As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent trends in DEX and CEX volumes have piqued my interest. While it’s disheartening to see the decline in DEX volumes from $198 billion in July to $181 billion in August, I find solace in the fact that Ethereum continues to dominate the scene.

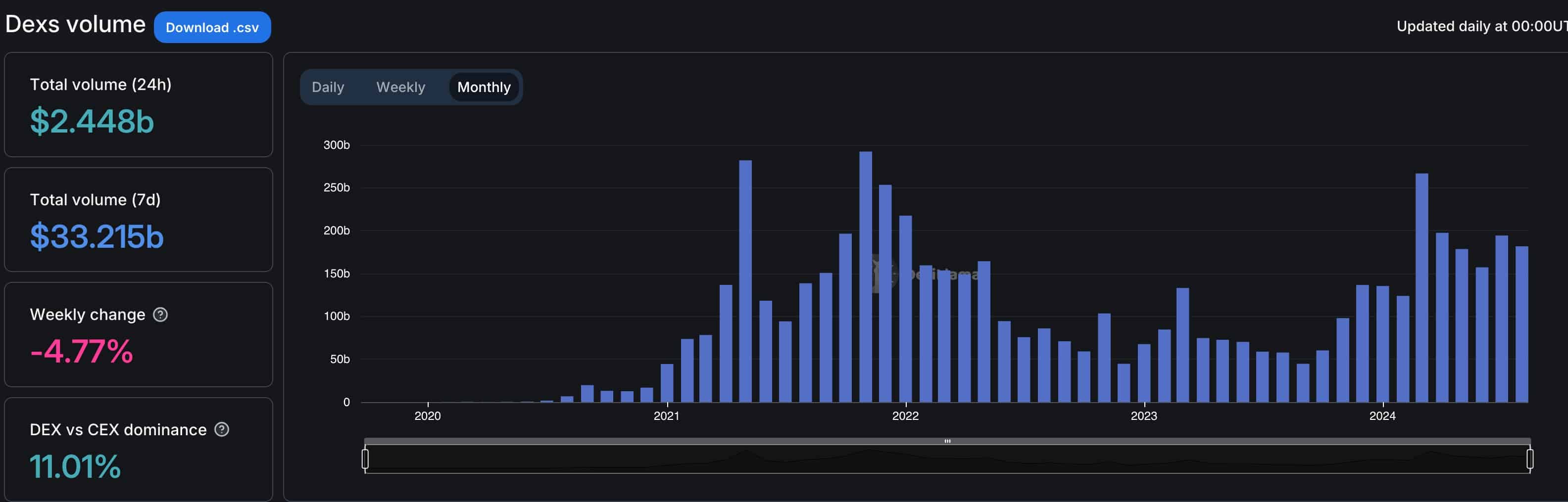

The volume of cryptocurrencies traded in decentralized exchanges dropped in August.

In August, as reported by DeFi Llama, decentralized exchange (DEX) platforms facilitated transactions valued at more than $181 billion, which is a decrease from the $198 billion handled in July.

In March, the level of daily transactions on Decentralized Exchange (DEX) platforms reached its highest point, processing more than $260 billion, as the majority of cryptocurrencies saw a significant increase in value.

In August, Ethereum (ETH) led the way among decentralized exchange (DEX) platforms, managing a whopping $52.5 billion in transactions. Solana (SOL) and Arbitrum (ARB) came in second and third place, with their respective DEX platforms handling approximately $42.5 billion and $22.3 billion in tokens during the same period.

In recent developments, Tron (TRX) emerged as the most progressing blockchain in decentralized exchange (DEX) platforms, bolstered by the debut of SunPump, a meme coin generator. The leading DEX platform within its ecosystem, SUN, facilitated transactions valued at approximately $3.2 billion worth of coins.

In August, Uniswap emerged as the busiest decentralized exchange (DEX), with Raydium on Solana and PancakeSwap on the BNB Chain coming in second and third respectively.

Solana’s DEX volume decreased due to the recent performance of meme coins in its ecosystem, such as Bonk, Book of Meme, and Dogwifhat. Notably, Bonk has plummeted by over 64% from its peak this year, while Dogwifhat and Book of Meme have both dropped more than 70% from their year-to-date highs.

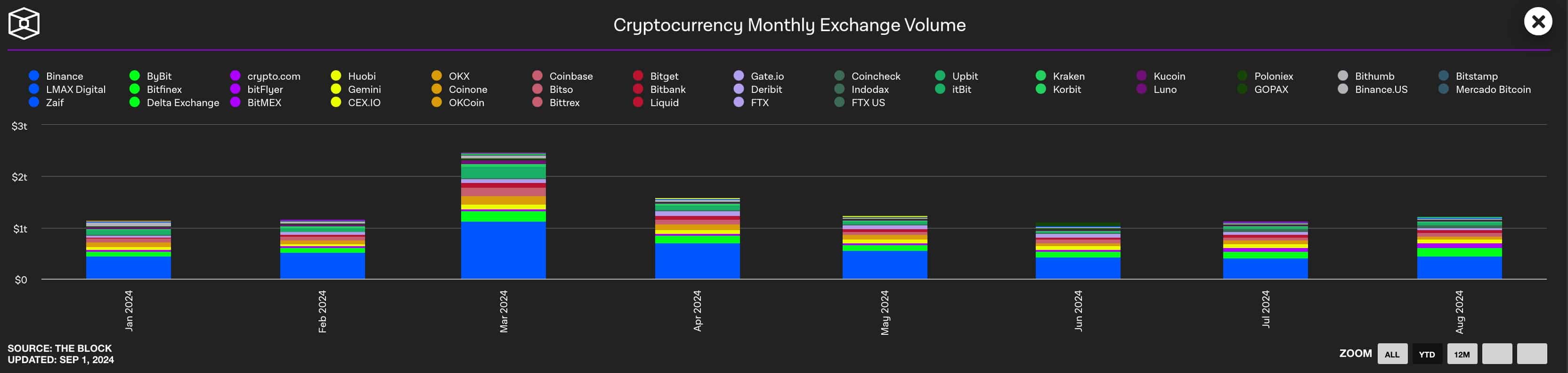

Binance maintained its lead among CEX exchanges

During August, it was Centralized Exchanges that outperformed, with data indicating they facilitated a transaction volume of approximately $1.2 trillion. This figure is higher than the $1.1 trillion they processed in July. Much like Decentralized Exchange platforms, the volume for Centralized Exchanges peaked at around $2.48 trillion in March, coinciding with Bitcoin and other cryptocurrencies experiencing a significant surge.

Leading the pack is Binance, managing a staggering $448 billion in trading volume, with Bybit, Crypto.com, Huobi, and Coinbase trailing closely behind.

It appears that further analysis reveals a decrease in the amount of cryptocurrency holdings in the futures market throughout the month. As of August 31st, Bitcoin’s futures interest was estimated at $30 billion, which is lower than its peak value of $37 billion for the month.

In August, cryptocurrencies faced another challenging month. On August 5th, many of them started to decline due to concerns about the winding up of the so-called Japanese yen carry trade, which in turn caused most assets to drop.

Despite rebounding from their monthly minimum values, many coins are still noticeably lower than the peak levels they reached this year.

As a crypto investor, I’ve noticed that Bitcoin is still 18% shy of its year-to-date peak, and Ethereum has plunged nearly 40% from its March highs. This means there might be an opportunity for potential gains if the market trends upward again.

In our previous update on Friday, we mentioned that certain experts attribute the recent underperformance of cryptocurrencies to a decrease in market liquidity and growing concerns about governments potentially selling their digital coins.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-01 18:34