The first week of May descends upon the digital bazaar, brief and heavy, like a thunderhead over the Volga, packing impossibly weighty portents into four brief days. Liquidity, never shy of melodrama, will be swayed by the whims of five grand market operas—each more likely to tip sentiment than a rumor in a Moscow teahouse. 👀

#1 The Crypto Collective Holds Its Breath for the FOMC (May 8)

In Washington, the Federal Open Market Committee is expected—by all but the mystical and deluded—to let interest rates fester at 5.25–5.50%. It’s the post-decision sermon from Chairman Powell the crowd awaits. Will a stray note in his address signal a rate cut by June or July, or will he dangle hope like a carrot in front of a famished mule?

Powell, ever the stoic priest of inflation, reminds us: “Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem.” The subtext: Don’t get too excited, kids—danger still lurks. Meanwhile, as tariffs rattle employment, the Committee shows all the flexibility of a stone statue.

Governor Waller, sharpening his rhetorical scythe, shrugs: “Don’t expect fireworks before July.” Trump and Bessent plead for action, but the Committee, unmoved, is like a poker player refusing to show his cards. If anyone even whispers dovishness on Wednesday, polar bears in Siberia will hear the echo ripple through Bitcoin’s halls. 🕵️♂️

#2 Ethereum Unveils Its Pectra Frock (May 7)

At five minutes past ten UTC, epoch 364,032, Ethereum, impatient to shed its old skin, embraces Pectra—a hard fork with more embroidery than a czarina’s wedding gown. Eleven EIPs stage a masquerade: EIP-7702 allows accounts to impersonate smart contracts (finally some drama!), enabling batch transactions, gas sponsorships, passkey authentication. Your wallet, in short, can now do horse tricks—without a new address.

Validators rejoice (or groan): EIP-7251 multiplies the max validator balance from 32 ETH to a wallet-fattening 2,048 ETH. Bandwidth tightens its belt, hopes run high. EIP-7691 lets the network handle six blobs per block—a phrase only a cryptographer could love—while EIP-7623 installs a bouncer at the door to block-size excess.

Deposit queue latency, formerly slower than a Russian winter, plunges from nine hours to thirteen minutes, thanks to EIP-6110. The Foundation, in a fit of optimism not seen since spring thaw, says Pectra “improves accounts, validators, scaling and more”—a To-Do list for the ages. 🚂

In Vienna, where Mozart’s ghost weeps into his wig, Sonic Summit 2025 convenes capitol allocators, builders, and researchers—each hoping to swap business cards, wisdom, or at least a coffee. Michael Kong and Dr. Scholz duel with PowerPoints while partners from Chainlink and others sketch interoperability utopias and plug zero-knowledge tools no normal aunt could ever comprehend.

“Technical deep-dives, networking and hands-on sessions!” the organizers promise, as if wisdom spills faster when accompanied by schnitzel. Funding is leaner now: gone are the days of giddy investments. Results, not bravado, will measure worth. Anyone caught self-promoting too zealously will have to buy the next round of strudel. 🎻

Today, Hyperliquid splits its spot and perpetual-futures fee rosters, like parents dividing chores. Spot turnover is now counted with the enthusiasm of a caffeine-addled accountant. Stakers can bag a 40% rebate if they possess 50 million HYPE—presuming they still believe in miracles.

“All fees to the community,” Hyperliquid intones, side-eyeing less generous venues. Maker rebates hit 0.015% for serious whales, so long as liquidity providers don’t decide to take their balls and go home. The week’s trading will reveal whether the new fee regime unlocks riches or just another episode in the ongoing liquidity sitcom. 💸

Coinbase, the great American bourse, unveils its earnings after Wall Street has put away its cigars. Consensus pegs earnings per share between $2.09 and $2.15—a leap worthy of a Dostoevsky hero. With lawsuits still simmering, analysts will squint at legal expenses, expansionary fantasies, and the delicate dance between trading fees and subscription cash flow.

