- Fartcoin dropped 6.93% after a mind-boggling, nose-tingling 550% rally, causing traders’ sphincters to visibly tighten with caution.

- The viral whoopee cushion that was Fartcoin’s social momentum has now deflated rather pathetically.

Fartcoin [FARTCOIN]—a name destined to grace both blockchain ledgers and unfortunate tattoo regrets—has witnessed a 550% rally over two months. That’s the kind of growth that launches dreams and, occasionally, misplaced retirement funds. Yet, like all things involving flatulence, there’s a whiff of change in the air.

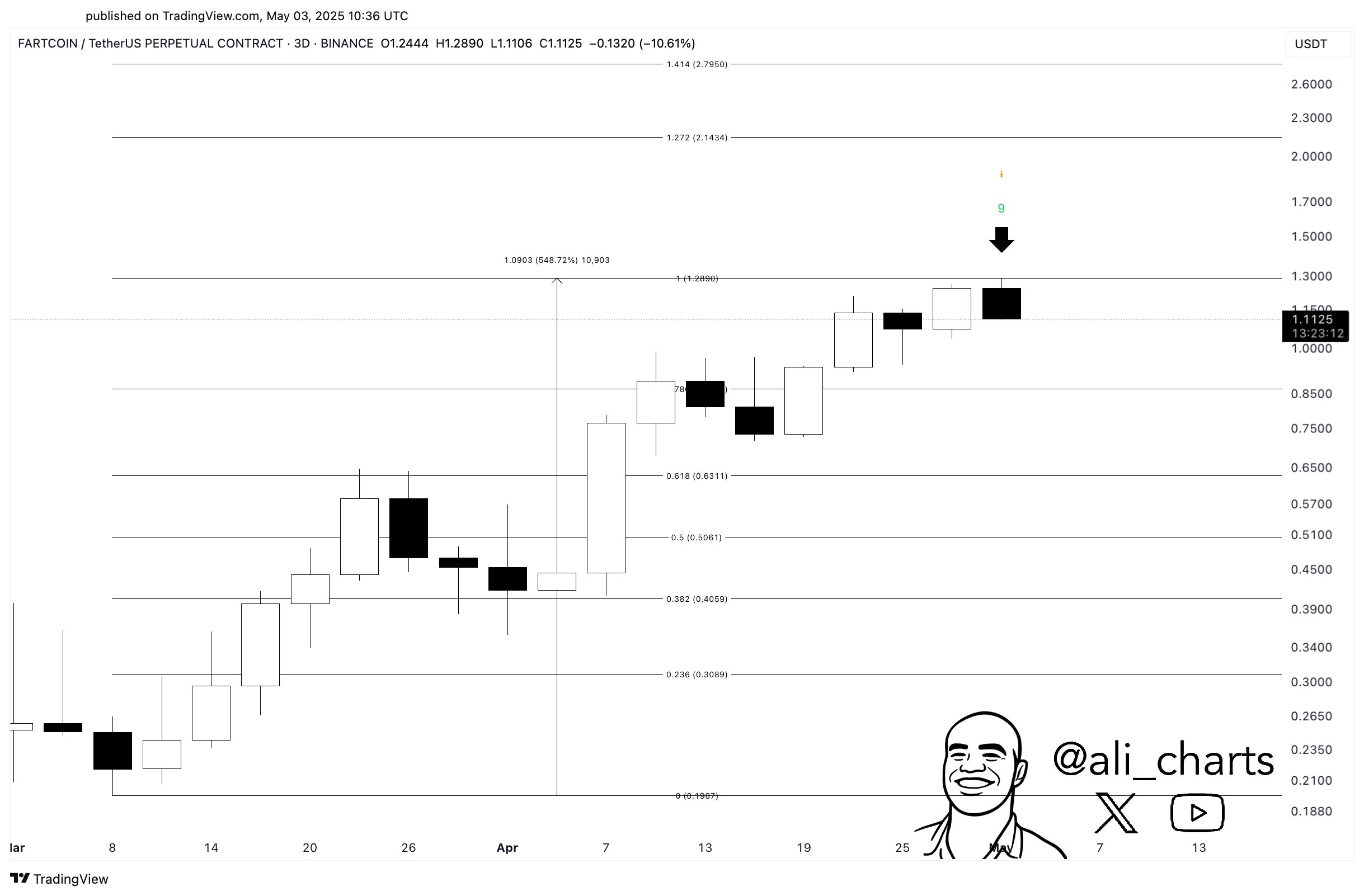

The market’s handy-dandy soothsayer—the TD Sequential—has flashed a dreaded 9-count sell signal on the 3-day chart. Seasoned analysts say this reliably foretells local tops, short-term corrections, and possibly the arrival of one of those bowel-shaking moments that crypto traders know all too well.

At the moment of writing, Fartcoin squeaked in at $1.11, deflating by 6.93% in just 24 hours. Traders, clutching their spreadsheets—and perhaps a little Tums—are left rethinking their life choices. Several market signals now stand ready to decide whether Fartcoin’s story will be tragedy, farce, or just… a lingering smell.

Is fading hype killing Fartcoin’s momentum?

The collective mood? Like soda gone flat, the Fartcoin community’s exuberance is simply not what it was.

Data from Santiment reveals that weighted sentiment is in the negatives (at -0.126). That’s right, the euphoria is evaporating, replaced by the sort of cautious pessimism you’d expect when your mother-in-law asks for your WiFi password for the fourth time. Usually, when traders start getting the cold sweats, it means a correction is doing warm-up stretches.

This loss of swagger is mirrored in Fartcoin’s social stats, and it turns out the internet now has better things to do—cat videos, probably.

The token’s social engagement has fallen to a level where even crypto bots have grown disinterested. Only 13 mentions recently, with a social dominance of 0.186%—numbers so low, you could misplace them in your sock drawer.

This collapse in online attention spells trouble for Fartcoin. Ever try to launch a memecoin without memes? It’s like trying to do karaoke in a library… Everyone just wants you to leave.

Are bulls losing control of the market?

Meanwhile, in the land of derivatives, canaries are dropping left and right. Long Liquidations erupted to $619,160, while shorts came in at a measly $30,600—the financial equivalent of showing up to a sword fight with a teaspoon.

Bulls nailed themselves with so much leverage, the tiniest dip turned their trading floors into slip-and-slides. Liquidation cascades like these can shake confidence and induce volatility hangovers that last longer than the average New Year’s resolution.

Spot market action only adds more spice to this gut-churning gumbo. On May 3rd, nearly half a million dollars in Fartcoin left exchanges, with $955,700 outflows compared to $496,590 trickling in. When holders start hiding their coins in private wallets, you know things are about to get interesting—or at the very least, awkward at family dinners.

Big outflows during downturns? They’re a bit like rats leaving a sinking ship—unless the ship is actually a majestic crypto yacht shaped like a Whoopee Cushion.

Can Fartcoin avoid a deeper correction?

To sum up the mood: it’s like watching your favorite sitcom take a sudden dramatic turn. Here’s bearish sentiment, a social media fade, funds skedaddling from exchanges, liquidations galore—and don’t forget the technical indicator doing ominous jazz hands.

The glory days may not be totally over—the memes, after all, can rise again—but unless the community rediscovers its slack-jawed enthusiasm, Fartcoin could be in for some classic “number go down” action. If this is a correction, let’s just hope someone remembered to open a window.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-05-04 12:14