In the capricious world of markets, today’s a jolly jaunt. ETFs are the darlings, and derivatives? Well, they’re napping. Let’s peek behind the curtain, shall we?

Join me, dear reader, as we dissect the latest whims of the ETF and derivatives circus.

Bitcoin Spot ETFs: A Rejuvenating Sip of $221 Million

After a rather dreary March, with BTC spot ETFs shedding a hefty $767 million, April has dawned with a spring in its step.

On April 2, the good old spot BTC ETFs received a delightful infusion of $221 million. ARKB, the charming ETF from Ark Invest and 21Shares, led the charge, swelling to a net worth of $4.14 billion. 🚀

But not all funds are dancing the tango; BlackRock’s ETF IBIT had a rather melancholic day, bleeding $115.87 million. Oh, the drama!

As of this quill’s scratching, Bitcoin Spot ETFs boast a net worth of $97.35 billion, a tidy sum that’s a mere 5.73% of Bitcoin’s grand total of $1.65 trillion. Such modesty!

BTC Derivatives: A Slumber Party With Put Options

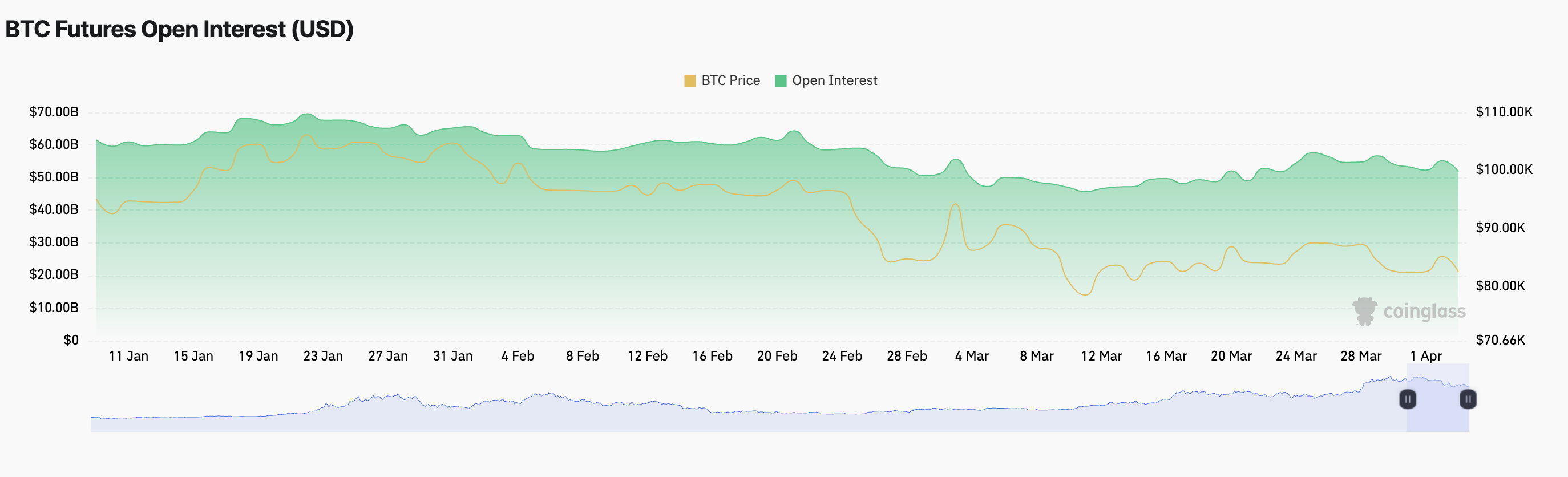

As for BTC derivatives, they’re having a bit of a snooze. Futures open interest? Down 7% in a day. A mere $51.82 billion at last count. Zzz…

Open interest, for the uninitiated, is the sum of all those derivative contracts still waiting to be settled. Rather like a queue at the post office—endless and tiresome.

BTC’s value took a 1% dive, confirming a rather lackluster trading day. When open interest and value both nosedive, it’s a sign that traders are packing up their tents. Sad times. 😞