Guidance on margins, with US regulation waxing and waning, will echo into the night. Whatever is uttered will set the mood not only for Coinbase, but every crypto stock nursing dreams of glory.

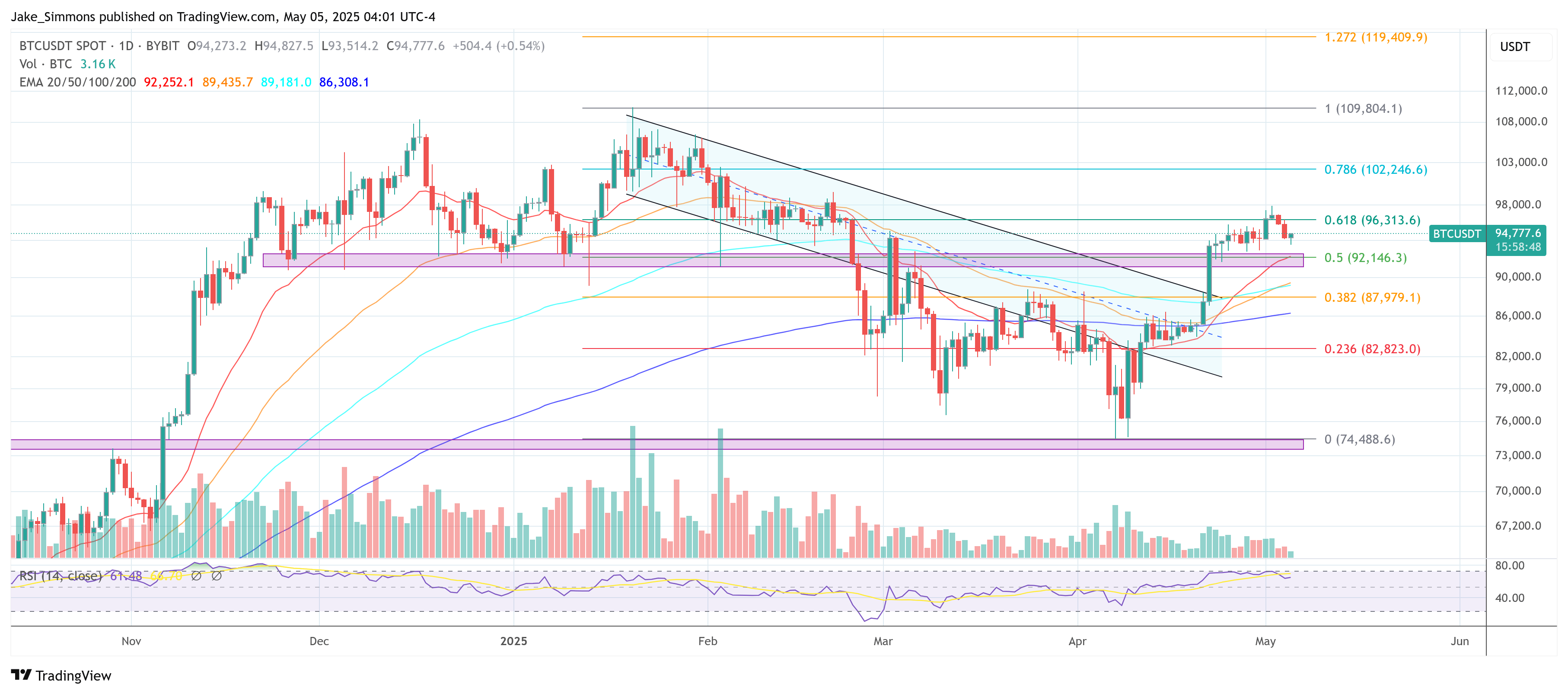

At this moment, as the moon floats above, Bitcoin loiters at $94,777—quiet for now, plotting its next act.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-05-05 20:13