As a seasoned cryptocurrency researcher with over a decade of experience in the digital asset market, I have witnessed countless ups and downs in the crypto world. The recent retreat of Ethereum (ETH) from its peak this month has been intriguing, given the robust fundamentals it continues to exhibit.

With my extensive background in analyzing market trends and understanding the nuances of various indicators, I find myself optimistic about ETH’s near-term prospects. The inflows into Ethereum-based exchange-traded funds (ETFs) have been impressive, with a cumulative net inflow of over $2.68 billion, led by the BlackRock Ethereum ETF. Furthermore, the increasing popularity of staking Ethereum is noteworthy, as more investors are recognizing the potential rewards associated with securing the network.

However, it’s essential to remember that the cryptocurrency market can be unpredictable and volatile at times. As a researcher who has seen Bitcoin‘s meteoric rise and subsequent crash in 2017-2018, I know better than to underestimate the power of market sentiment. Nevertheless, Ethereum’s strong technical indicators, such as its position above the 100-day moving average and the rising accumulation/distribution indicator, suggest that investors are buying the dip.

In conclusion, while the current price action may be disheartening for some, I believe that Ethereum’s fundamentals and technical indicators point to a potential rebound in the coming weeks. The next target for ETH could be $3,750 if the Elliot Wave pattern plays out as anticipated.

Now, let me share a little humor to lighten up the mood: As a researcher who’s been around long enough to witness Bitcoin’s wild ride, I can’t help but think of it like an old friend who always keeps you on your toes – sometimes with heartbreakingly low prices and other times with breathtaking gains. It’s a love-hate relationship, but I wouldn’t trade it for anything else!

In recent times, the value of Ethereum has retreated, even though there have been favorable exchange-traded funds investments and an increase in staking deposits.

On December 29th, Ethereum (ETH) was being traded at approximately $3,400, representing a drop of more than 17.2% from its peak this month. This descent took place despite Ethereum maintaining robust underlying factors.

According to SoSoValue’s data, there was a substantial increase of approximately $47.7 million in daily investments on Friday. Over the past four days, these funds have experienced inflows, with only two instances of outflows occurring within the previous 25 days.

The combined amount of money flowing into these ETFs has surpassed $2.68 billion, raising their collective value to over $12.1 billion. Among them, the BlackRock Ethereum ETF has seen the largest influx of funds, boosting its total worth to approximately $3.58 billion.

Grayscale, Fidelity, and Bitwise also offer ETH funds.

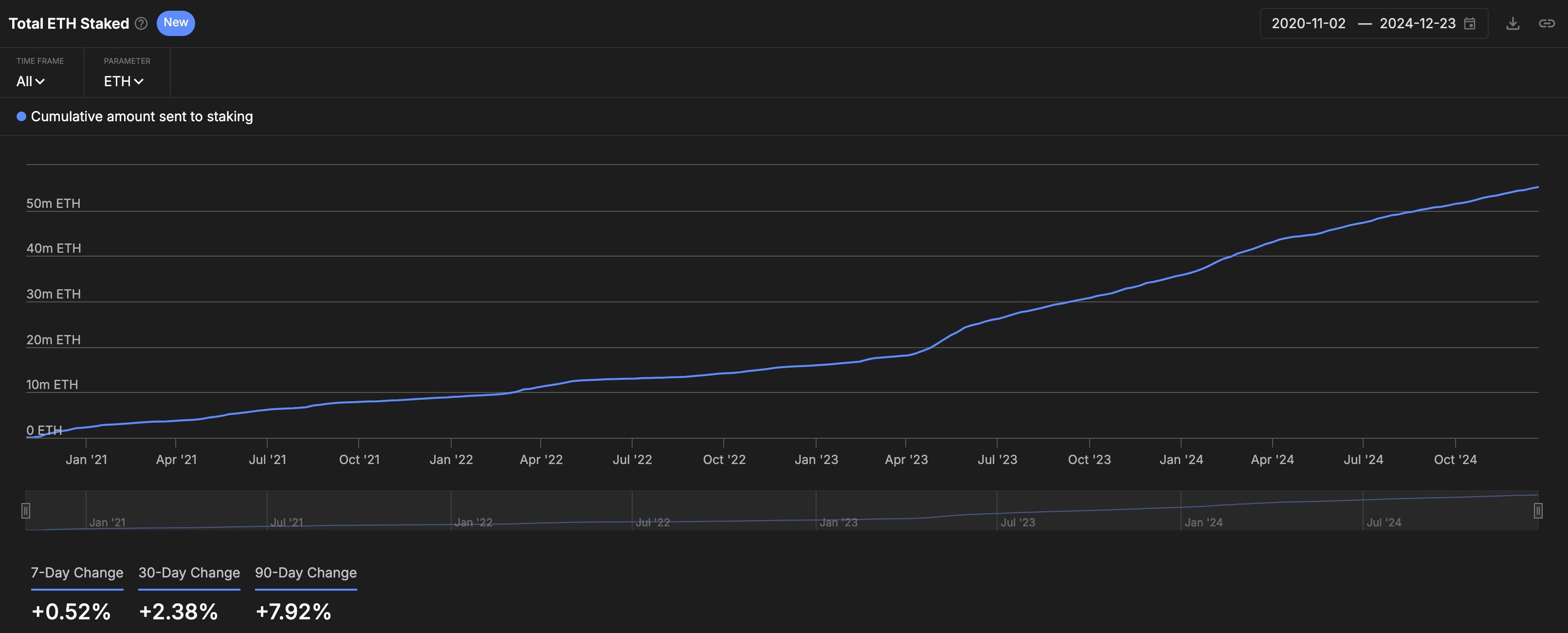

Currently, data from IntoTheBlock indicates that an increasing number of investors are choosing to stake Ethereum. As a result, the total amount of ETH sent for staking has reached approximately 55.18 million ETH. This surge in staked ETH has boosted the staking market capitalization to around $114.95 billion, with an average reward rate of 3.06%.

Staking refers to the act of Ethereum owners assigning their coins to help maintain the network’s security. In return for this service, they receive compensation through transaction fees, which have seen steady growth over the last couple of years.

Based on TokenTerminal’s data, Ethereum earned approximately $2.4 billion in 2024, placing it as the second highest earning network within the crypto industry, trailing only behind Tether.

Some experts are hopeful that Ethereum’s price might recover soon, as suggested by TMV, a well-respected commentator, who anticipates a rebound once Ethereum has finished the fourth phase of the Elliot wave analysis – a distinctive pattern used to identify five stages assets typically experience.

The fourth wave is usually bearish, while the fifth tends to be bullish.

Ethereum price analysis

The day-by-day graph indicates that the Ethereum price pulled back following a significant barrier it encountered around $4,000, which was beyond the typical reach of Murray Math Lines.

Or simply:

The daily chart shows ETH’s retreat after hitting a roadblock at $4,000, which was higher than usual for the Murray Math Lines.

The coin’s position has dipped slightly beneath the significant pivot reversal level of $3,437. However, it continues to stay above its 100-day moving average, suggesting that it is still supported by this metric. Additionally, the accumulation/distribution indicator is climbing, implying increased investor interest and potential buying activity.

Consequently, it’s possible that technical indicators like the Elliot Wave pattern may regain strength within the upcoming weeks. Should this occur, the potential price level could reach $3,750, which represents the peak resistance point according to the Murrey Math Lines.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-29 17:52