As a seasoned crypto investor with battle-scarred fingers and a heart full of coins, I find myself intrigued by EigenLayer’s recent performance. The token’s recovery from last week’s dip, following the airdrop, is a testament to the market’s resilience and its knack for overlooking even the most unsettling events.

EigenLayer’s token regained strength, with buyers jumping at the opportunity during a price drop that followed last week’s airdrop.

EIGEN unlocks and TVL retreat

On Tuesday, the value of the EigenLayer (EIGEN) token surged to an impressive peak of $3.86, marking its highest point since October 2. Remarkably, this price increase places it 26% above its record-low level.

After the founder of EIGEN declared that the platform would concentrate on developing Web3 applications following the airdrop, a phenomenon known as the “EIGEN’s rebound” took place. This is significant because EigenLayer lacks a user-facing application. Instead, it provides security for several actively validated services such as AltLayer, Ethos, and Lagrange.

Following the theft of approximately 1,673,645 tokens worth more than $6.8 million by an unidentified hacker, the market experienced a bounce-back. The hacker is believed to have traded these stolen tokens via a decentralized exchange platform before transferring the stablecoins to various centralized trading platforms.

Alert for the Community:

— EigenLayer (@eigenlayer) October 4, 2024

As an analyst, I find myself cautioning EIGEN token holders about two potential risks on the horizon. Primarily, there’s a dilution risk to consider due to the current circulation of 187 million tokens, with a total maximum supply exceeding 1.6 billion tokens.

Developers have planned that the network will make available and distribute approximately 4% (which is 67 million tokens) of the initial supply over the course of the first year. These distributions will occur weekly on Tuesdays for the subsequent 12 months. Out of these distributed tokens, 3% will be allocated to Ethereum and liquid staking token holders, while the remaining 1% will go to EIGEN stakers and operators.

token releases tend to indicate a bearish trend as they expand the total supply of tokens, making each individual holder’s stake less valuable due to the increased circulation.

A potential issue is a decrease in interest for restaking, as indicated by DeFi Llama. This platform reports that EigenLayer’s total value locked (TVL) has decreased to $10.7 billion, which is significantly lower than the approximately $20 billion it was earlier this year. In terms of Ethereum, the network currently secures 4.43 million Ethereum, as compared to its year-to-date high of 5.34 million.

It seems plausible that the decrease in Ethereum (ETH) staking market capitalization over the past few weeks may be a contributing factor. In fact, it has decreased by nearly 8% within the last 24 hours, dropping to approximately $83 billion, as reported by StakingRewards.

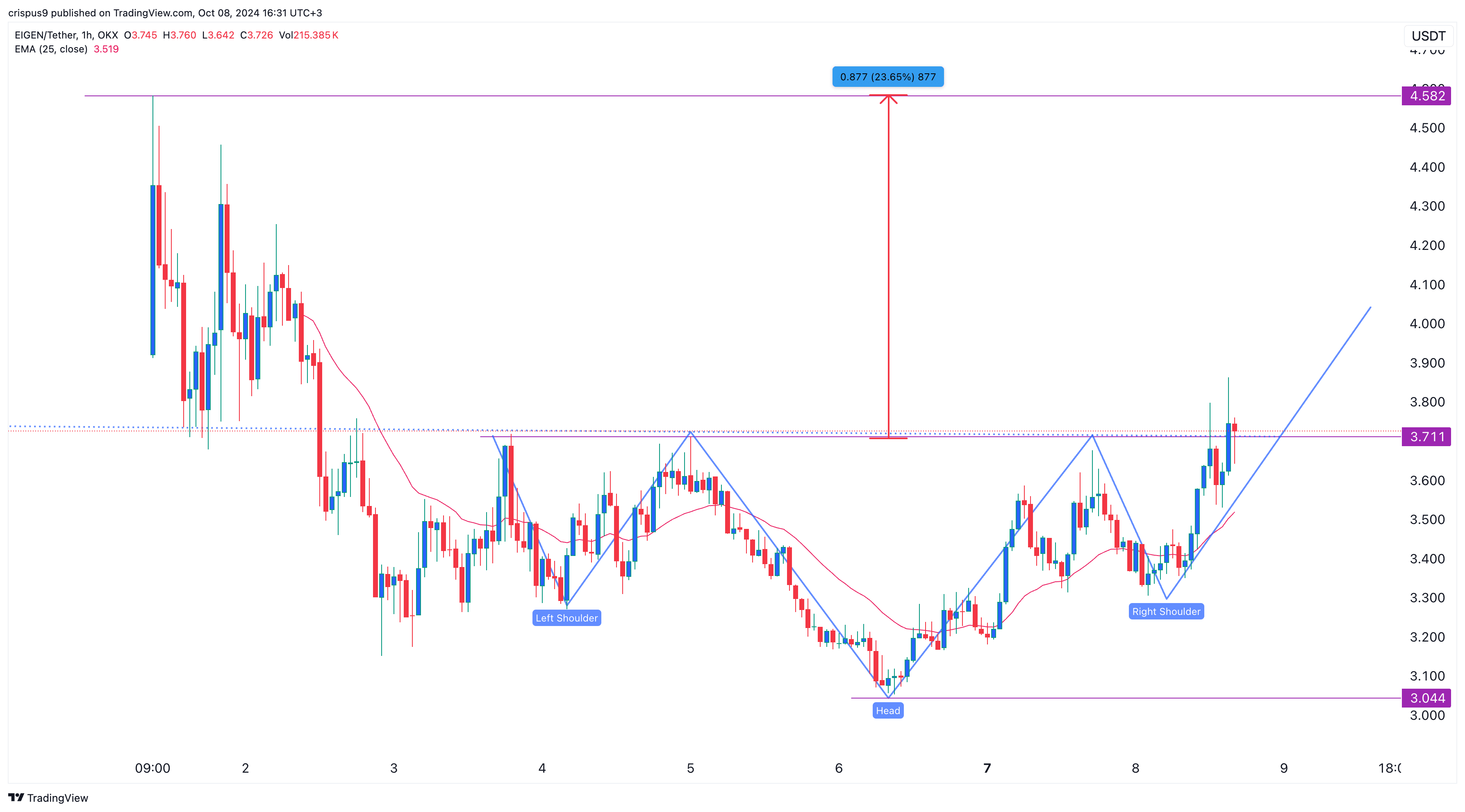

EIGEN forms an inverse H&S pattern

According to the one-hour chart, the price of EIGEN token dropped to $3.04 on October 6th, but it subsequently rebounded to reach its peak of $3.8, a level not seen since October 2nd.

The price has climbed over its 25-day moving average, which is significant, but what truly stands out is that it’s shaped an optimistic inverse head and shoulders chart formation. In terms of price action, this pattern is among the strongest bullish indicators in the market.

It’s plausible that the price of EigenLayer’s token could recover and potentially reach its peak value of $4.58 again, representing a rise of approximately 23% from its current position.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-10-08 16:46