As a seasoned researcher with a keen eye for financial misdeeds and a background in unraveling complex financial schemes, I find this case particularly intriguing. The alleged tax evasion through crypto transactions by the Ukrainian blogger, reportedly Oleksandr Slobozhenko, is a testament to the ingenuity of modern-day financial criminals.

A local blogger, based in Ukraine, has been accused by financial investigators of avoiding taxes worth approximately $5 million, allegedly through cryptocurrency transactions associated with online affiliate marketing activities.

A well-known blogger from Ukraine, as stated in a press release on August 16th, is being accused by the Economic Security Bureau of the country for avoiding over $5 million in taxes using a complex strategy that involved cryptocurrency transactions.

According to the financial intelligence agency, this well-known blogger, who often engages in activities like web traffic mediation and affiliate marketing, masterminded an intricate scheme to hide large sums of money earned across multiple digital sectors such as online gambling, dating platforms, sports betting, and health product sales.

Although the bureau hasn’t publicly revealed the blogger’s name yet, local news outlets suggest that the accusations may be aimed at Oleksandr Slobozhenko, a prominent figure in Ukraine’s tech and social media scene.

Over $5 million in unpaid taxes

As an analyst, I’ve uncovered allegations suggesting that I established a commercial entity in the year 2020 without legally registering it as a business, thereby potentially evading tax responsibilities. Remarkably, despite the company’s prosperity, it appears to have never been registered with Ukrainian tax authorities, and no official employment contracts were signed with its workforce, as stated in the press release.

To make their earnings harder to trace, the blogger and his colleagues swapped their profits for cryptocurrencies by utilizing digital wallets that were registered under reliable individuals’ names.

“Reliable allies of the suspect opened cryptocurrency accounts with their own information and paperwork, earning cryptocurrency from the company’s web traffic mediation services. These digital assets were subsequently moved into the electronic wallet of the company director and converted to US dollars.”

The Economic Security Bureau of Ukraine

As a analyst, I uncovered that my blogging activities, backed by multiple IT experts, generated undeclared earnings surpassing ₴1 billion (approximately $27 million) from 2020 to 2023. Regrettably, none of this income was disclosed to tax authorities during this period, resulting in an estimated $5.1 million in unpaid taxes.

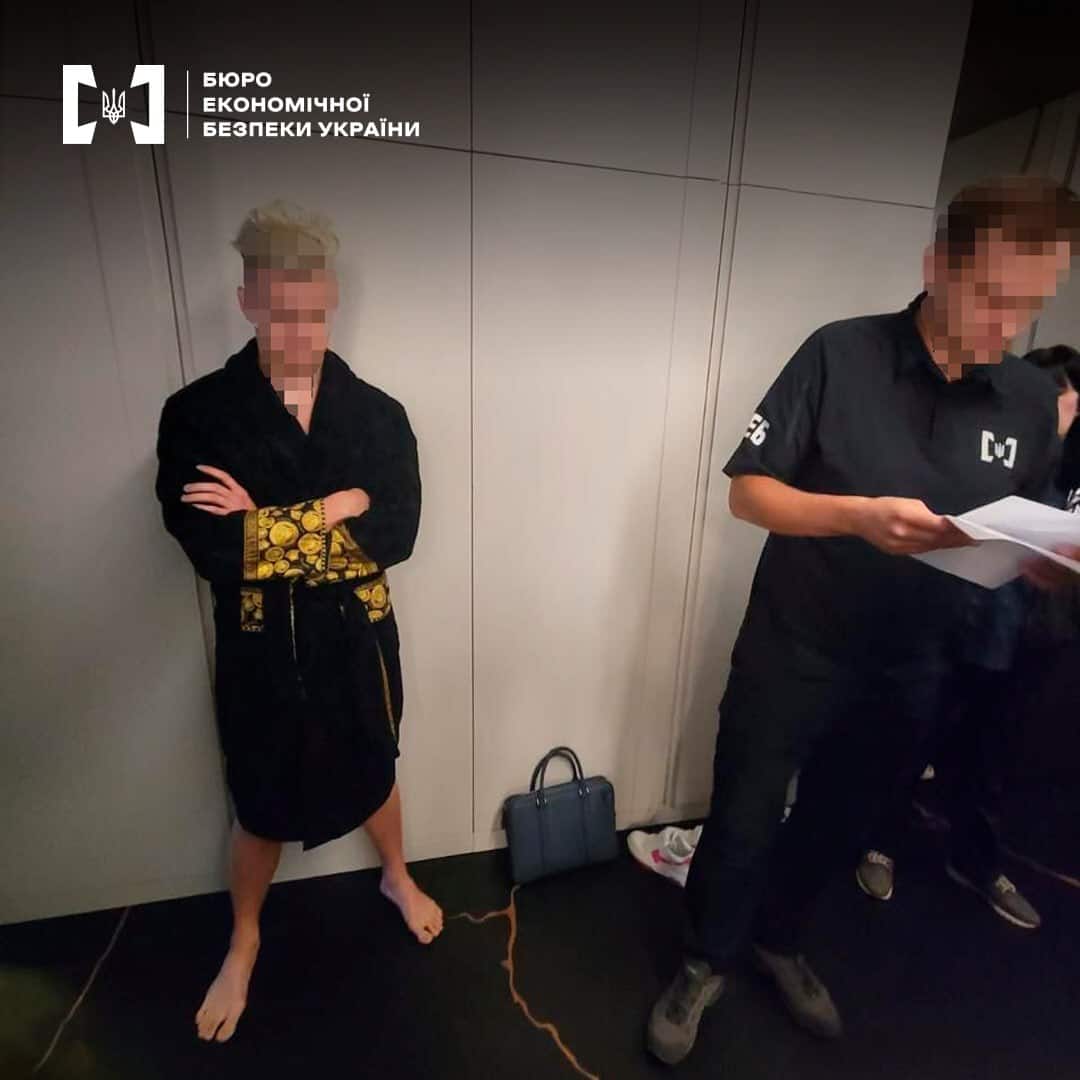

In the course of their continuing probe, investigators carried out several searches, confiscating high-end automobiles, apartments, and various other real estate within Kyiv. The blogger is currently accused of significant tax fraud and money laundering under Ukrainian legislation.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gods & Demons codes (January 2025)

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-16 18:44