On this fine Wednesday, as the sun rises and the world turns, Bitcoin, Ethereum, and XRP find themselves in a slight upward dance, preparing for the grand spectacle of the U.S. FOMC rate decision at 2 PM ET. Unlike the long, dreary winters of previous bear markets, traders now witness shorter cycles of despair, followed by sudden bursts of joy, akin to a peasant finding a hidden stash of potatoes in the ground. 🥔✨

The impending FOMC meeting promises to bring forth a tempest of volatility, a veritable storm in the teacup of cryptocurrency prices, presenting both opportunities to buy the dip and chances for traders to take their hard-earned profits, all while navigating the murky waters of a prolonged bear market. 🐻💸

Table of Contents

Bitcoin, Ethereum, and XRP trader sentiment turn risk-off

In the past 24 hours, the brave traders of Bitcoin (BTC), Ethereum (ETH), and XRP (XRP) have retreated from the derivatives market, much like a soldier withdrawing from a battlefield after a fierce skirmish. The data from Coinglass reveals a decline in trade volume, with BTC and ETH down nearly 11% and 7%, respectively, while XRP has taken a more dramatic plunge of nearly 14%. 📉😱

It appears that traders have donned their armor of caution, following a staggering $89 million in liquidations among the top three cryptocurrencies. A wise move, indeed, as the winds of fortune can be fickle. 🌬️⚔️

Open Interest, that elusive metric of all open contracts, has seen a modest rise of 1.42%, 4.90%, and 1.49% for BTC, ETH, and XRP, respectively. A glimmer of hope amidst the chaos! 🌈

BTC, ETH, XRP on-chain analysis

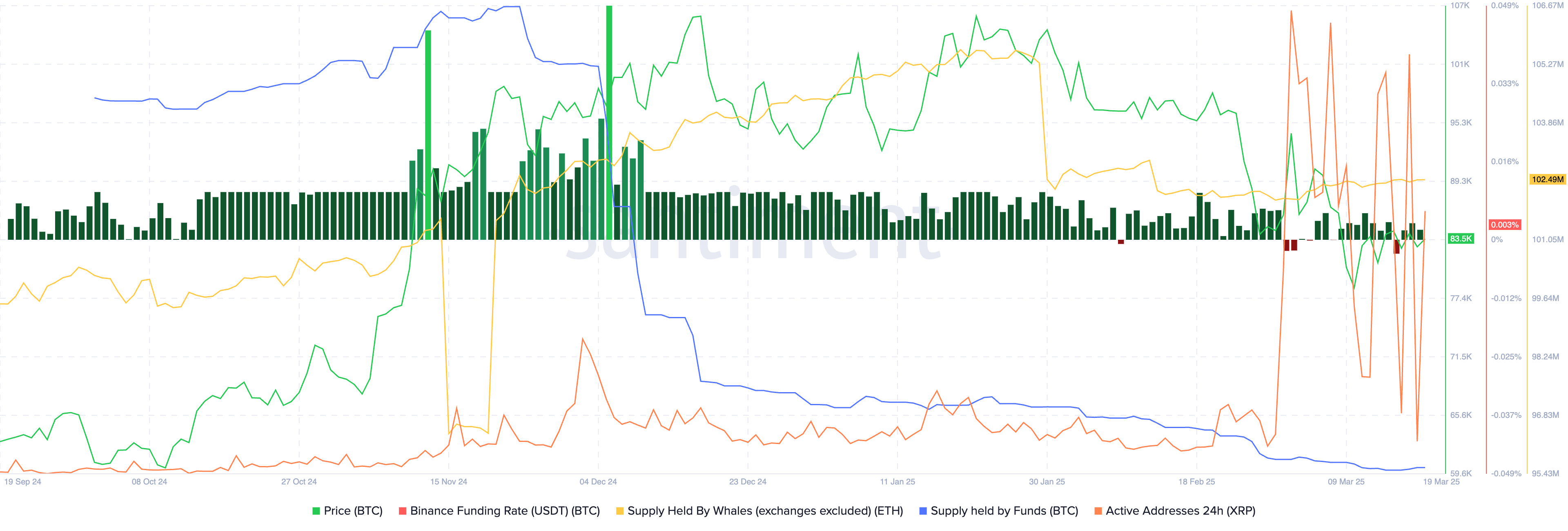

On the grand stage of on-chain analysis, Santiment reveals that the Binance funding rate for Bitcoin has been positively glowing for three consecutive days. This suggests that Bitcoin derivatives traders, despite their reduced activity, harbor hopes of a price appreciation. A curious contradiction, much like a man who fears the dark yet seeks the stars. 🌌

