Gather around, financial enthusiasts, doomsday preppers, and anyone who stubbornly pretends they “understand Bitcoin” at dinner parties. Macro investor and noted financial Nostradamus Dan Tapiero is out here screaming, “Bitcoin is about to pop off!” louder than your aunt at Thanksgiving after three glasses of boxed Chardonnay.

Dan, posting for his 129,100 followers on X (yes, Twitter, but with more existential dread), is basically saying: The Fed’s gonna panic, crank down those interest rates, and Bitcoin might just rocket harder than my anxiety when my ‘low battery’ warning appears. Think 180K per Bitcoin, people—so, about enough to buy half a dozen avocados at Whole Foods by 2026. 🥑💸

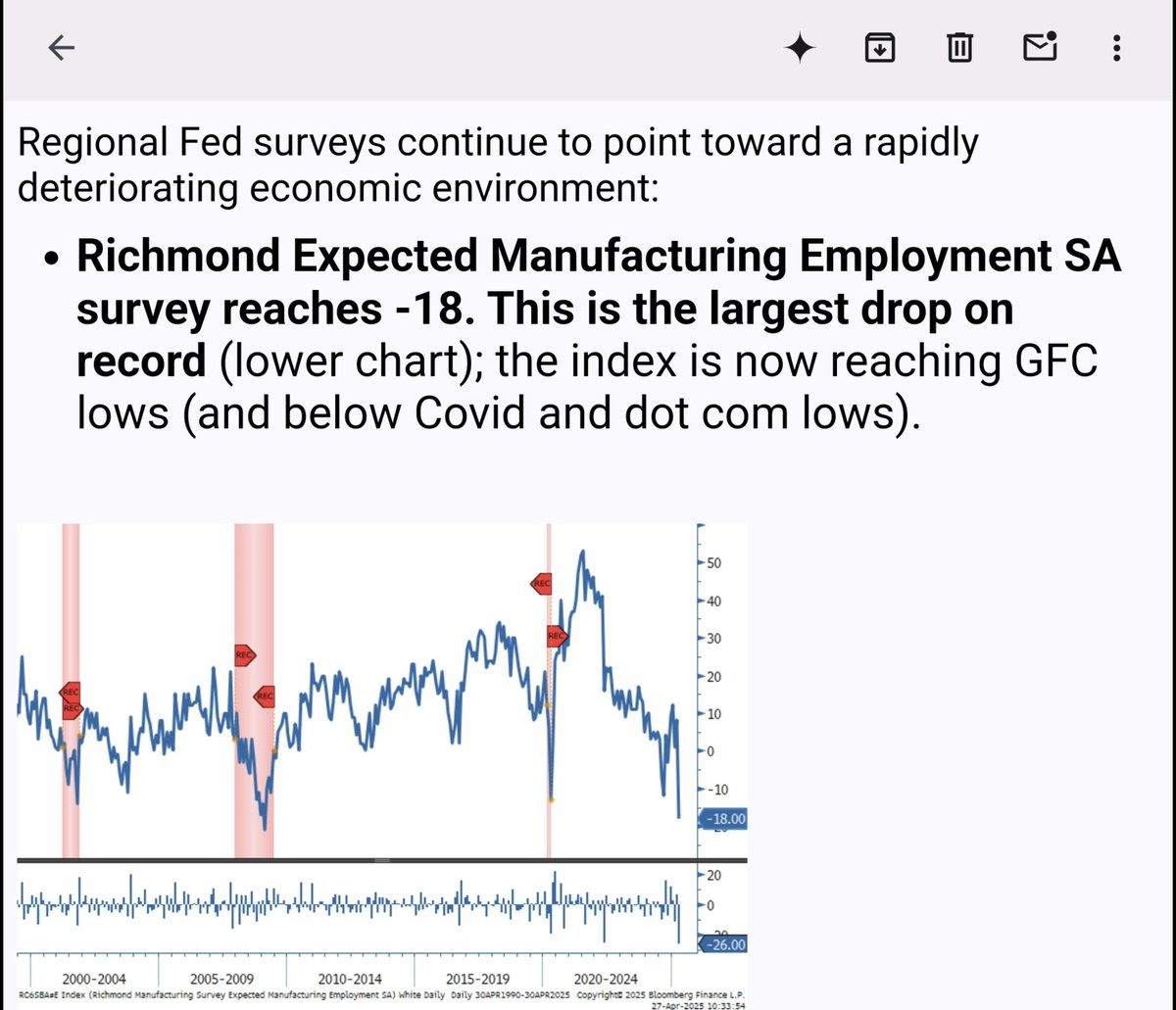

Dan’s proof? He’s looking at the Federal Reserve Bank of Richmond’s Expected Manufacturing Employment index, which recently did a swan dive worthy of an Olympic medal straight back to ‘08 financial crisis levels. The kids call this “vibes-based investing.” Economists call it “a really, really bad sign.”

“Here we go again. More second-tier macro data signaling a rapid slowdown ahead. Largest drop ever – back to ’08 lows. It’s a Fed survey, so hard for them to ignore. Short rates at 4% are way too high.

Same theme: more liquidity coming. BTC to $180,000 before Summer ’26…”

[This index] is just an indicator that shows we are at an extreme very rarely if ever reached. I search for these extreme outliers as they increase the odds that the slowdown is more severe than is currently priced in.”

Just when you thought things couldn’t get more spicy, Dan drops this: More economic sad trombone sounds means the Fed will dust off the old money printer. Get ready for the dollar to buy less, and everyone with hopium in their lungs will YOLO into Bitcoin as a safety raft.

“Fed is playing with fire. Massive collapse in consumer expectations for the economy in the next six months (hits 54.4). Back to March 2009 lows, well below Covid panic lows. This is extreme data. Much lower rates and USD needed to offset fiscal austerity. Fiat debasement equals +BTC.”

And what’s Bitcoin doing right now? At the time of writing, chilling at $94,277 and refusing to make eye contact with your altcoin bags. Flat for the day—because apparently, even Bitcoin sleeps.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-05-01 10:24