As a seasoned crypto investor who’s been through multiple market cycles, I must admit that the dominance of Ethereum and TRON in the stablecoin market isn’t surprising, given their robust infrastructure and strong community support. However, the recent decline in Ethereum’s market share despite an increase in its stablecoin supply is a reminder that this space is as unpredictable as a rollercoaster ride at Cedar Point.

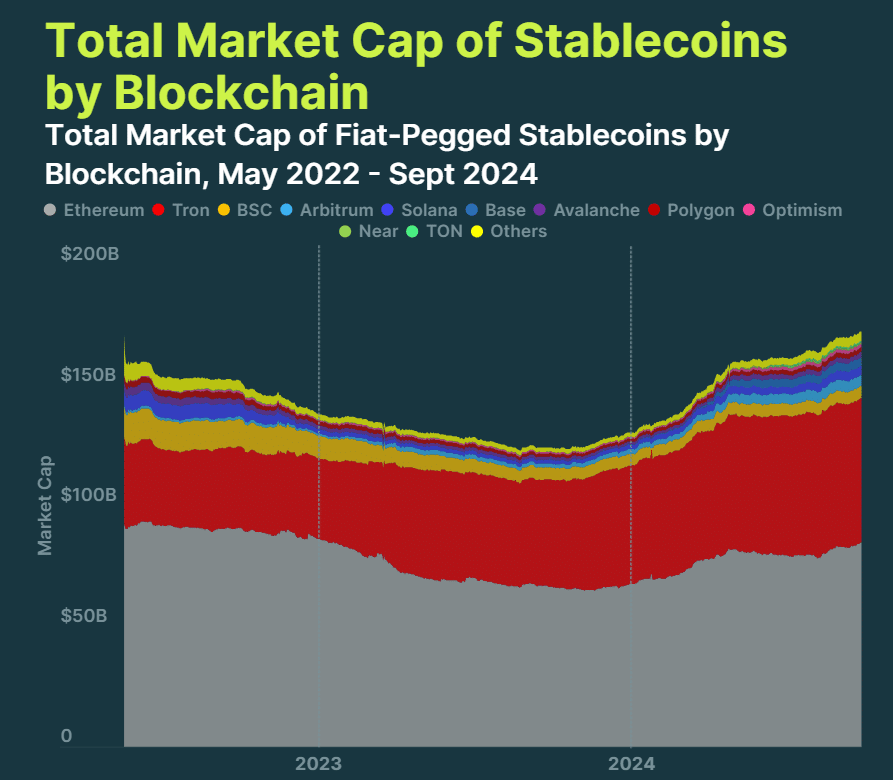

As a researcher delving into the world of cryptocurrencies, I discovered through CoinGecko’s data analysis that Ethereum and TRON hold an impressive 83.9% combined market share of all stablecoins, with a collective value of approximately $144.4 billion.

The Ethereum and TRON blockchain systems remain significant players in the stablecoin sector, accounting for approximately 84% of the total market, with a collective worth of around $144.4 billion, as per data from September.

Based on figures from crypto data platform CoinGecko, Ethereum takes the lead with a market share of about 49.1%, or an estimated total of $84.6 billion. TRON trails closely behind, representing approximately 34.8% of the market, which equates to around $59.8 billion.

In my analysis as a researcher, while Ethereum’s stablecoin supply expanded by approximately $17.2 billion in 2024, its market share dwindled. This contraction was largely influenced by the crash of Terra’s stablecoin UST, the arrival of the bear market, and the surge of layer 2 solutions during that period.

On TRON’s platform, the high demand for Tether (USDT) makes up nearly all the stablecoins used, accounting for an impressive 98.3%. However, even with a 21.6% rise in its supply, TRON’s market share has dropped from 37.9% earlier this year.

