As a researcher with experience in the cryptocurrency market, I’m closely monitoring the developments surrounding Ethena and its stablecoin USDe. The recent integrations with major players like Bitget, Symbiotic, AAVE, Bybit, BounceBit, and Blast have undeniably strengthened USDe’s position as a leading stablecoin in the industry. With over 25 million users on Bitget alone now able to utilize USDe as margin collateral and enjoy zero-fee spot trading, it’s evident that Ethena is gaining traction.

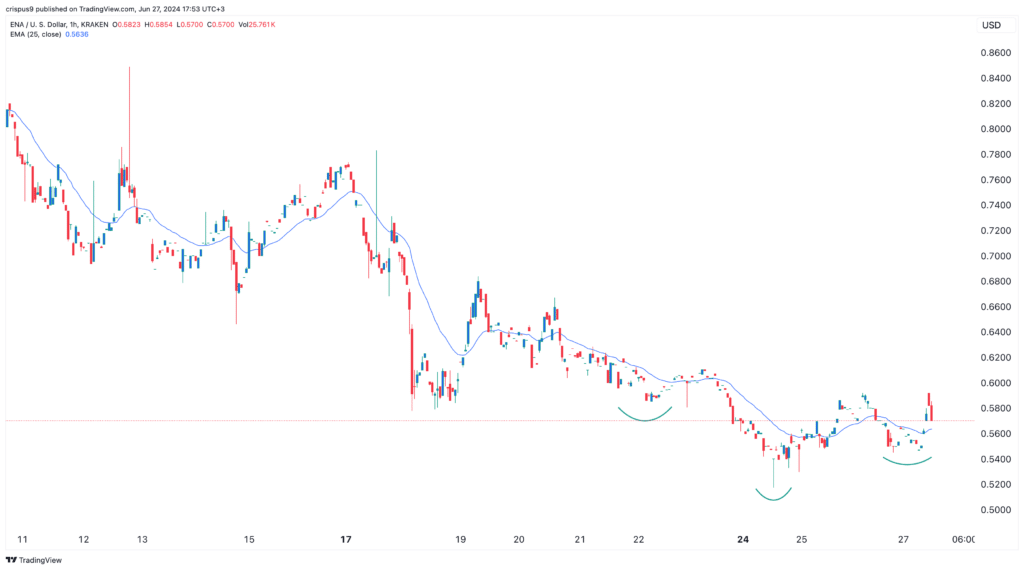

As an analyst, I’ve observed that the price of Ethena has remained relatively stable over the past three days. This stability comes as developers continue to secure integrations with USDe. The coin was priced at $0.58 on Thursday, marking a 12.5% increase from its lowest point this month. However, it’s important to note that Ethena is still 48% below its all-time high.

Recently, the developers of Ethena havemade announcements about several new integrations as the usage of their stablecoin, USDe, continues to increase in the market. Last week alone, Ethena revealed a strategic collaboration with Bitget, a major cryptocurrency exchange, which will allow Bitget’s 25 million users to utilize USDe as collateral when trading coin-margined perpetuals.

Users can enjoy zero-fee trading for the USDe/USDT pair in the spot market, providing an opportunity to make profits. Additionally, they can earn returns through the “Earn” section.

I’m thrilled to announce that one of the most significant integrations for USDe is now live on Bitget Global! With over 25 million users, this is an exciting development for the crypto community. Here’s what you can look forward to:

— Ethena Labs (@ethena_labs) June 20, 2024

This week, Ethena announced a collaboration with Symbiotic, a stake reward platform. Through this alliance, users can earn staking rewards by holding the ENA token in Mellow. Additionally, they will obtain a 30x multiplier for ENA tokens, Symbiotic points, and potential future access to LayerZero allocations.

Additionally, Ethena has collaborated with Aave, a major player in Decentralized Finance (DeFi), allowing users to deposit USDe, the Ethena stablecoin, and utilize it to create loops with other stablecoins available on Aave. Users will also have the option to deposit stETH, wETH, ETH, and WBTC on Aave to obtain borrowed stablecoins in USDe.

1. Users can now deposit USDe into Aave and utilize it to create positions with other stablecoins.

— Ethena Labs (@ethena_labs) June 6, 2024

Among the integrations for USDe are well-known companies such as Bybit, BounceBit, and Blast, which rank among the leading layer-2 networks.

The integrations have significantly contributed to the growth of Ethena USDe, making it the industry’s fourth-largest stablecoin with a market capitalization of $3.6 billion and more than 232,000 holders.

Enthusiasts are drawn to USDe due to its impressive return rate of approximately 8.6%, exceeding the returns provided by U.S. government bonds.

As a crypto investor, I’m aware of the concerns surrounding the current yield’s sustainability, particularly during volatile markets. Some experts have drawn parallels between these high yields and those of Terra Luna, which infamously collapsed in 2022. The two most significant risks that I see are the potential reversal of funding rates and counterparty risks.

Ethena price has stabilized

The value of Ethena’s ENA token has taken a hit, dropping nearly half from its peak despite USDe’s expansion and new integrations. This underperformance can be attributed to mounting concerns surrounding its stablecoin. Furthermore, this trend aligns with the broader altcoin market, which has dipped into a bearish phase over the past few weeks.

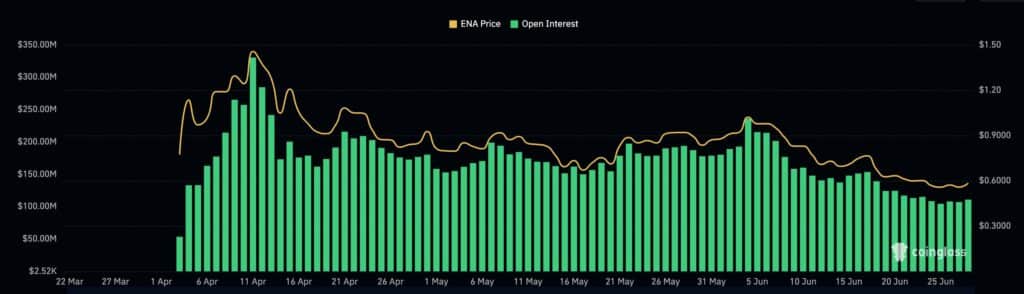

Ethena futures open interest

The volume of Ethena’s daily trades and its open interest in the futures market have been declining since reaching their highest points in April.

Ethena price hourly chart

As a technical analyst, I would be optimistic about the potential reversal of the trend based on the emerging small inverse head and shoulders pattern visible on the hourly chart. This pattern is widely recognized in technical analysis for its high accuracy in signaling price reversals.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-06-27 18:30