Meanwhile, Ethereum’s supply held by whales remains unchanged, while Bitcoin’s supply held by funds has been steadily decreasing. The active addresses in XRP have seen a resurgence on this fine Wednesday, following a brief dip on Tuesday. The mixed signals from on-chain data hint at a slightly bullish outlook for Bitcoin and XRP, while Ethereum may remain stable, like a calm lake before a storm. 🌊

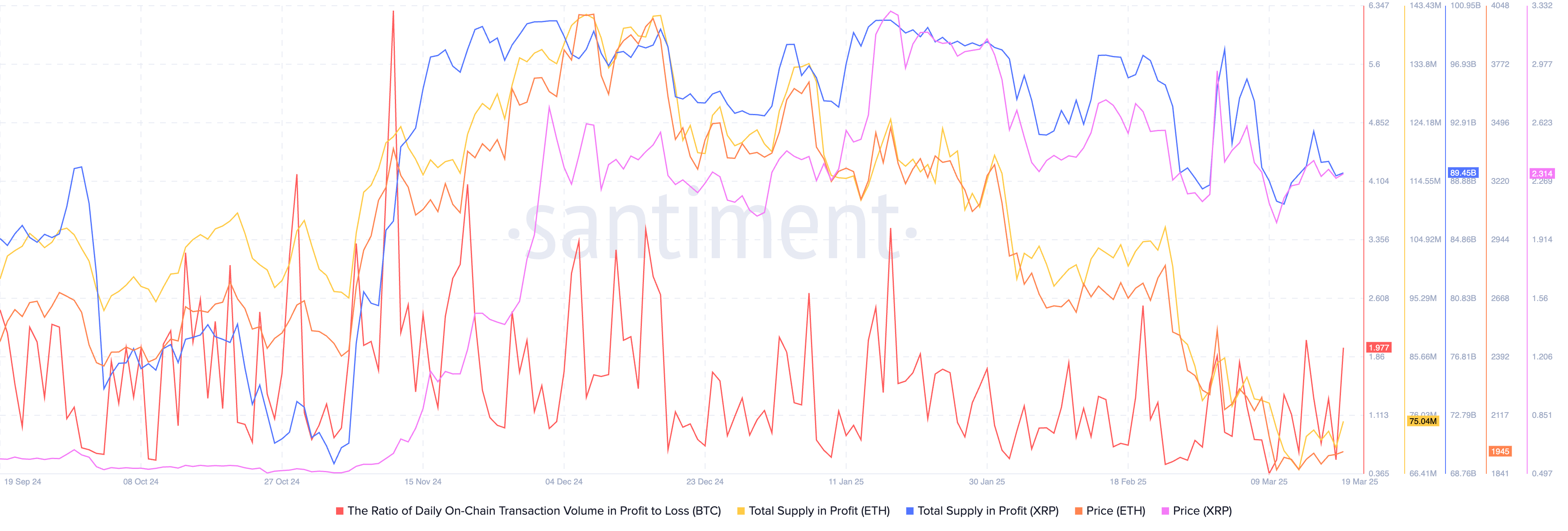

On the Bitcoin blockchain, the ratio of daily transactions in profit nearly doubles those in loss, offering a glimmer of hope for traders who bought low. Ethereum and XRP, however, present limited opportunities for profit-taking, as illustrated in the chart below. 📊

Trump push and FOMC rate decision

Gracy Chen, the wise CEO of Bitget, has shared her thoughts with Crypto.news, noting that Trump’s newfound affection for crypto has left many traders scratching their heads. The notion of a U.S. strategic Bitcoin reserve is gaining traction, and while the government has yet to dip its toes into Bitcoin, the waters may soon be stirred. 🏊♂️

“The Stablecoin bill is making its way through

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Every Upcoming Zac Efron Movie And TV Show

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-03-19 23:49