Ethereum—you stubborn beast!—finds itself, as so many men have, wedged between two walls: the cold indifference of the 100-day and the reminiscence-heavy gloom of the 200-day moving averages. Not even a cockroach could crawl through such tightness. The world outside keeps whispering about breakout, about deliverance, but here, in this cryptographically locked cell, all you have is hope, and, well, a lot of nervous traders chain-smoking in Telegram chats.

A breakout looms, they say—perhaps bullish, perhaps not. If one day the guard (the market) forgets to lock the door, Ethereum might slip through into daylight. Or maybe the lock’s there for keeps, and we’ll just rot in anticipation, drawing hopeful graphs on the cell wall with stale crumbs.

ETH Price Analysis: Technicals (Or How To Lose Sleep Watching Candles 🕯️)

By Shayan

The Daily Chart (Or: “The Eternal Recurrence of $2.5K”)

On this endless plain of apathy, ETH sits quietly between those two moving averages, hands folded in its lap, contemplating fate. Once, recently, our protagonist made a dash through the no-man’s-land of the 200-day Average at $2.5K, only to pull back—like a prisoner let out for a stroll, then shoved back into his cramped barrack. If the powers (buyers) gather enough resolve to stage an uprising here, maybe, just maybe, a push toward $2.8K resistance will echo like rumors of freedom down the hallway. Until then, the price paces between $2.5K and $2.8K, wearing a groove in the floor, because that’s what prisoners (and markets) do: they wait.

The 4-Hour Chart (Also Known As “Hope in Short Supply”)

Tuning into the four-hourly news bulletin from the east wing: ETH made a run for it, straight into a barricade of bear-manned guard towers (order block: $2625-$2670). Immediate rejection, spirits dashed. Now price shuffles back to that weary old $2.5K support, where shadows and doubt congregate after dark. If buyers muster courage, perhaps another riot will ensue. If not—expect another long, gray season of shuffling feet, poorer men, and dreams deferred.

Onchain Analysis (“Funding Rates as a Window Into the Soul—Or Something Like It”)

By Shayan

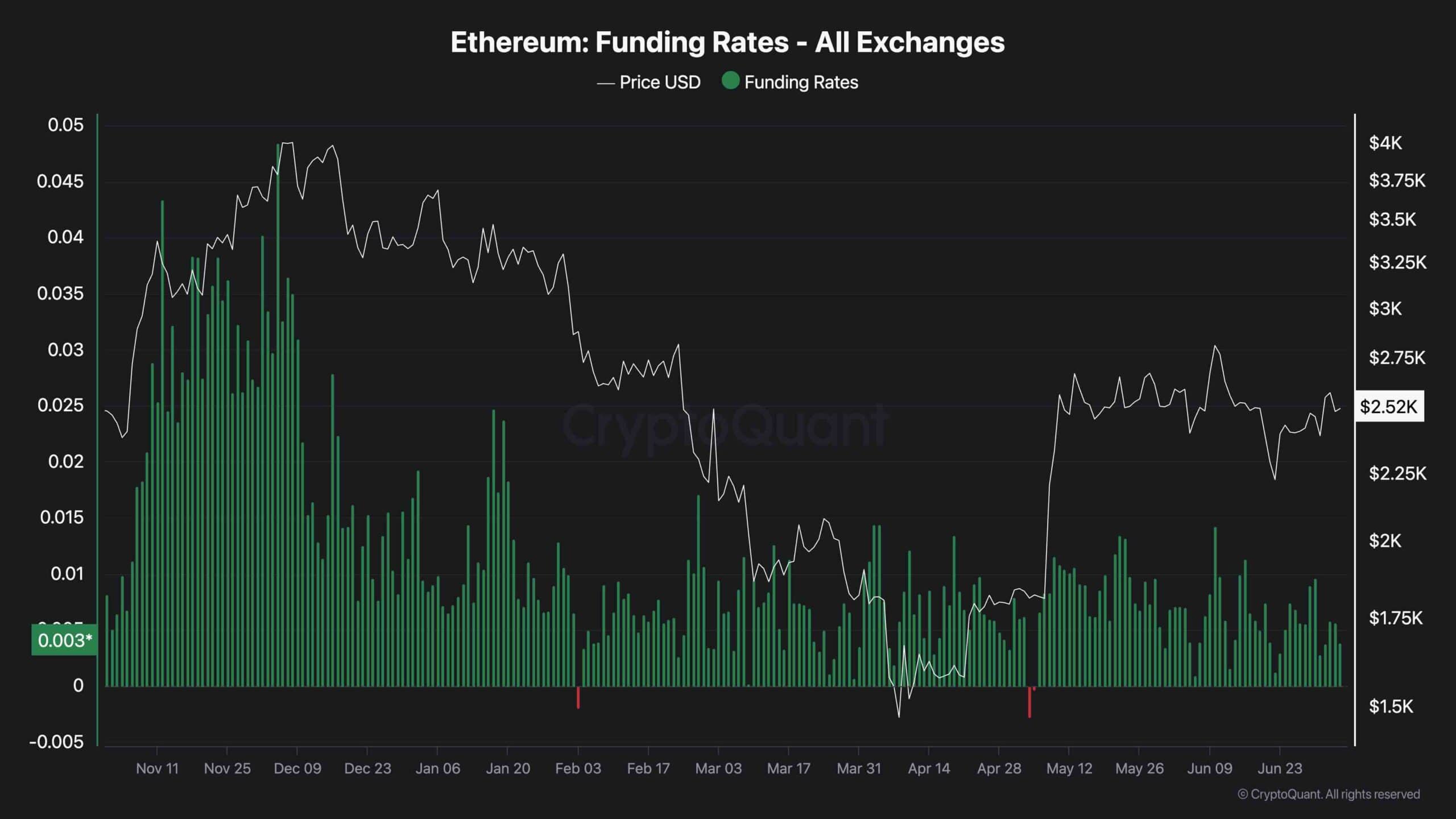

Funding rates: these fragile echoes of sentiment among futures traders. On the rare days that optimism catches in the collective throat, rates tick up—like finding an extra crust of bread beneath your bunk. But right now, the funding rate drains away and, with it, bullish enthusiasm. Each tick downward is a reminder: dreams are hard to sustain on stale bread and stale memes alone.

There’s talk in the mess hall: if demand surges, if the funding rate rises, maybe there’s an escape ahead—through $2.6K and $2.8K. But until then, comrades, we continue our slow shuffle, waiting for the next shift change, or the next flash of hope—or at least a sarcastic meme to lighten the gloom. 🤡

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

2025-07-05 18:24