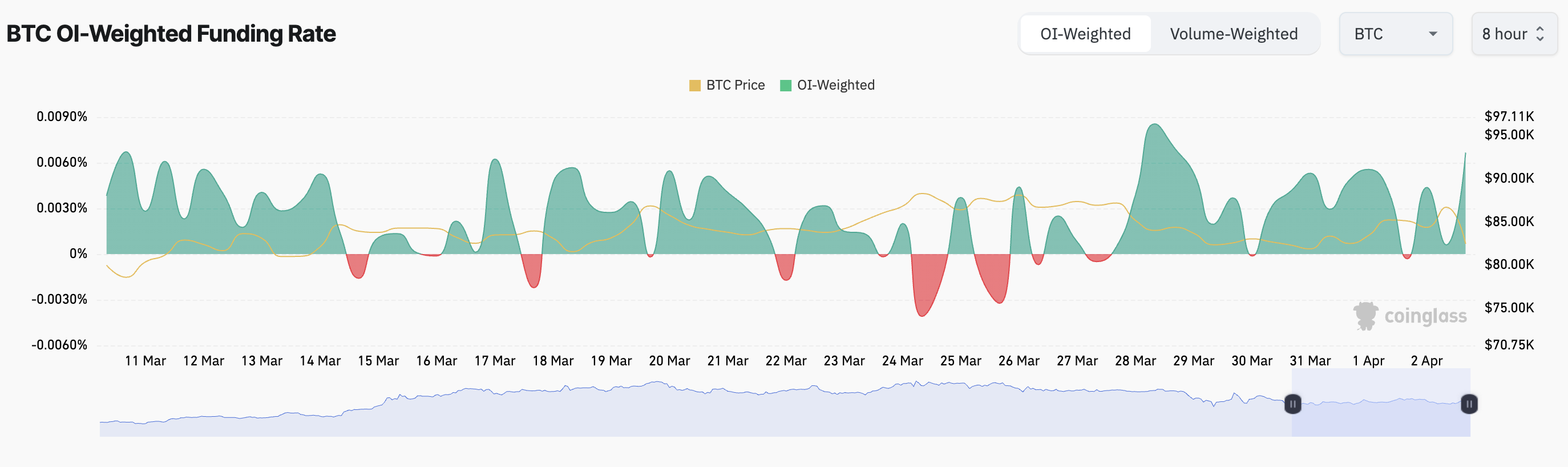

But fear not! BTC’s funding rate is a beacon of hope. At 0.0067%, it shows that the bulls are still prancing about, undeterred by the coin’s temperamental nature.

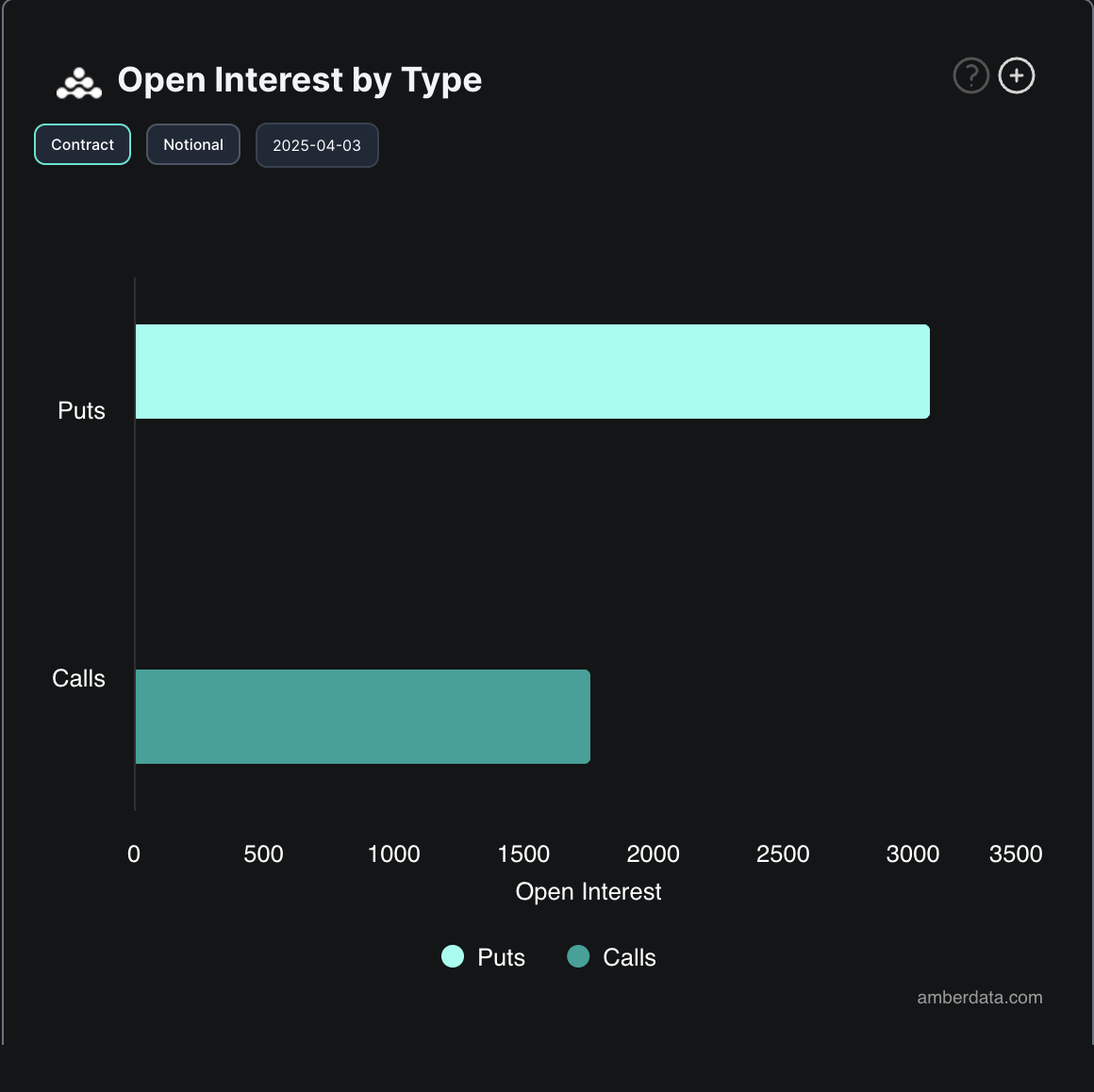

In the options market, the bears are having a party, with put options outnumbering call options. Traders seem to be betting on Bitcoin’s next move being a nap or a tumble. How thrilling!

More put options mean the market’s donning its raincoats, expecting a downpour. Will BTC’s price take a dive? Stay tuned to this delightful soap opera!

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-03 10:46