Stablecoins reshape global finance landscape

BNB Chain (previously known as BNB Smart Chain), currently ranking third, has experienced a decline in market share to 2.9%, largely due to regulatory hurdles concerning Binance USD (BUSD). This has led to a significant decrease of 61% in the chain’s stablecoin supply since May 2022. At the same time, newer blockchain platforms such as Coinbase’s Base, which increased its stablecoin supply by an impressive 1,941.5% in 2024, are making headway. This suggests a growing diversity within the stablecoin market landscape.

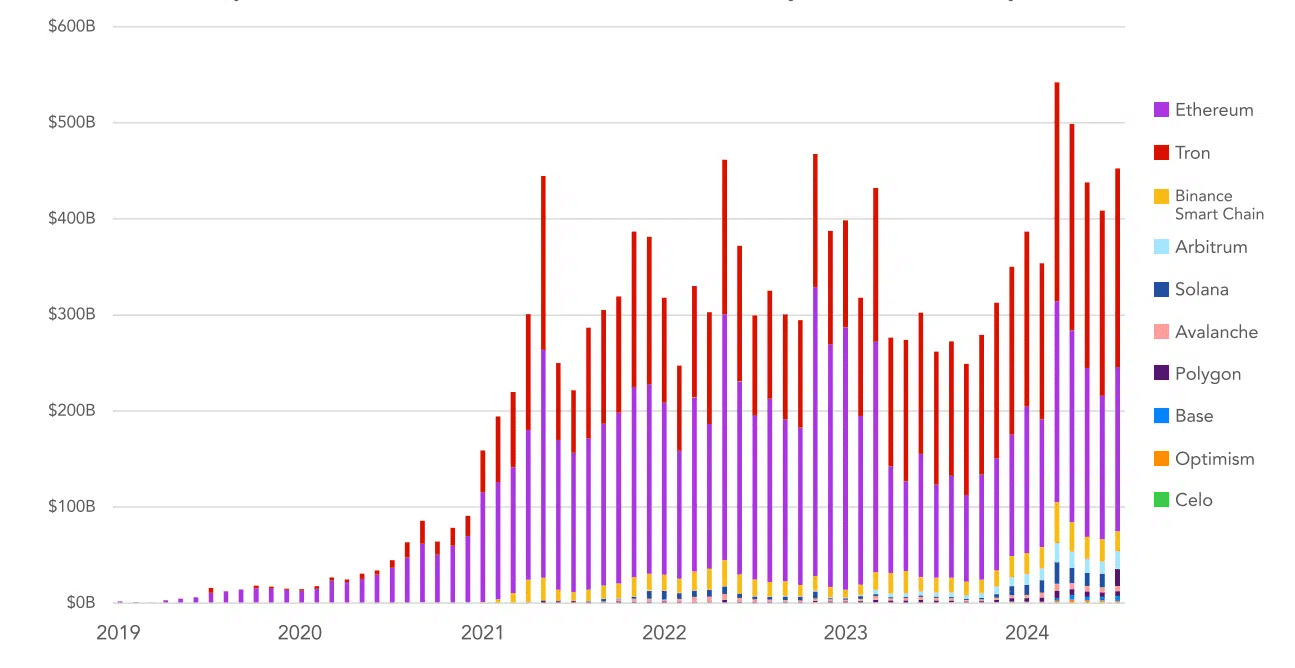

In recent years, stablecoins have been taking a more significant position within the global financial landscape, with over $3.7 trillion worth of transactions completed in 2023 alone. By the end of 2024, this figure is expected to surge to approximately $5.28 trillion. As previously mentioned by crypto.news, research conducted by Castle Island Ventures and Brevan Howard Digital indicates that stablecoins are being utilized beyond just exchange settlement, with a noticeable increase in adoption particularly in developing markets. Here, they are serving purposes such as savings, currency conversion, and generating returns on investments.

After examining responses from approximately 2,540 cryptocurrency users in Nigeria, Indonesia, Turkey, Brazil, and India, it was discovered that using stablecoins primarily for trading cryptocurrencies or non-fungible tokens is the most common use. However, non-crypto applications are not insignificant either.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

2024-10-01 16:32