The cost of Ethereum (ETH) has picked up speed, with investor confidence showing a significant increase.

In the last 24 hours, ETH has gained a 0.3% increase and is priced at $3,080 now. Its market capitalization reaches an impressive $370 billion. Yet, Ethereum’s daily trading volume experienced a significant decline, dropping to $17.1 billion (a decrease of 21%).

Based on Santiment’s data, approximately 7 out of 10 social media discussions about Ethereum express optimistic views. In contrast, fewer than one in five investors and traders anticipate a price decrease.

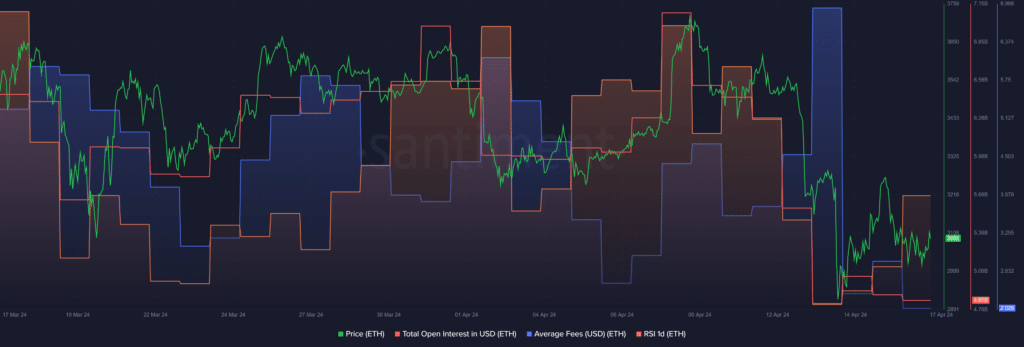

The cost averages for transactions on the Ethereum network, as reported by our market intelligence tool, have dropped by approximately 70.6% since their peak of $6.93 on April 13. At present, these fees are at a 11-week low, amounting to $2.03.

The decrease in fees indicates that Ethereum’s network usage has dropped substantially, reflecting the market’s uncertain mood.

In addition, the total open interest of Ethereum (ETH) has dropped for the third day in a row. According to Santiment, the asset’s open interest decreased from $5.02 billion on April 14 to $4.83 billion as of the latest update.

A decrease in open interest (OI) for Ethereum (ETH) could possibly result in reduced price swings for the token, as fewer contracts are likely to be liquidated and thus less market turbulence is created.

In contrast, the Ethereum RSI, as reported by Santiment, increased from 38 to 43 within the last 24 hours.

The ETH price indicator suggests that ETH is currently doing well but is starting to approach overvalued territory. For ETH to continue being a bullish investment, its Relative Strength Index (RSI) should remain under the 50 threshold.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-04-17 10:57