As a seasoned researcher with over two decades of market analysis under my belt, I find myself intrigued by dYdX’s recent performance and its potential for further growth. The 4% surge over the past 24 hours is certainly a positive sign, especially considering the prolonged bearish trajectory we’ve seen in the broader market.

dYdX is making an effort to recover due to increased buying interest, however, a group of sell orders could potentially hinder its further upward trend.

In the last 24 hours, dYdX has risen by 4%, placing it as the top performer among the top 100 cryptocurrencies. This upward trend represents its third straight day of daily profits, following a period of consolidation due to the general market’s downward trend.

The initial decline began on July 23 after it was confirmed that the platform’s website had been hacked, causing a sudden drop of 7%. At present, dYdX is trading at $1.127, showing an increase of 2.07% in the early hours of today.

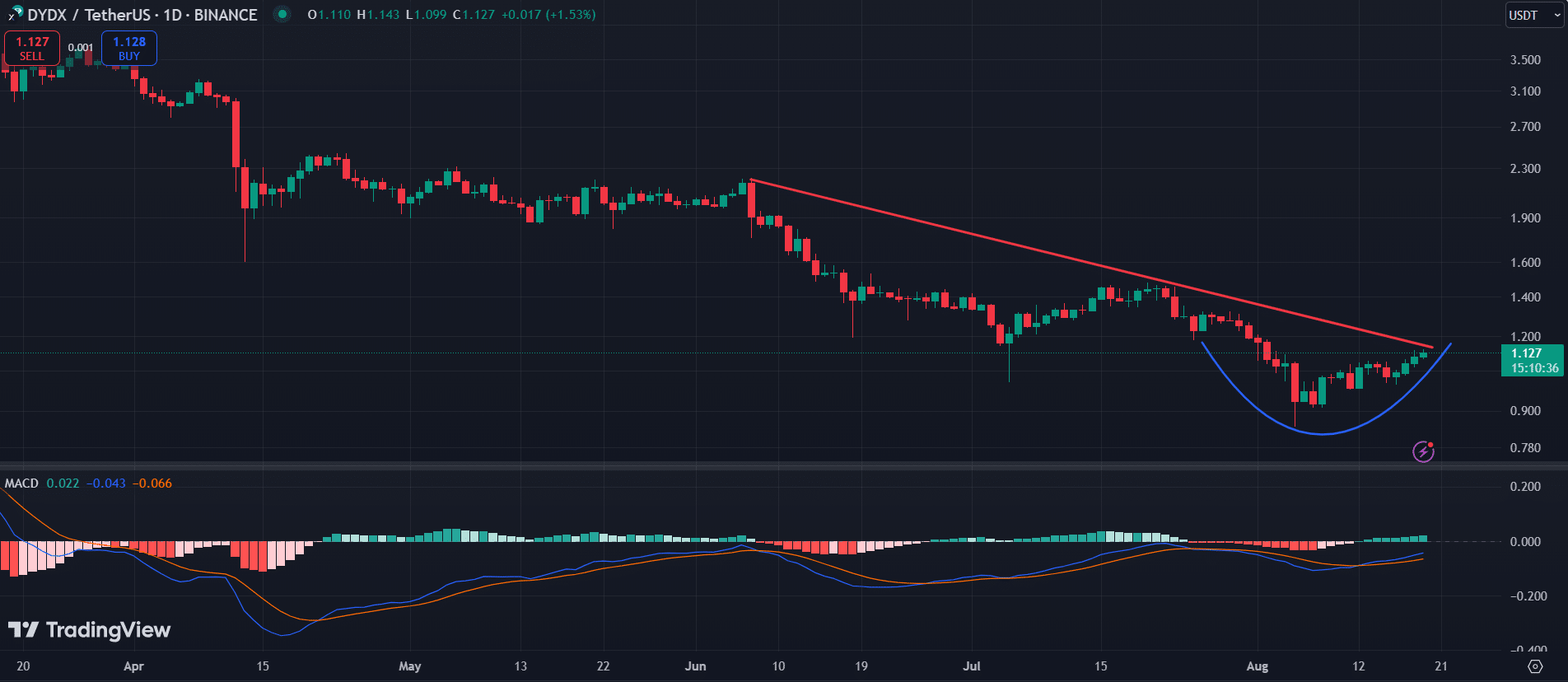

Based on the data from the daily graph, it appears that dYdX has been forming a rounding bottom pattern since July 26th. This pattern is often seen as a positive sign of a potential change in market opinion, suggesting a possible turnaround might be on the horizon.

