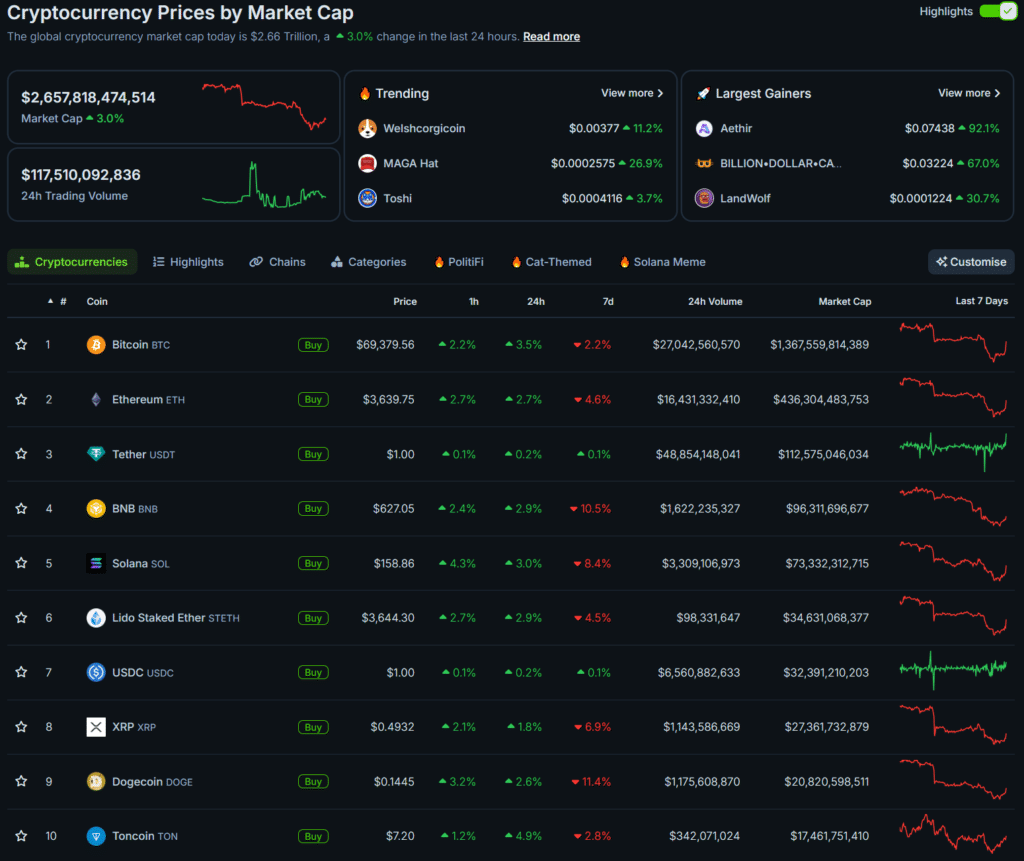

According to recent data updates, the overall value of the cryptocurrency market expanded by approximately 3%, resulting in a total cap of around $2.65 trillion as reported by CoinGecko. Bitcoin (BTC) experienced a noteworthy rise of nearly 4% and surpassed the $69,300 mark, while Ethereum (ETH) saw a growth of almost 3%, reaching $3,639 at the time this statement was composed.

Digital currencies besides the top 10 cryptocurrencies, such as Binance Coin (BNB), Solana (SOL), Ripple (XRP), Dogecoin (DOGE), and Toncoin (TON), experienced moderate growth during the day.

Softer inflation data could buoy crypto prices

The QCP Capital report indicated that cryptocurrency market participants were expecting lessened inflation figures in the upcoming FOMC meeting’s outcome.

The firm observed significant purchases of June 13 call options and heightened funding levels, signaling a preparedness for potential market upward momentum.

As a market analyst at QCP Capital, I believe that a non-stimulative decision from the Federal Open Market Committee could fuel renewed momentum in the cryptocurrency market, potentially pushing prices back up to their previous highs.

As a researcher studying the financial markets, I’ve observed that cryptocurrencies and risk assets could potentially benefit from increased liquidity if the Federal Reserve follows in the footsteps of other central banks, such as the European Central Bank and the Bank of Canada, by implementing rate cuts. These monetary policy decisions have the effect of making capital more easily available for investments. Consequently, following these announcements, the U.S. dollar index (DXY) has risen to a 30-day high. This means that there is an influx of capital into the market, which could be directed towards cryptocurrencies and risk assets.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-06-12 18:40