As a seasoned researcher who has witnessed the crypto market’s volatile rollercoaster ride for years now, I must say that the recent decline in Ethereum’s gas prices and whale activity is nothing new to me. However, the sheer speed at which it happened post-Dencun upgrade left me a bit taken aback, much like a deer caught in the headlights of an oncoming blockchain truck!

Ethereum’s gas prices and whale activity have declined as its price dropped below the $2,600 mark.

As an analyst, I’ve noticed a significant drop in the daily average gas price on the Ethereum network, which dipped to a record low of approximately 2.9 Gwei, equivalent to around $0.026, on August 18th. Currently, the average gas price is showing a slight increase and stands at 3 Gwei.

“Even with Ethereum ETFs getting approved, the value of Ether ($ETH) has been slumping since the Dencun update. This has led to an over 197,000 ETH increase in its supply and a drop in price by about 35%.” – By @EgyHashX— CryptoQuant.com (@cryptoquant_com) August 19, 2024

The data indicates that just 115 Ethereum, valued at roughly $300,000, were destroyed due to high gas fees reaching a new low. Meanwhile, Ethereum’s price remained stable near $2,600 as the broader market experienced turbulence and uncertainty.

One primary factor contributing to the sharp decrease in Ethereum’s gas prices is the implementation of the EIP-1559 (Dencun) update, rolled out in March this year. This update facilitates layer 2 networks to process their data bundles on the Ethereum mainnet, resulting in a substantial reduction in transaction fees.

However, the CryptoQuant analyst claims that the declining network fees could potentially cause long-term problems such as “user and liquidity fragmentation.”

The analyst pointed out that the ETH supply has increased by 197,000 tokens while the price plunged 35% despite the approval of the long-awaited spot ETH exchange-traded funds in the U.S.

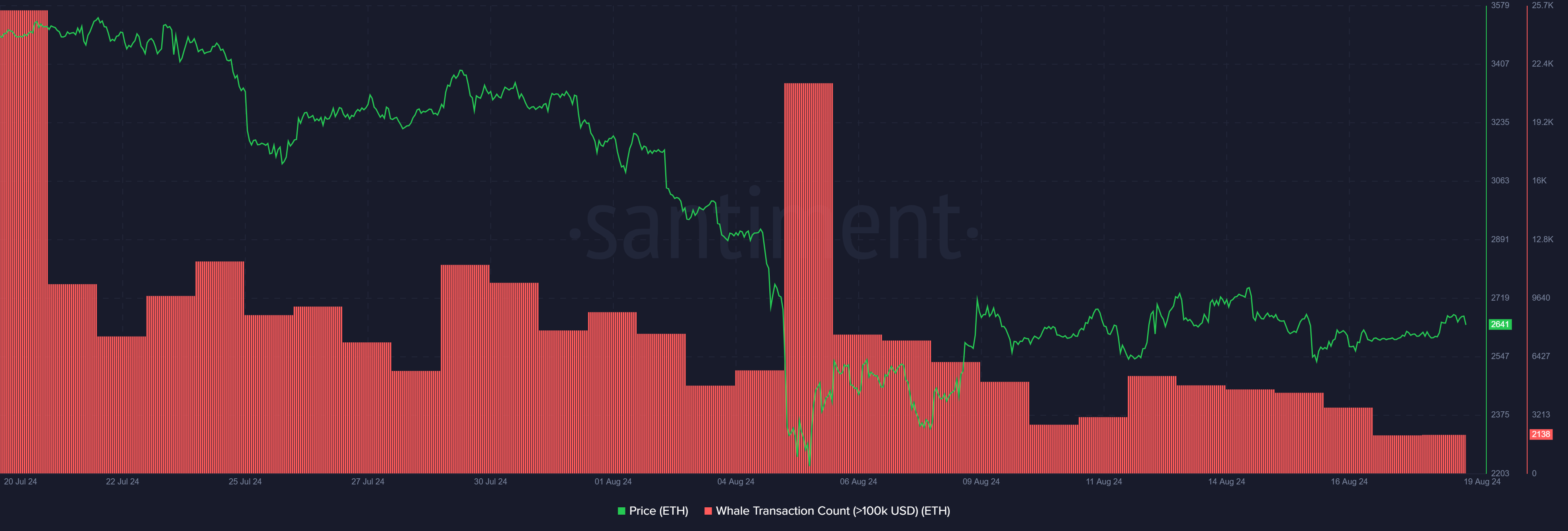

As an analyst, I’ve noticed a correlation between Ethereum’s transaction fees and whale activity. According to data from Santiment, the number of significant transactions, valued at over $100,000 in ETH, has been decreasing steadily over the past week. This figure dropped from approximately 5,371 unique transactions on Aug. 12 to around 2,138 at the time of my report.

In my exploration as a researcher, I’ve noticed that Ethereum (ETH) has dipped by approximately 3% over the past 24 hours, currently sitting at $2,580. Despite this slight downturn, it’s encouraging to see that its daily trading volume has significantly increased by 32%. This surge in activity has propelled the volume past the impressive milestone of $10 billion.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-19 13:56