As a seasoned researcher with years of experience navigating the dynamic world of cryptocurrencies and blockchain technology, I find myself intrigued by this recent surge in activity on Ethereum Decentralized Exchanges (DEX) despite the general market downturn.

The trading activity on Ethereum‘s decentralized exchanges showed a rebound, despite the decline in the value of cryptocurrencies.

Ethereum DEX had robust activity

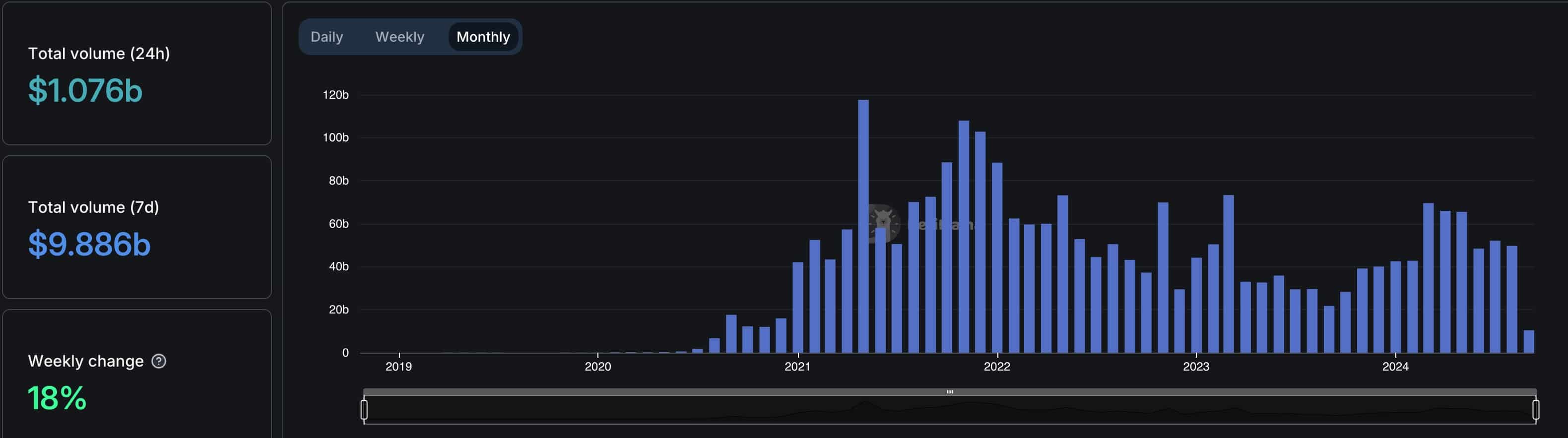

As reported by DeFi Llama, the value of transactions in Ethereum (ETH) increased by 18% to reach $9.88 billion, while the volume on other chains experienced a decrease. Specifically, the volume on Solana (SOL) DEX dropped by 8%, and the volume on Base, BNB Smart Chain, Arbitrum, and Polygon decreased by 4%, 14%, and 10% respectively.

The poorest-performing cryptocurrency was Tron (TRX), experiencing a 52% drop in volume to exceed $642 million. This significant decrease occurred as the buzz surrounding the newly released SunPump meme coins diminished. As reported by CoinGecko, the majority of SunPump tokens such as Sundog, Tron Bull, and Muncat have pulled back from their peak values.

On Ethereum’s network, many Decentralized Exchange (DEX) networks experienced a significant surge in trading volume. Specifically, Uniswap saw an uptick of approximately 14.2%, reaching a whopping $5.7 billion in volume, following its settlement with the Commodity Futures Trading Commission regarding its margin products. The agreement included a $175,000 fine and a commitment to discontinue offering these products within the United States.

In a notable increase, the trading volume of Curve Finance surged by 68% to exceed $1.48 billion. Meanwhile, Balancer, Hashflow, and Pendle experienced similar percentage gains, with Balancer rising by 68%, Hashflow soaring by 196%, and Pendle climbing up by 85%.

Bitcoin and most altcoins tumbled

This week was tough on the crypto industry as most assets experienced a decline. Bitcoin hit a low of $52,550, which is its lowest since August 5 and represents a drop of 26% from its all-time high. Similarly, Ethereum dropped below $2,200, marking a fall of over 44% from its highest point this year. The combined market value of all coins dipped below $2 trillion for the first time in several months.

The possibility exists that the downtrend may persist, given the widespread apprehension in the cryptocurrency market. This apprehension is reflected in the decrease of the crypto fear and greed index to 34, which falls into the “fear” zone. Historically, cryptos tend to exhibit more vulnerability when investors are fearful.

Decentralized (DEX) and Centralized (CEX) cryptocurrency exchanges can see reduced trading activity when the value of cryptocurrencies is decreasing, such as what was observed during August compared to March. According to DeFi Llama, the trading volume on Ethereum DEX platforms dropped from a peak of $69 billion in March to $49.5 billion in August, as most coins experienced a surge earlier in the year.

Over various Decentralized Exchanges (DEX), the trend was consistent as trading volumes decreased. From approximately $257 billion in March, they dropped to around $240 billion in August.

As the Federal Reserve prepares to lower interest rates, it’s possible that cryptocurrencies could see some positive impact. Last week, we saw a slight drop in the unemployment rate to 4.2% and the economy adding 142k jobs. Historically, risky assets like cryptocurrencies tend to perform better when the Fed reduces interest rates.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-09-08 18:06