In simple terms, CryptoRank released a study detailing the venture capital investment trends within the crypto sector during the initial three months.

Experts commented that investors have grown more wary, observing the disparity between Bitcoin‘s (BTC) price and the quantity and value of financing rounds. Within the initial quarter, a total of 422 funding rounds took place, amounting to $2.3 billion.

“This occurrence highlights an increasing pattern of venture capital firms being more careful and selective when investing in cryptocurrencies.”

CryptoRank report

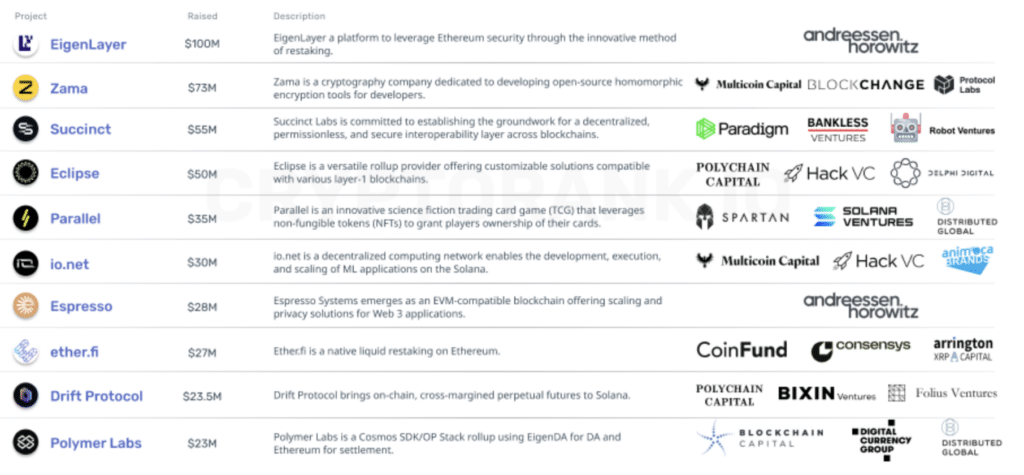

Six projects received investments exceeding $50 million each, whereas the majority of transactions took place between $1 million and $10 million, according to CryptoRank’s analysis. The current funding trends fall short in comparison to historical records spanning the previous four years, suggesting a subdued investment climate.

Over the last three months, investors have mainly shown interest in modifications to protocols, advances in interoperability, and the establishment of stable decentralized exchanges (DEXs). Notably, EigenLayer and Ether.fi each secured investments totaling $100 million and $27 million respectively.

Caution prevails among crypto investors as they wait and see if the current market trend will lead to more funding growth. According to CryptoRank, the durability and robustness of the recent market surge is still up for debate and requires careful monitoring.

Starting from the beginning of this year, a grand total of $13.8 billion has flowed into crypto investment funds – an all-time high. According to CoinShares analysts, the previous record, which amounted to $10.6 billion, was set in 2021.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Grimguard Tactics tier list – Ranking the main classes

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Every Upcoming Zac Efron Movie And TV Show

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

2024-04-09 18:33