It appears this pattern indicates the potential close of a long-term price decline, as buyers seem to be regaining dominance. Yet, dYdX is moving towards a multi-week downward trendline that has proven resistant in the past.

For dYdX to indicate a strong bullish reversal, it needs to close above the psychologically important price point of $1.60, signifying a breakout.

Boosting the optimistic perspective, the Moving Average Convergence Divergence (MACD) on the daily graph demonstrates increasing momentum, as indicated by the MACD line (at 0.043) now moving above the signal line (at 0.066).

dYdX faces sell order cluster

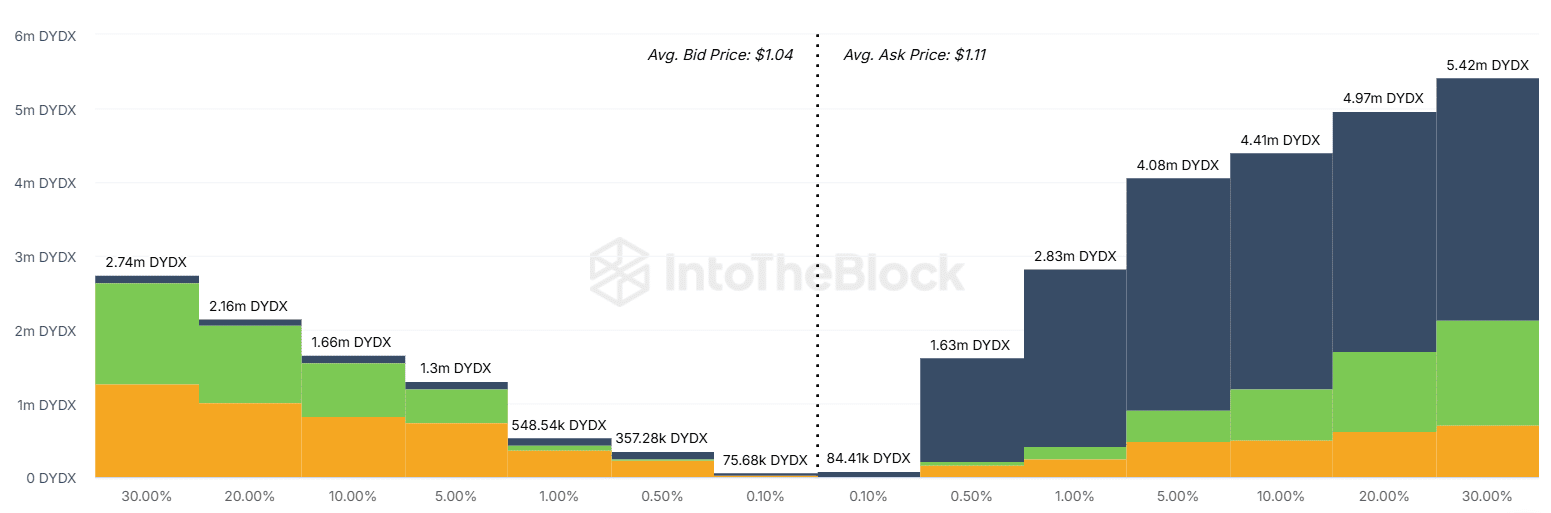

The path forward may encounter some obstacles, suggested by the market activity of the asset, as shown by IntoTheBlock’s data. Although the typical bid price stands at $1.04, the average ask price is comparatively higher at $1.11, signifying that sellers are prepared to dispose of their holdings at a premium price.

Above the current price level, there’s noticeable reluctance from buyers. As the price nears and exceeds $1.20, sell orders pile up substantially, with a congested area of high sell orders found at $1.30 and above.

The market data shows that there are more sell orders than buy orders at prices 10% and 20% higher than the current price. Specifically, at these levels, there are sell orders for approximately 4.08 million dYdX and 4.97 million dYdX, respectively.

It implies that if dYdX reaches $1.20, there might be more sellers than buyers, which could limit its growth unless there’s significant demand to buy it.

On the negative side, there are substantial buy orders below $1.10 in dYdX, with noticeable trading activity at $1.00 and $0.90. These large bids could potentially halt a rapid drop, offering a stable base for dYdX to gather strength before making another attempt to rise further.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-19 13:28