As a seasoned analyst with over a decade of experience in the volatile world of financial markets, I have seen my fair share of market turbulence and recovery cycles. The recent crypto market dip, followed by a stabilization, is a classic example of the rollercoaster ride that is cryptocurrency trading.

After a significant drop on October 22nd, the digital currency market appears to be recovering and cooling down, as indicated by the decrease in liquidation activity.

Based on figures from CoinGecko, the worldwide cryptocurrency market experienced a drop in value of approximately $57 billion yesterday, resulting in a total market cap of around $2.44 trillion. This decrease occurred after the market had reached a three-month peak of $2.498 trillion the day prior.

The global market cap faced a 2.5% decline in the past 24 hours again, wiping another $7 billion.

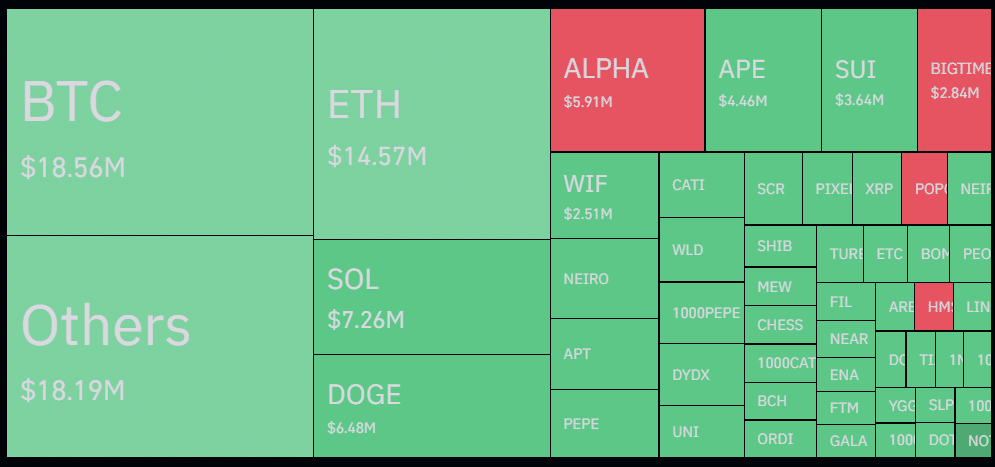

Over the last 24 hours, as the selloff on Tuesday appears to be subsiding, crypto liquidations have dropped by around 40%, amounting to approximately $121 million, according to data from Coinglass. Given the broader market downturn, it’s worth noting that about 75% of these liquidations, equivalent to around $91 million, were long positions.

Currently, Bitcoin (BTC) dominates with approximately $18.5 million in liquidations – including $11 million long positions and $7.5 million short positions – as its price dipped below the $67,000 threshold. At the moment of writing this, BTC is trading at $66,800, representing a one-week low.

The majority of Ethereum (ETH) liquidations, amounting to around 77%, were from long positions, indicating a high long-short ratio. Yet, ETH remains above the significant level of $2,600, defying the bearish outlook surrounding it.

On Binance, the leading cryptocurrency exchange by trade volume, the biggest liquidation order for about 690,000 dollars in the SOL/USDT pair was executed.

Based on a report from crypto.news, exchange-traded funds (ETFs) that deal with buying Bitcoin spot markets in the U.S. experienced their initial day of withdrawals as the overall market feeling turned negative. These investment products collectively saw a net withdrawal of approximately $79.1 million, primarily driven by Ark and 21Share’s ARKB fund, which withdrew a significant amount of $134.7 million.

ETH ETFs, on the other hand, witnessed a net inflow of $11.9 million amid market uncertainty.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-23 12:14