Ethereum, that old buckboard of the crypto trail, rolled along steady through early May—price stuck like a rusty nail between $2,320 and somewhere up towards $2,650. But then the news dropped like a leftover anvil: the United States had launched attacks on Iranian nuclear sites. Wall Street spooked, traders ran for the hills, and the mighty Ethereum wagon hit a rut so deep you could lose a shoe in it. Down below the precious $2,320 line it tumbled, dragging a train of altcoins in its wake, like a wagon master losing half his horses at a river crossing.

That hardscrabble range, where bulls and bears had been locking horns for weeks with all the grace of a bar fight, is now just a ghost town. The air’s thick with jitters, and every trader is asking themselves—should I hang tight, or cash out before this ship sinks to the bottom of the creek? Seems the whole market’s got a case of the nerves, what with the Middle East heating up and world economies looking shakier than a farmer’s hands at his first poker game.

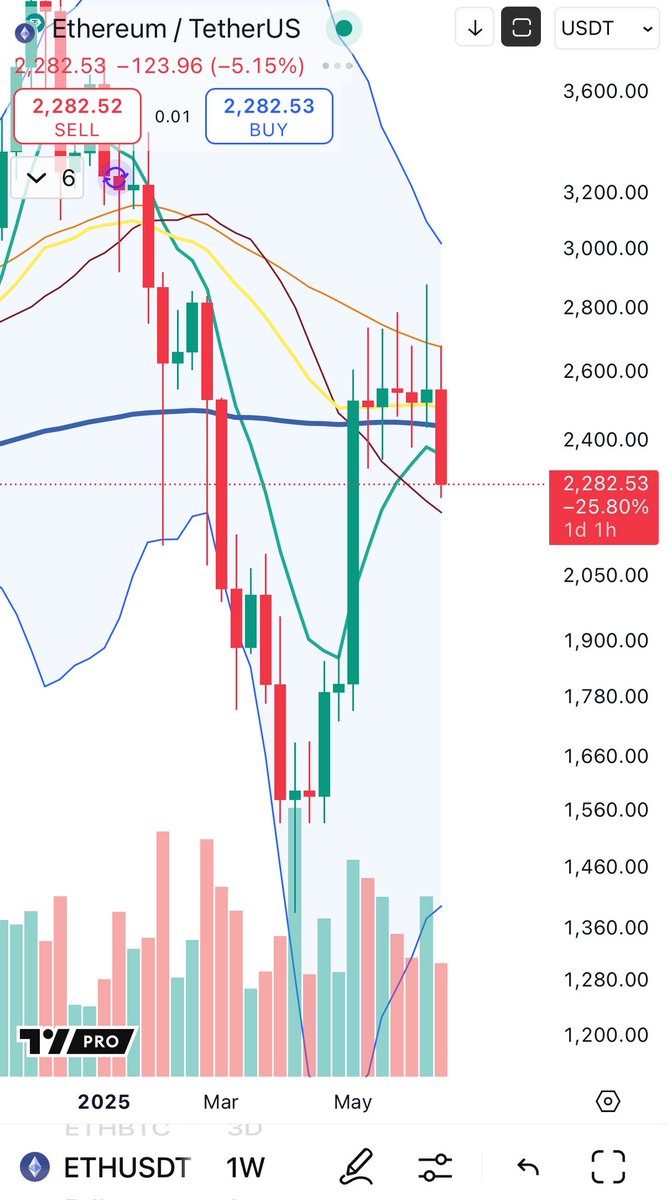

Even Big Cheds—analyst, chart wrangler, and possibly minor prophet—peered at Ethereum’s weekly chart and saw a tower top pattern shaping up. If that tower top completes, we might see Ethereum sliding further down the ravine unless a horde of buyers rides in to save the day. Everyone’s got their eyes glued, as if watching some cursed cattle drive, trying to guess if we’ll get a recovery—or if the buzzards are just circling lower. 🦅

Ethereum Takes a 22% Beating—Crypto Cowboys Watch in Horror

The facts are plain: Ethereum’s dropped over 22% since its early June high, like a prospector dropping his gold-panning pan straight into the river. The bears have kicked the bulls right out of town, while headlines fret and the whole market braces for another wild ride. Rumors from the Middle East—the kind that makes even hardened traders sweat—have thrown the crypto space into disarray, with altcoins like ETH falling so fast you’d think gravity was up to something new.

Yet, even with the panic, plenty of true believers refuse to budge. Maybe Ethereum will lead the next gold rush. Or maybe it ends up like one of those abandoned mining towns: tumbleweeds and regrets. Some analysts are convinced there’s more pain to come—$2,000 is looking mighty close from here. Others claim we’re nearly out of sellers, and a rebound could happen any second. My advice? Don’t bet the farm. Or if you do, at least enjoy the view.

If those elusive buyers ever do show up, there’s hope for a rescue—sort of like hoping rain’ll come before your last well dries out. For now, everyone’s holding their breath, waiting to see if this breakdown is for real, or just another trap to shake the weak hands out. As July rolls in, keep an eye on the chart and maybe wear a helmet.

ETH Falls Below Support—Somewhere, a Trader Weeps into His Coffee

The $2,320 barrier—once sturdy as a barn door—has caved in, and Ethereum now drifts around $2,260. Sure, the price was cozy up near $2,900 early last month, but nostalgia won’t buy you dinner. With every support line smashed on the way down, ETH looked less like a champ and more like a boxer seeing stars.

The drop came fast and hard, with volume spiking like the punchline to a bad joke. Panic selling took the wheel and didn’t ask for directions. With each busted support, even past demand zones looked as empty as a saloon at sunup.

Technicals? Forget it. Unless ETH snaps back above $2,320 and catches a decent tailwind, we might be staring down another leg lower, maybe $2,100, maybe even $2,000, just for good measure. Traders would be wise to watch for any glimmer of hope—bullish divergence, a random blessing, the ghost of a good market. Until then, the bears have the floor. Good luck out there, cowpokes. 🤠

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Gods & Demons codes (January 2025)

2025-06-22 09:22