As a seasoned crypto investor with over a decade of experience navigating the ever-evolving digital asset landscape, I find myself increasingly captivated by the potential of projects like EigenLayer and its governance system, EigenGov. With roots in decentralized autonomous organizations (DAOs) and a focus on trustless coordination, EigenLayer is charting a path that could reshape how we collaborate and make decisions within the crypto space.

Over the past week, the native token EIGEN from EigenLayer has experienced a surge of approximately 50%, largely due to the announcement of their fresh governance system. This new system is a groundbreaking framework for decision-making, aiming to decentralize power and boost collaboration within the ecosystem. This revelation has ignited excitement among potential investors.

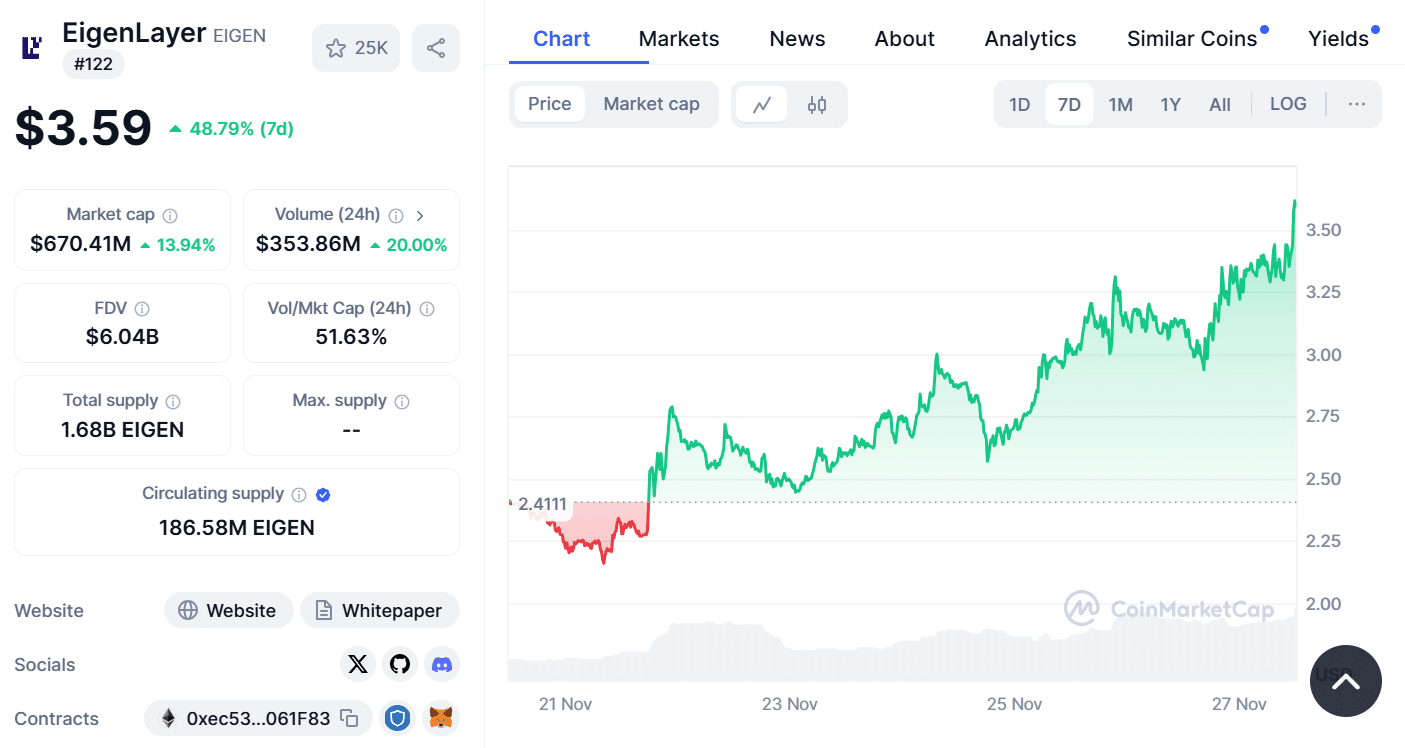

Over the past day, I’ve observed a significant surge: EIGEN has jumped by 15%. Currently, EIGEN is being traded at approximately $3.59, with a total market capitalization of around $670.4 million – an increase of 14% today alone. The trading volume has also spiked, reaching a staggering $353.86 million in the last 24 hours, indicating heightened market activity.

The surge in the rally can be traced back to increased positive sentiment within the market about EigenGov’s innovative aspects, such as its council-led governance model and token holder supervision. These features are designed to promote openness, stability, and encourage decentralization by ensuring transparency and security.

EigenLayer has revealed EigenGov V1, a governance structure that encourages decentralized decision-making and collaboration within the EigenLayer community. This platform concentrates on trustless coordination, with the goal of empowering EIGEN token holders, AVS developers, operators, and stakers to collectively shape the network’s success and dependability.

At the heart of EigenGov V1 is its councils, which are specialized teams made up of domain experts given the responsibility for decision-making in areas like protocol updates, incentive management, grant distribution, and governance supervision. The token holders maintain ultimate control, having veto power over council decisions and the capacity to endorse potential contributors for council positions. This setup encourages a transparent and responsible system.

EigenGov operates using a two-tier structure – Core and Vision – to maintain stability as it experiments with novel governance ideas. This method facilitates gradual evolution by combining efficient day-to-day functions with strategic steps towards decentralization.

As a crypto investor, I’m excited about the incubation strategy being implemented by EigenGov. Initially, it will be managed under the guidance of the Eigen Foundation, focusing on creating decentralized structures for council incentivization, alignment, and accountability. The goal is to mold EigenGov into a lean, secure, and adaptable governance model that fosters long-term efficiency and open innovation.

EigenLayer’s endeavor showcases their dedication towards fostering advanced decentralized governance structures. They are leveraging previous Decentralized Autonomous Organization (DAO) concepts to construct a flexible, open-source governance framework that can be tailored to suit various ecosystems.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2024-11-27 11:16