As an analyst with over two decades of experience in the financial markets, I have seen numerous market cycles and price movements. The recent pullback in Ethereum’s price, although concerning for some, does not shake my confidence in its long-term potential.

Ethereum’s price has pulled back in recent days as some whales continue to sell their tokens.

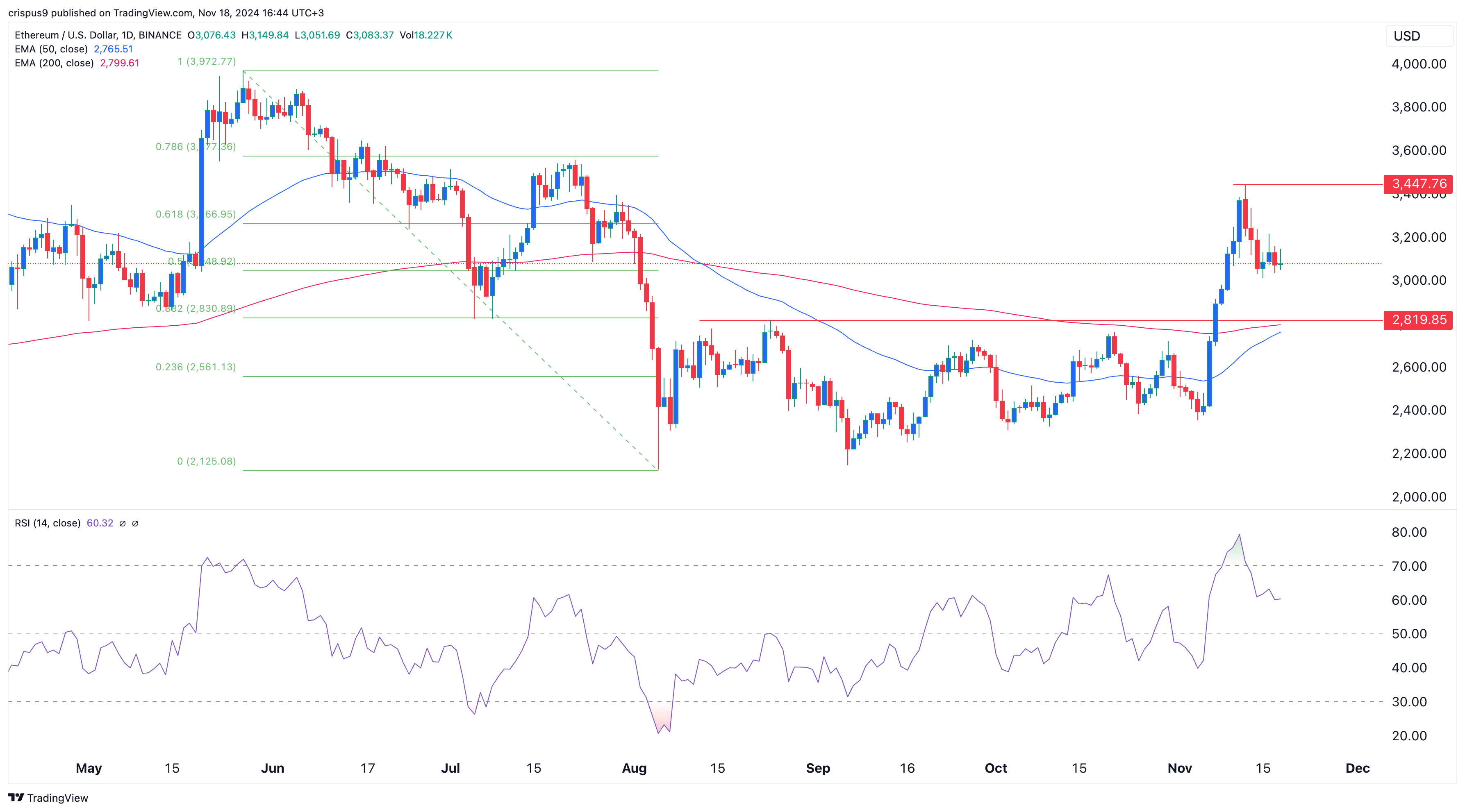

On November 18th, Ethereum (ETH) pulled back to $3,058, a drop from the month’s peak of $3,445 it reached earlier. This dip represents a brief technical correction in the local market as ETH has declined by approximately 11% from its highest point this month.

The price behavior of Ethereum was influenced by some large investors (whales) offloading their coins. According to LlamaFeed’s data, these whales transferred Ethereum tokens worth more than $300 million in the last day. Notably, the largest transaction involved moving 50,000 ETH tokens, valued at over $153 million, to Kraken, with a transaction fee of approximately $12.80.

A significant whale transferred approximately 15,579 units, equivalent to around $47.8 million, from one wallet to Coinbase. Transferring tokens to trading platforms like Coinbase is often the initial action taken by investors when they decide to sell their holdings.

The price of Ethereum decreased alongside two consecutive days of outflows in spot ETFs. On Friday alone, the outflows totaled $59.8 million, which is a significant rise from the previous day’s $3.24 million. In comparison, these ETFs have attracted inflows worth $178 million compared to Bitcoin‘s massive inflows of $27 billion.

Currently, blockchain’s DEX networks are not living up to their potential compared to smaller networks in the decentralized exchange industry. Over the last 24 hours, the amount of transactions on its DEX networks decreased by 4.7% to reach approximately $850 million. On the other hand, Solana (SOL), Base, Binance Smart Chain (BSC), and Arbitrum handled significantly higher volumes, with Solana at $5.92 billion, Base at $1.28 billion, BSC at $1.27 billion, and Arbitrum at $992 million.

Nonetheless, certain experts remain hopeful that Ethereum’s price could recover significantly in the future. One such expert predicts that Ethereum’s value might surge as high as $10,000 in the long run, suggesting a potential increase of 226% from its current price.

Listen, I’m done with all the nonsense. $ETH has been building solid momentum with higher lows over the past 2.5 years. Yes, it’s moving slow, but building momentum takes time.

Once it clears 4k, it’s off to the races.

10k is the target.— Wolf 🐺 (@IamCryptoWolf) November 17, 2024

Other experts point out additional factors such as its deflationary characteristics and the possibility for staking within ETFs, given Trump’s victory in the election, as potential reasons for its growth.

Ethereum price has bullish technicals

According to today’s analysis, Ether appears to have some strong factors driving its price up, known as bullish catalysts. Soon, it is expected to exhibit a golden cross pattern, which occurs when the 200-day and 50-day Exponential Moving Averages (EMAs) intersect in an upward direction, suggesting a bullish trend.

The decline in Ethereum prices appears to have slowed near the 50% Fibonacci Retracement mark, suggesting a possible recovery ahead. If this happens, we might see ETH tokens reaching their highest point this month at around $3,447. Should it surpass that level, further gains could take us back to the year-to-date high of $3,972.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-18 17:12